Darius McDermott’s five fund picks flying under the radar .

The multi-asset manager highlights the strategies investors have been ignoring this year.

- Patrick Sanders

- 4 min reading time

Source: Trustnet

Investors who have piled back into the US market in recent months have “left behind” some excellent long-term funds that are not “chasing the ‘go-go’ exciting stocks”, according to Darius McDermott, manager of the VT Chelsea fund range.

In the summer, investors pivoted back into the US after a “rise in animal spirits in markets” following strong US earnings and a renewed enthusiasm for artificial intelligence (AI) stocks, McDermott said.

The S&P 500 is up 6.4% in sterling terms so far this year, but much of this has been made in the second half of 2025. Between January and June, the market was down around 3%, but since the start of July it has gained 10.5%.

But by chasing these gains, investors have allowed some top-performing value, thematic and emerging market funds to slip from their radar.

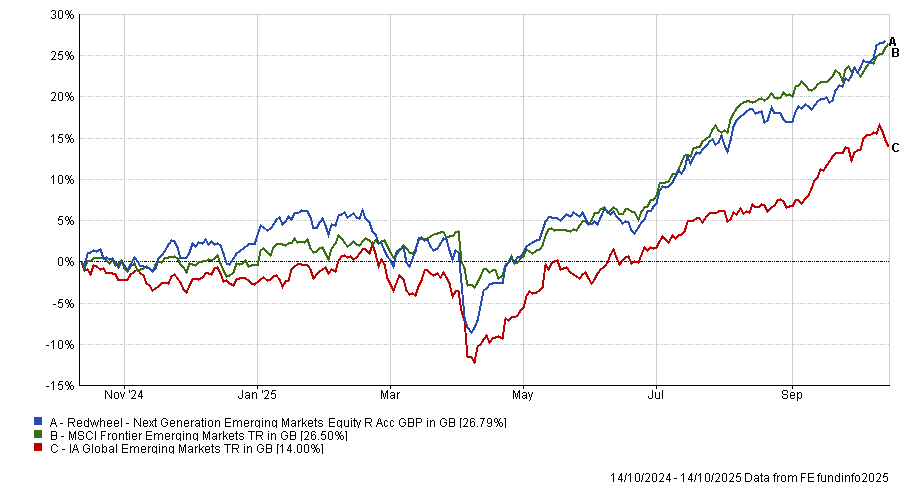

An example of this is the Redwheel Next Generation Emerging Markets Equity fund, which focuses on frontier markets such as Kazakhstan and Indonesia.

These frontier markets have exceptional quality assets, such as Bangladeshi banks, which often have better balance sheets than their counterparts in markets such as China or India, McDermott said.

Under the leadership of James Johnstone, Redwheel has delivered “spectacular performance” in recent years, with top-quartile returns over the past one, three and five years.

Performance of fund vs sector and benchmark over past year

Source: FE Analytics

McDermott has increased his allocation towards the strategy this year, taking some US exposure off the table in the process as investors have openly questioned whether the end is near for ‘US exceptionalism’.

He noted: “If the US is no longer the only game in town, why not take on some exposure to emerging markets?”

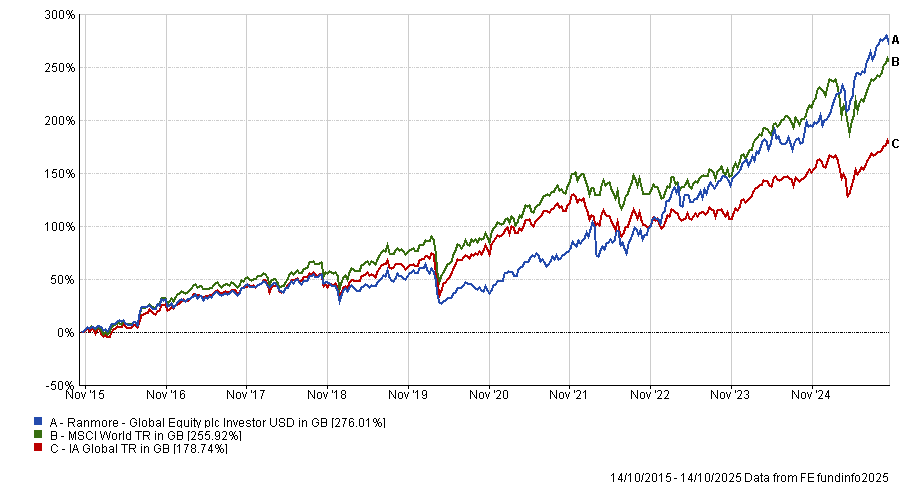

Ranmore Global Equity is another fund that is “only just starting to hit people’s radars” despite being one of the global sector's “shining stars,” he said.

Run by Sean Peche, the fund is a global value portfolio with a significantly differentiated exposure to the market. It is almost 50 percentage points underweight the US compared to the MSCI World and holds none of the ‘Magnificent Seven’, which represent more than 20% of the index.

This has not held the portfolio back, however, with the fund up 15% since McDermott bought it at the start of the year.

Over the longer term, it has continued to deliver for investors, with further first-quartile performance over the past three, five and 10 years.

