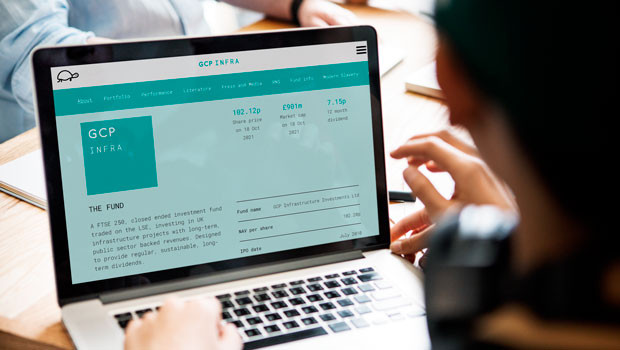

- GCP Infrastructure Investments Ltd

- 10 May 2024 11:12:36

Source: Sharecast

The company announced on 26 April that it has sold its interest in loan notes secured against the onshore wind farm in Dumfries and Galloway for £31m – a 6.4% premium to a valuation at the end of March – proceeds of which will be used to prepay drawings under its revolving credit facility (RCF).

Jefferies pointed out that the deal reduces GCP's net debt to £45m, making a "key initial contribution" to the company's conditional target of releasing £150m (equal to 15% of its portfolio) from disposals or refinancings to repay the RCF and return £50m to shareholders before the end of the year.

"A recent disposal has helped bring forward the date at which the RCF will be repaid and the capital returns indicated for 2024 can begin," Jefferies said in a research note.

"Additional disposals will further accelerate this process, with scheduled loan repayments raising the prospect of ongoing capital returns beyond 2024."

The stock was up 2.2% at 76.65p by 1111 BST.