-

30 April 2025 18:37:39

- Source: Sharecast

Consolidated Annual Report and Financial Statements

FIRST CLASS METALS Plc

For the Year Ended 31 December 2024

(Company Number: 13158545)

First Class Metals Plc

Company Information

|

Directors |

James Knowles - Executive Chairman Marc Bamber - NED Andrew Williamson - NED David Webster - NED (appointed 3 March 2025) (resigned 31 March 2025) Marc Sale - Executive Director (Resigned 3 March 2025) |

|

|

|

|

Company Secretary |

Siddharth Muricken |

|

|

|

|

Registered Office |

Manor Court Offices, Suite 24 Manor Court Salesbury Hall Road Ribchester Preston Lancashire PR3 3XR |

|

|

|

|

Financial Advisors |

Novum Securities 2nd Floor 7-10 Chandos Street London W1G 9DQ |

|

|

|

|

Auditor |

Royce Peeling Green Limited The Copper Room Deva City Office Park Trinity Way Manchester M3 7BG |

|

|

|

|

Corporate Lawyers to the Company |

OBH Partners 17 Pembroke Street Upper Dublin2 Ireland D02 AT22

|

|

|

|

|

Lawyers to the Company as to Canadian Law |

Peterson McVicar 18 King Street East Suite 902 Toronto Ontario M5C 1C4 Canada |

|

|

|

|

Registrars |

Share Registrars Limited Molex House Millennium Centre Farnham Surrey GU9 7XX |

|

|

|

|

Company Website

|

Table of Contents

CEO's Review on the Company Portfolio, Strategy and Operations

1. Hemlo area

2. Sunbeam

3. Esa

4. Kerrs

5. Zigzag

6. McKellar

7. Enable

8. Coco East

9. Magical

10. Quinlan

11. Sugar Cube

Summary, strategy, and conclusions

The principal risks and uncertainties

CLIMATE RELATED FINANCIAL DISCLOSURES

Statement of Directors' Responsibilities in respect of the Annual Report and the financial statements

Consolidated Income Statement for the Year Ended 31 December 2024

Consolidated Statement of Financial Position as of 31 December 2024

Company Statement of Financial Position as of 31 December 2024

Consolidated Statement of Changes in Equity for the Year Ended 31 December 2024

Company Statement of Changes in Equity for the Year Ended 31 December 2024

Consolidated Statement of Cash Flows for the Year Ended 31 December 2024

Company Statement of Cash Flows for the Year Ended 31 December 2024

Notes to the Financial Statements for the Year Ended 31 December 2024

Independent auditor's report to the members of First Class Metals Plc

HIGHLIGHTS

Corporate Developments

· The Company maintained operational discipline while progressing exploration on the core gold and critical metals projects.

Exploration and Operations

· Review of the historical core from the Sunbeam property was undertaken which potentially increases the geological and geochemical profile of the target zones.

· Exploration of the Dead Otter trend confirms the prospectivity, as well as potentially increasing the width of the structure anomalous in gold (Au).

· Acquisition of the Kerrs Gold Project with a historic NI43-101 resource.

Post-Period Events

· On 25 February 2025, The Seventy Ninth Group Limited completed an equity injection of approximately £548,000 and full repayment of all outstanding Company debt. under the strategic investment agreement announced on the 18 December 2024.

· The Company is actively reviewing its position in light of emerging regulatory matters involving The Seventy Ninth Group, applying a prudent and governance-led approach.

· Further winter work programmes initiated at priority projects, maintaining focus on value-driven exploration and critical mineral development

CHAIRMAN'S STATEMENT

For the Year Ended 31 December 2024

I am pleased to present the Chairman's Statement for the year 2024, a year of progress and prudent strategic management for First Class Metals PLC. Throughout 2024, we advanced our portfolio of exploration projects in Ontario with encouraging results and took deliberate steps to strengthen the Company's long-term outlook. This year was marked by the development of existing key projects, new partnerships, and active portfolio refinement, all underpinned by a cautiously optimistic approach in a favourable market for our commodities.

