Source: Sharecast

Launching its investor day, ASML said the long-term outlook for the semiconductor industry "remained promising", fuelled in part by the boom in artificial intelligence.

It confirmed plans to deliver annual revenues of between €44bn and €60bn by 2030, with a gross margin of between 56% and 60%.

That represents sales growth on average of between 8% and 14% over the next five years.

Analysts welcomed the update, especially after third-quarter numbers in October missed expectations. Although AI-related demand remained strong, ASML said at the time that customers were being more cautious in other areas.

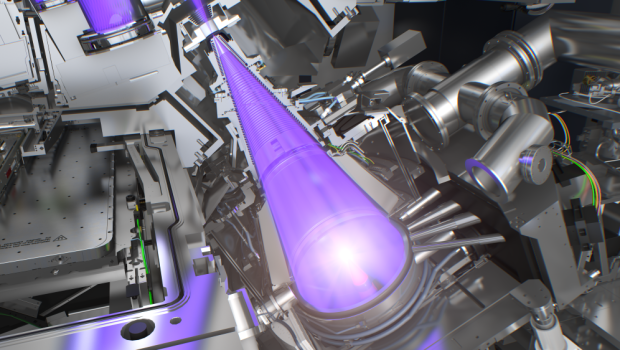

ASML, which makes the high-precision machines needed to make chips, counts Intel, Samsung and TSMC as clients.

As at 1000 GMT, shares in ASML - Europe’s biggest tech firm - had put on 5%.

Christophe Fouquet, chief executive, said: "We expect that our ability to scale EUV technology into the next decade, and extend our versatile holistic lithography portfolio, positions ASML well to contribute to and leverage the AI opportunity, and allows ASML to deliver significant revenue and profitability group."