Source: Sharecast

Net income surged 49% to $1.9bn, driven by a 14% increase in revenue to $10.8bn.

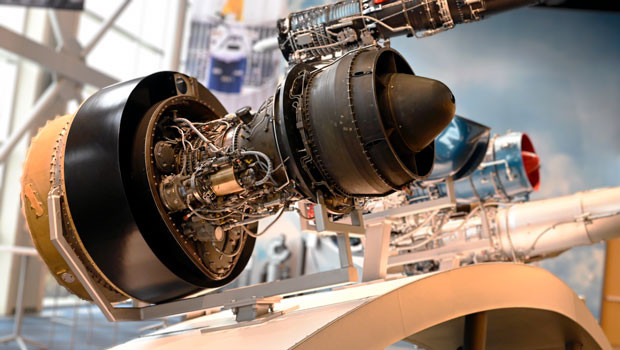

The company’s commercial engines unit, a key revenue driver, performed particularly well with revenue exceeding forecasts at $7.65bn.

GE attributed that success to “robust demand for our services and products”.

Looking ahead, GE Aerospace flagged continued growth in 2025.

The company said it expected double-digit revenue growth and an increase in operating profit to between $7.8bn and $8.2bn.

It explained that its positive outlook was fuelled by ongoing demand for parts and services, as production delays for new aircraft forced airlines to rely on older planes requiring more maintenance.

The company did warn, however, that material availability issues would constrain deliveries in the near future.

GE Aerospace announced a $7bn share buyback programme for 2025, and a 30% increase in its quarterly dividend.

At 0929 EST (1429 GMT), shears in GE Aerospace were up 6.55% in premarket trading in New York, at $200.70.

Reporting by Josh White for Sharecast.com.