Operational Highlights and Project Development: FCM's exploration activities in 2024 yielded substantial developments across our key properties. At our flagship North Hemlo (Dead Otter) project, we built on the gold discovery announced in the previous year and increased our understanding of the Dead Otter gold trend. Follow-up work, including stripping and channel sampling along this trend provided a greater geological understanding. These results have reinforced our confidence that Dead Otter represents a high-profile gold target with considerable upside. Similarly, at the Sunbeam Gold Project, our work programmes delivered positive outcomes. In early 2024 we reported values up to 18.8 g/t Au from the Roy occurrence. Notably, we discovered gold not only in the quartz veins around the old workings but also in the surrounding altered porphyry host rock, indicating a larger mineralised system than previously thought. This finding could significantly enhance the project's potential, as it suggests the gold is more widespread and not confined to the historical vein structures. These gold project results position us well to advance toward more invasive exploration (including drilling) in the next stages, subject to final data analysis and target definition.

In the critical minerals segment, FCM also made strong strides. Our Zigzag Lithium/Critical Metals Project progressed substantially in 2024. In late 2023 we initiated an inaugural drill programme at Zigzag, and the assay results, announced in early 2024, exceeded expectations. Every hole drilled targeting mineralisation intersected visible spodumene (a lithium-bearing mineral), confirming lithium mineralisation along the core zone. Many intercepts returned high lithium grades over significant widths-several exceeding 1% Li₂O, with a standout result of ~2.3% Li₂O over 5.5 metres in one section. Our geological teams identified a potential second lithium-bearing (and other significant critical minerals), trend parallel to the main zone, south of the area drilled, which opens up additional exploration targets on the property. Building on Zigzag's success, we expanded our lithium portfolio by acquiring the Quinlan Lithium Property (via earn-in agreement) in the first quarter of 2024. Quinlan, a hard-rock lithium prospect in the same region, adds another promising exploration target for critical metals. Together, Zigzag and Quinlan give FCM a strong foothold in the burgeoning lithium exploration space at a time when demand for battery metals continues to rise.

Portfolio Expansion and Strategic Partnerships: During the year, we actively managed our property portfolio to ensure focus on the most value-accretive opportunities. In early 2024, FCM secured an option into the Kerrs Gold Project in northeastern Ontario. Kerrs holds a historic resource estimate of approximately 386,000 ounces of gold (NI 43-101 compliant), immediately placing a significant gold asset into our pipeline. Formalising the Kerrs earn-in agreement in April was a major step that brings a more advanced-stage gold project into FCM's portfolio, complementing our exploration-stage assets with a project that has substantial historical data. We believe Kerrs, alongside Sunbeam and North Hemlo, strengthens FCM's position in the gold exploration sector with both near-term exploration targets and longer-term district scale development potential.

Concurrently, in line with our "discover → add value → monetise" strategy, we made the strategic decision to divest certain non-core assets and collaborate with external partners. In June 2024, FCM completed the sale of the McKellar and Enable properties for £270,000 in cash to the UK-based Seventy Ninth Group Limited ("79TH Group"). These two properties, while prospective, were considered non-core relative to our main focus areas, and this sale allowed us to unlock their value in cash. Alongside the sale, we entered into a cooperative funding arrangement with 79TH Group to provide FCM with a £230,000 loan facility (over 12 months) to support our ongoing exploration on the remaining projects. This two-part transaction was a clear validation of FCM's "incubator" business model-we proved that advancing our assets up the value curve can generate tangible returns without diluting shareholders, as the proceeds from the sale and the injection of loan capital bolstered our balance sheet directly. Throughout the second half of 2024, our partnership with 79TH Group deepened: by December, after further due diligence and discussions, the initial loan facility was increased to £500,000 in October and to £700,000 by year-end. These funds, have been instrumental in fully funding our winter 2024/25 exploration programme, including geophysical surveys and expanded geochemical sampling at North Hemlo and Sunbeam.

