- Gem Diamonds Ltd. (DI)

- 28 August 2024 09:15:56

Source: Sharecast

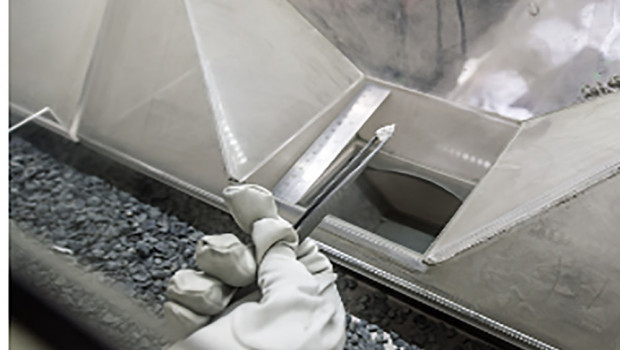

The mine, one of the largest open pit diamond mines in the world situated in the Maluti Mountains of Lesotho, produced a 129.71-carat Type II white diamond last week, the company announced.

Type II diamonds have no measurable nitrogen or boron impurities, and these high-value, 100-carat-plus diamonds from Letšeng account for 70% to 80% of Gem Diamonds' annual revenue.

Letšeng, Gem's only operation after its Botswana underground mine Ghaghoo was placed on care and maintenance in 2017, has produced three of the 20 largest white diamonds ever recorded since Gem took ownership in 2006.

Recent discoveries include a 439-carat diamond recovered in 2020 which sold for $16.1m, and a 367-carat stone found in 2021 which sold for $9.6m.

Gem said earlier this month that 55,873 carats were recovered in the first half of 2024 from Letšeng. A total of 56,944 carats were sold, generating $77.9m in revenues (up 9% on last year) at an average price of $1,366 per carat.

The company is due to report its half-yearly results on Thursday.

The stock was up 1.4% at 13.71p by 0909 BST, its highest level since last October.