Gold, banks and defence: The funds topping the tables in 2025 so far.

Trustnet finds out which funds have made the highest returns over the past five months.

- Gary Jackson

- 5 min reading time

Source: Trustnet

Although it has been a turbulent few months, funds investing in European banks, gold miners and defence stocks have made strong total returns since the start of 2025, FE fundinfo data shows.

In the past five months markets have jumped up and down as investors navigated the uncertainty caused by the early days of Donald Trump’s second US presidency and conflict in eastern Europe and the Middle East.

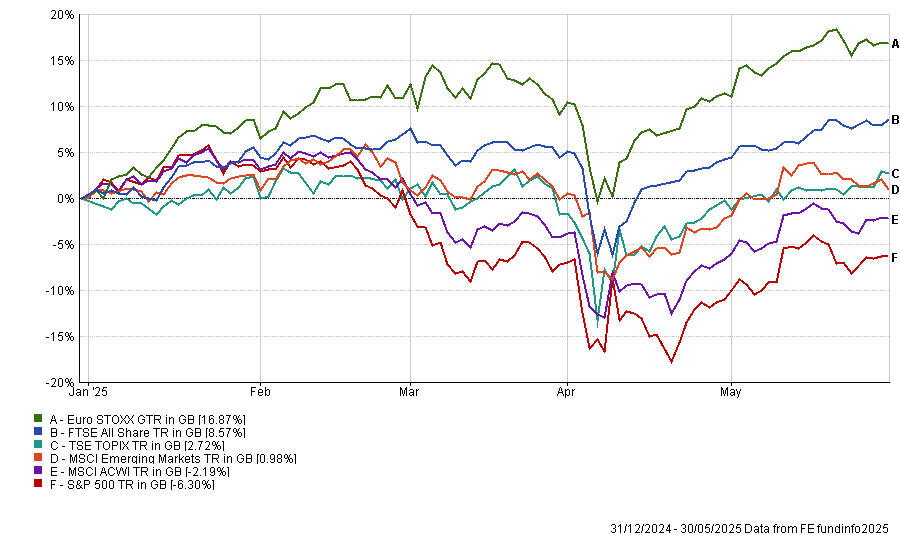

The MSCI AC World index lost 2.2% (in sterling terms) between the start of the year and the end of May, with the S&P 500 falling 6.3%. However, this is an improvement on the situation around six weeks ago, when global equities were down about 12.5% and US stocks had lost close to 18%.

Performance of indices in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 31 May 2025

Other markets are performing better, with the Euro Stoxx up 16.9%, the FTSE All Share 8.6% and the Topix 2.7%. But which funds have performed the best in this environment?

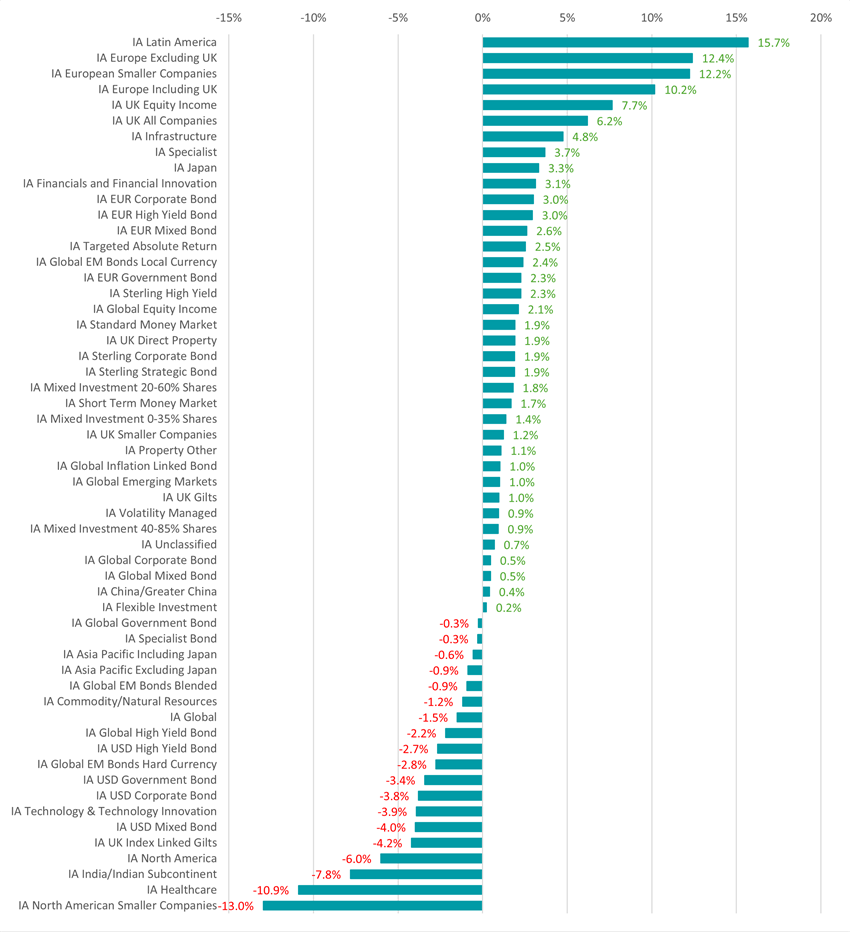

On a sector level, IA Latin America comes on top with its average member making a 15.7% return. This follows Latin American stocks being among the worst performers of 2024, which may have made them more attractive to bargain-hunting investors this year.

The space is dominated by Brazilian and Mexican stocks, which have made double-digit gains this year, as have the smaller markets of Columbia and Chile.

