Crown Ratings: The funds that have gone from one to five crowns.

Trustnet looks at the funds that have improved the most over the past six months.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

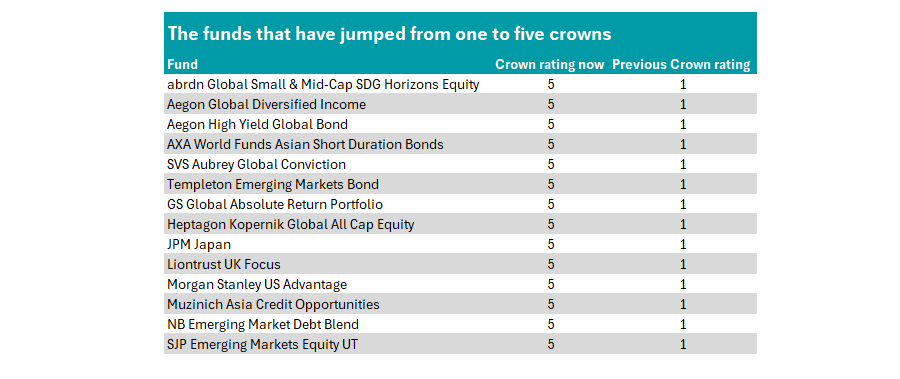

A number of funds run by Aegon, Liontrust, JP Morgan Asset Management and St James’s Place have rocketed up the rankings in the latest FE fundinfo Crown Ratings review, jumping from a lowly one-crown rating in January to the top five-crown ranking in the latest rebalance.

The bi-annual rankings look at three main factors: alpha, relative volatility and consistent performance over the past three years.

The top 10% of funds are awarded five FE fundinfo crowns, the next 15% receive four crowns and each of the remaining three quartiles will be given three, two and one crowns respectively.

Charles Younes, deputy chief investment officer at FE fundinfo, said: "The first half of 2025 marked a renewed confidence in growth strategies. Large-cap tech led a significant rally, assisting growth-based funds to recover from much of the market volatility that started in 2022 and impacted previous Crown assessments.

“Our latest rebalance reflects this renewed momentum, but also highlights how quickly market sentiment can rotate. Value funds have performed well previously due to sticky inflation and high interest rates.

“While many of these factors still persist across markets, investors' appetite has shifted towards a greater risk tolerance. Quantitative strategies and disciplined benchmarking continue to be critical for consistent performance, particularly in a volatile macroeconomic environment."

The largest of the funds to jump from one to five crowns is SJP Emerging Markets Equity. With £7.1bn in assets under management (AUM), the portfolio is managed by Aikya Investment Management, ARGA Investment Management, Lazard Asset Management and Wasatch Global Investors and sits in the IA Unclassified sector.

Aegon High Yield Global Bond, another with more than £1bn in AUM run by Thomas Hanson and Mark Benbow, is also in the IA Unclassified sector.

Two more funds run more than £1bn: Templeton Emerging Markets Bond and Heptagon Kopernik Global All Cap Equity.

Source: FE fundinfo

The former, managed by Michael Hasenstab and Calvin Ho, has been the second-best performer in the IA Global EM Bonds – Blended sector over the past three years (up 36.2%), although its long-term track record is weaker, as it is the worst performer in the peer group over 10 years.

Heptagon Kopernik Global All Cap Equity, meanwhile, is headed by David Iben and Alissa Corcoran and is one of three IA Global funds on the list alongside abrdn Global Small & Mid-Cap SDG Horizons Equity and SVS Aubrey Global Conviction.

It has had a strong past year up 29.3% over 12 months, and has surged in 2025, rising 21.6% over six months. It is heavily underweight the US, with just 8.4% to the world’s dominant market, with more than 40% in the emerging markets and some 14.7% in cash.

Liontrust UK Focus is the sole UK fund on the list, having made 42.7% over the past three years, although it is below the average peer over one, five and 10 years.

Morgan Stanley US Advantage is the only IA North America fund, while JPM Japan and GS Global Absolute Return Portfolio are sole entrants on the list from IA Japan and IA Targeted Absolute Return respectively.

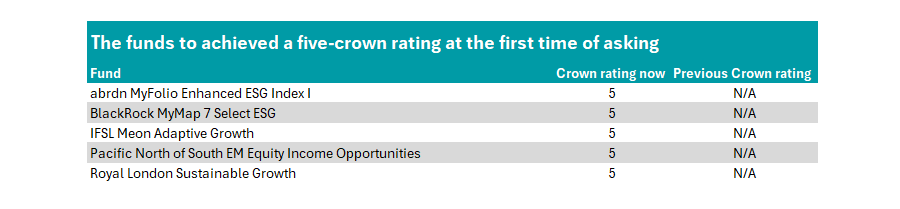

There were also five funds to achieve a crown rating of five at the first time of asking, as the below table shows.

Source: FE fundinfo

BlackRock MYMap 7 Select ESG, Royal London Sustainable Growth and abrdn MyFolio Enhanced ESG Index I are sustainable funds in multi-asset ranges for behemoth fund groups, while Pacific North of South EM Equity Income Opportunities has excelled in the IA Global Emerging Markets sector – sitting in second place over three years – while IFSL Meon Adaptive Growth has performed well in the IA Global peer group.

At the fund group level, Invesco houses the most funds with a five-crown rating (14), the same number it had at the start of the year, followed by Artemis (10), which has three more than in the previous rebalance.

Of the fund groups with at least 10 portfolios in their umbrella, Artemis remains the standout, with 43.5% of its funds gaining the top rating. It was followed by Man Group, Allianz and Aegon, with around a third of their funds getting top marks.

Factoring in those with more than one fund, but fewer than 10, Orbis Investments is the clear winner, with all three of its funds getting the top five-crown rating in the half-year rebalance.

Elsewhere, JP Morgan Asset Management was the big winner from the latest data, with seven new five-crown ratings, while L&G, Janus Henderson, Allianz and Threadneedle all had four more than six months ago.

By contrast, traditionally value-focused groups struggled, with M&G and Royal London (down five) slightly ahead of Schroders (down three) among the groups that saw their five-crown numbers drop.