Source: Sharecast

These are not the financial markets as they used to be. They are turning to sophisticated digital tools that can be useful to make transactions immediately, analyze data more accurately, and protect it. Technology is redefining the playbook of finance, and it is not simply about automation of processes — it is about creating systems that can enable a company to stay ahead of the competition and evolve quickly in a quickly changing environment. In this article, we’ll explore why the quality of digital solutions has become critically important for financial markets and what steps you can take to avoid falling victim to poor software.

The Evolution of Financial Markets

Financial markets have evolved a great distance from the raucous trading floors of the past. Where traders once yelled their offers on the exchange floor, algorithms now process millions of trades in one second. All this would have been impossible to imagine without quality software, as modern markets not only require software but also solutions that can scale, integrate, and secure data.

These markets are moving faster than was once the stuff of science fiction. Thousands of transactions per second have to be processed by payment systems and investment platforms providing real-time information. Slow software costs tens of millions of dollars in terms of latency, and high-quality digital solutions lower response times and give a feeling of confidence.

One of the most important capabilities is security, as cyberattacks are becoming more sophisticated and the loss or breach of data can harm the reputation of a company as well as impose astronomical fines. This is the reason why premium digital solutions also contain:

● Multi-factor authentication: Defending platform access;

● End-to-end encryption: Protecting data;

● Compliance with GDPR and PCI-DSS: The ability to offer compliance with the high standards of regulation.

The last one deserves particular mention as GDPR, PCI-DSS, and KYC entail flawless treatment of data. That is where custom software development provider Acropolium comes in to create solutions that are designed to be compliant. Their high-end software not only automates but also minimizes the likelihood of fines.

Scalability: Preparing for Growth

The financial markets are volatile, and an increase in the number of users, transactions, or entry into new markets suggests that the systems need to be scalable. Scalable solutions are a competitive advantage to companies that adopt such solutions, particularly in FinTech, where the volumes of transactions can be rapidly increased.

Enterprise-grade solutions can be scaled horizontally, are readily compatible with cloud computing providers like AWS or Azure, and are capable of being extended to accommodate new functionality. These platforms allow firms to grow without necessarily reworking their entire infrastructure.

It must be noted that some off-the-shelf solutions have too many features that are unnecessary and add expense and complexity to use. In this case, a company offering custom software development develops solutions according to business needs, where technologies like AI, blockchain, and big data can be utilized:

● AI for automation: Speeds up processes like loan processing or insurance claims handling;

● Blockchain for transparency: Allows for data immutability;

● Big data analytics: Helps to identify trends and provide decision-making assistance.

Such technologies are not only able to enhance processes but also facilitate the emergence of new business opportunities. These digital solutions make a difference in the success as they target more users to sign up, maximizing trading volumes, and ensuring that all the required regulatory standards are met. Such software can help to change your business to become competitive and attractive to the clientele.

How to Choose the Right Digital Solution

In case you cannot understand how low-quality digital solutions can become a disaster, the primary concerns are a) system failures, b) data breaches, and c) non-compliance with standards. All of these inevitably lead to the following consequences:

● High costs for rework: Fixing errors often costs more than building from scratch;

● Loss of clients: Slow or unreliable systems drive users to seek alternatives;

● Security risks: Vulnerabilities threaten customer data.

According to all this, the choice of the right digital solution is a very crucial step. But it is not technology per se — it is collaboration. For example, the Acropolium team is characterized by its flexibility, and even the director of Vestberry praised their professionalism when developing FinTech SaaS solutions, noting that they always begin with an intensive analysis of the client's needs in order to offer a product that is custom-made.

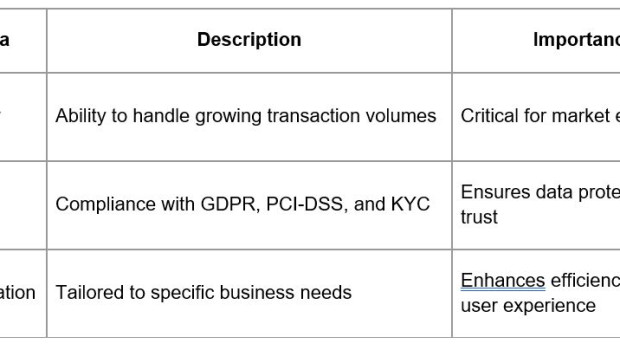

However, regardless of which partner you choose, never forget the three most crucial criteria in mind, which we summarize in the table below:

The criteria will help you choose a solution to facilitate long-term prosperity. Be cautious in your choice, as the financial markets' future inevitably rests on further digitalization.

Final Thoughts

The sustainable finance market is projected to be 18.8 trillion dollars by 2029, and only businesses investing in high-end software will be capable of staying up to date with new trends, learning to cope with the increased customer expectations, and minimizing operating costs.

Here, it will be the integrity of online solutions that will ultimately determine whether your business will prosper or not. The Acropolium team takes pride in assisting businesses in attaining their goals, be they start-ups or huge corporations. Therefore, in case you want to know how we can assist your business, all you would have to do is contact us and have a free consultation, and start changing today.