- Arm Holdings Plc Ads

- 03 June 2024 12:40:47

Source: Sharecast

The company is pricing its initial public offering at between 260p and 280p per share, and is thought to be valued at around £500m when conditional trading starts on 11 June, according to Bloomberg.

Chipmaker Arm Holdings, which holds a minority stake in the firm following an investment last November, has agreed to buy $35m of shares in the IPO, while fellow shareholder Lansdowne Partners as agreed to buy up to $20m.

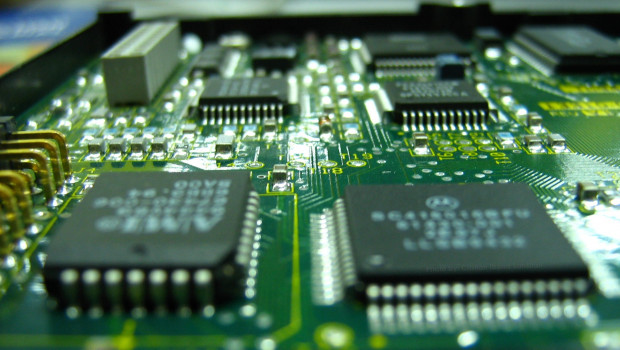

Raspberry Pi was founded initially as a computer maker for hobbyists and tech enthusiasts, but has expanded its offering to more industrial and commercial purposes in recent years.

In a statement last month, Raspberry Pi's non-executive chair Martin Hellawell, said the IPO "underscor[es] our confidence in the UK as the home for innovative and growing global businesses".

"Raspberry Pi is a British computing success story, and this marks the next stage in the evolution of the company. Through the team’s dedication to excellence in high-performance, low-cost, general-purpose computing, Raspberry Pi has been transforming the global computing landscape since its first product was launched in 2012, successfully marrying a social agenda with commercial focus," Hellawell.