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics

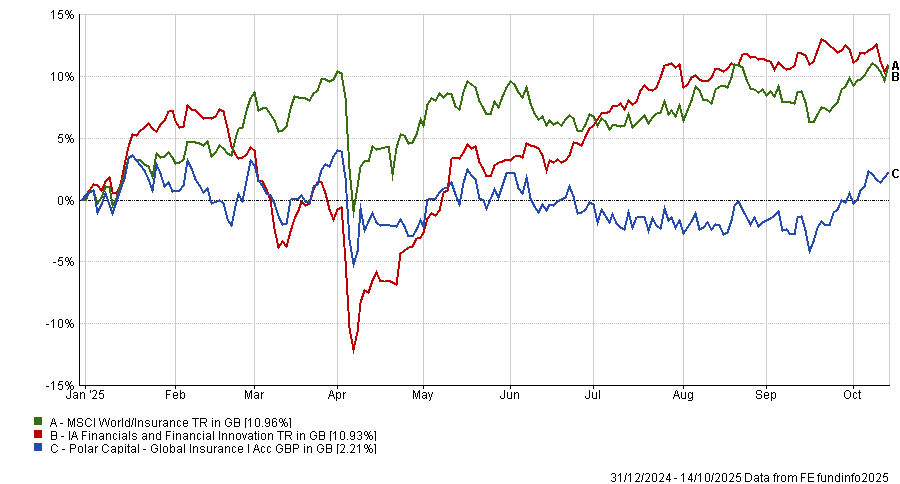

Thematic funds have also been forgotten by investors this year, such as Polar Capital Global Insurance, said McDermott. He praised lead manager Nick Martin, noting there are “few managers with a more intimate knowledge of their market”.

This fund may make sense for investors who want defensive assets, as it has a low beta with equity markets (0.36 versus the MSCI ACWI over three years). This means during downturns the fund will minimise investors' losses, McDermott said.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

While global insurance has “basically flatlined this year” and underperformed the wider market, this has not deterred McDermott, who has increased his allocation.

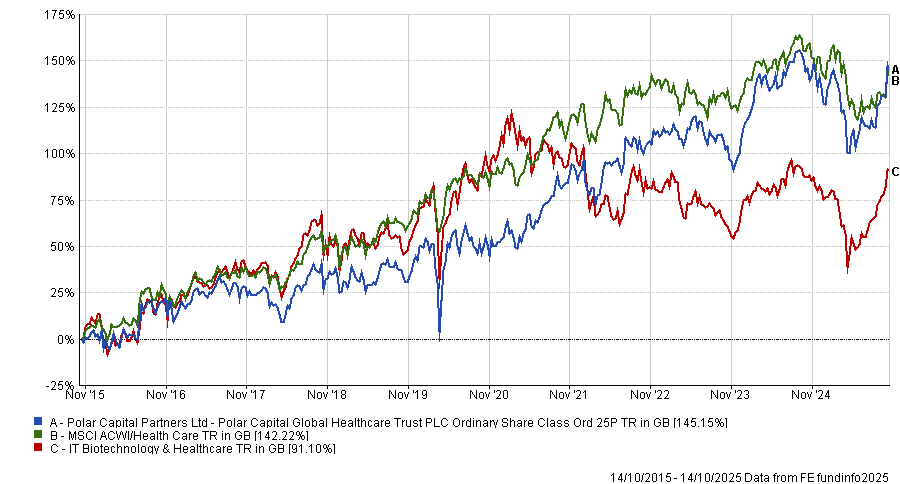

From the same stable, McDermott also favoured the Polar Capital Global Healthcare Trust. Run by James Douglas and Gareth Powell, it invests in a range of pharmaceuticals, biotechnology, medical technology and healthcare services.

This approach has served the trust well over the very long term, with the strategy producing a 145.2% total return over the past 10 years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

McDermott conceded that healthcare portfolios have “enjoyed none of the rally this year” as the sector has had to contend with a number of challenges recently, including president Donald Trump’s revamping of drug prices.

However, this has caused valuations to fall, meaning investors can now access the defensive asset class at one of the “lowest relative prices to the S&P 500 in its history”.

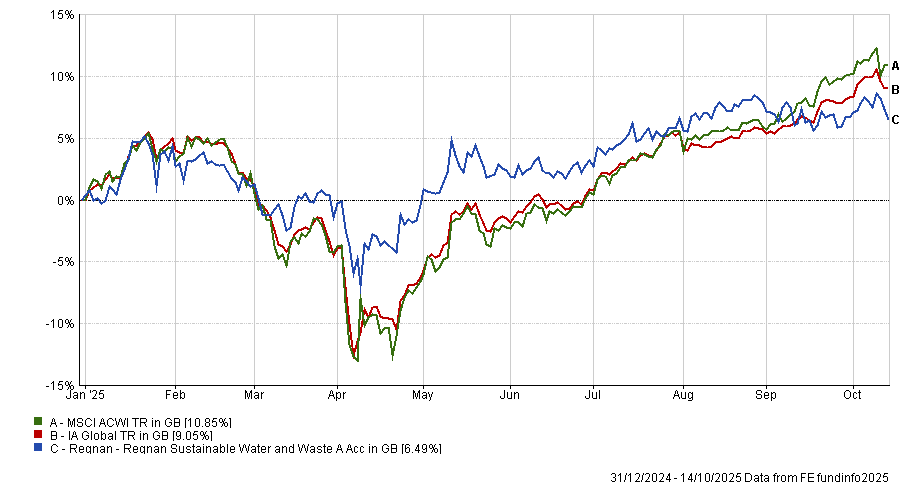

Finally, he identified Regnan Sustainable Water and Waste, a high conviction fund focusing on the “largely under-researched water and waste themes”. This means it holds a very different set of assets to IA global peers, with an average beta versus the MSCI ACWI of just 0.6 or 0.7 historically.

“Because of that low beta, if the market falls 20%, you should expect this to fall just 10% or 12%, which we find compelling,” he said. Indeed, during the peak of the ‘Liberation Day’ slide earlier this year, the fund fell 6.9%, compared to the 13% drop for the MSCI ACWI.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

“We think it’s important to allocate to these specialist funds that can still make returns while also protecting in the event of a sell-off,” McDermott concluded.