There are only eight funds in the IA Latin America sector and the best performers this year are BlackRock GF Latin American (up 22.3%), abrdn Latin American Equity (17.1%) and Liontrust Latin America (16%). Even the worst performers, CT Latin America and JPM Latin America Equity, have made close to 14%.

Source: FE Analytics. Total return in sterling between 1 Jan and 31 May 2025

The three European equity sectors – IA Europe Excluding UK, IA European Smaller Companies and IA Europe Including UK – are next in the peer group rankings year to date, in line with the strong returns in continental stock markets.

European stocks have benefited from an improving macroeconomic backdrop, interest rate cuts from the European Central Bank and higher defence spending. Investors have also turned to Europe as they sought alternatives to the faltering ‘US exceptionalism’ narrative.

The highest returns from these sectors have come from iShares EURO Dividend UCITS ETF (29.3%), Artemis SmartGARP European Equity (28.9%), Invesco EURO STOXX High Dividend Low Volatility UCITS ETF (26.3%), Xtrackers EURO Stoxx Quality Dividend UCITS ETF (25.6%) and SSGA SPDR MSCI Europe Financials UCITS ETF (25.6%).

On the other hand, IA North American Smaller Companies has been the worst performing sector with its average member losing 13% over the first five months of 2025.

US small-caps were one of the initial ‘Trump trades’ behind the market rally that followed the president's election victory in November 2024 but have sold off this year when the new administration’s trade policies caused investors to sour on the US economy.

Every fund in this peer group has lost month over the past five months. Barclays GlobalAccess US Small & Mid Equity has held up best, falling just 4.1%, while First Eagle US Small Cap Opportunity is at the bottom of the sector with an 18.6% drop.

Source: FE Analytics. Total return in sterling between 1 Jan and 31 May 2025

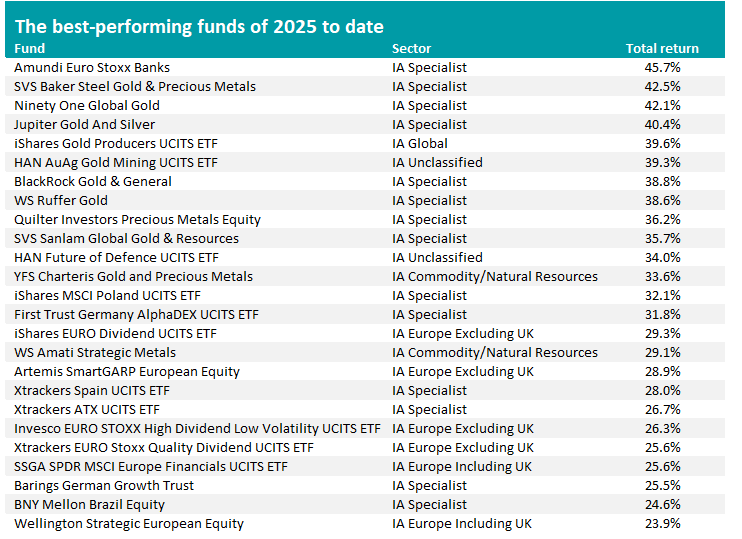

When it comes to individual funds, the best performer was Amundi Euro Stoxx Banks UCITS ETF, which made a 45.7% total return over the period under consideration.

European banks have performed strongly in recent years. The MSCI Europe Banks index is up 252.1% over the past five years (in sterling terms), compared with a 71.7% gain from the MSCI AC World; it has even beaten the tech-heavy Nasdaq by a wide margin.

In a recent update, strategists at Amundi tipped European stocks for continued outperformance, arguing that low valuations, falling inflation and supportive monetary policy should offset risks such as geopolitical tensions and economic uncertainty.

They added: “The financials sector, particularly EMU [economic and monetary union] banks, remains a key driver of this momentum, benefiting from attractive valuations, strong earnings and a shareholder-friendly approach.”

However, it is clear that one trend dominates the table above: the strong performance of funds that invest in gold and the companies that mine the precious metal. SVS Baker Steel Gold & Precious Metals, Ninety One Global Gold and Jupiter Gold And Silver are all up more than 40% this year, while another eight funds are among the top 25.

The yellow metal has surged in 2025 as investors have sought out safe havens from tariff-related uncertainty, taking it to successive record highs. The S&P GSCI Gold Spot index has gained 15.4% this year, while the S&P GSCI index (which tracks a broader range of commodities) has fallen 9.4%.

Although gold’s rally cooled in May, some are bullish from here. Fawad Razaqzada, market analyst at City Index, said: “Except last month, investors have been flocking to the yellow metal for months now as years of stubborn inflation and mounting debt across developed nations – especially the US and Japan – continue to chip away at confidence in fiat currencies.

“While a brief spell of trade optimism capped gold’s momentum in May, the tide might be turning again. Trade tensions have returned to the headlines and, with bond markets wobbling, gold could be setting up for another leg higher. The potential for a breakout this week is rising – especially if bond yields in the US and Japan resume climbing for all the wrong reasons.”

HAN Future of Defence UCITS ETF is another topical inclusion on the list of the year-to-date winners, with its 34% total return. It provides exposure to NATO and NATO+ ally defence and cyber defence spending.

Defence stocks are performing strongly in 2025 as rising geopolitical tensions have driven governments to increase military spending, boosting order volumes for major contractors. Sustained demand for advanced weapons systems and defence technology has led to stronger earnings and upward revisions in forecasts across the sector.