Strategic Investment:

In December 2024, we announced a proposed strategic equity investment by 79TH Group, under which it would acquire approximately a 51.2% equity stake in FCM through a staged investment totalling around £2.18 million, , subject to regulatory and shareholder approvals.

Stage One of the transaction was completed in February 2025, after the period end, resulting in an equity injection of approximately £548,000 and the full repayment of all outstanding debt previously owed by the Company. However, Stage Two, the final completion, is currently on hold, following the emergence of certain external matters involving 79TH Group. Whilst 79TH group denies any wrongdoing, the Board has taken a prudent and measured approach in light of these developments.

We continue to monitor the situation carefully and will assess any further steps in line with our governance standards and the long-term interests of shareholders. At the time of writing, there are no outstanding loans and the Company remains focused on advancing its exploration plans independently, with a clear commitment to maintaining stability and discipline in its operations.

Financial Review and Funding: FCM entered 2024 with a solid cash position thanks to the fundraisings in the prior year, and we maintained a disciplined approach to financing during the year. We successfully raised additional equity capital through two targeted placings: in February, we completed a small £166,500 private placement at 10% above the prevailing market price, and in August we raised a further £256,500 at 2.7p per share. Importantly, we also benefited from non-dilutive funding sources during 2024. FCM was awarded a C$200,000 grant under the Ontario Junior Exploration Programme (OJEP) for the Zigzag project, recognition by the provincial authorities of the project's significance in the critical minerals space. We also received a C$212,780 tax credit refund from the Canadian government (for exploration expenditures), which provided a welcome reimbursement of funds spent on our projects. These grant and tax credit proceeds, equivalent to roughly £250,000, were immediately redeployed into our exploration budget. Combined with the asset sale proceeds and the infusion of loan capital mentioned earlier, FCM ended the year in a stronger financial position. The careful mix of funding sources, strategic asset monetisation's, partnership financing, equity placements at opportune times, and government incentives-exemplifies our prudent financial strategy. We have managed to advance our projects without over-reliance on dilutive equity issuance, which is a testament to the creative and shareholder-conscious approach our management and Board have taken. This financial stewardship gives us confidence that we can sustain our exploration and development plans going forward, even as we remain vigilant about market conditions.

With our portfolio evolving, FCM now boasts a robust suite of projects at various stages of maturity. By the end of 2024, we have multiple assets that we believe can drive substantial long-term value and attract further partnership or monetisation opportunities as they advance. Notably, our core projects include:

· North Hemlo (Dead Otter Gold Trend): A large, district scale property with a 3.7 km mineralised trend confirmed by surface high-grade gold occurrences. With exploration permits secured and new anomalies identified, this project is poised for the next level of exploration to unlock its full potential.

· Sunbeam Property A past-producing high-grade gold project featuring several historical workings (Sunbeam, Roy, Pettigrew) and newly identified gold zones in host rock. 2024 results have expanded the scope of mineralisation, and we plan to refine drill targets around both the known vein structures and the broader shear/porphyry system.

· Kerrs Gold Property: A more advanced-stage gold project with a historical resource, providing FCM with a significant gold inventory subject to confirmation and expansion. Kerrs is strategically located in a prolific mining district and offers a potential development pathway as we validate past work and conduct further exploration activities.

· Zigzag: A hard-rock lithium and critical metals exploration project located in the Thunder Bay-Northwestern Ontario region, an emerging lithium province. Zigzag has delivered strong lithium and associated critical metal drill results, confirming the presence of spodumene-bearing pegmatites and revealing significant multi-trend potential across the property. The project continues to advance as a cornerstone of FCM's critical minerals strategy and positions the Company to capitalise on the growing demand for lithium in North America.

This well-balanced and diversified portfolio across precious metals and battery metals gives FCM multiple avenues for potential success. It also affords us flexibility in our strategic decisions, for instance, we can pursue partnerships on certain projects while concentrating our in-house resources on advancing the highest-priority targets. We are confident that this approach of actively managing our portfolio will continue to crystallise value efficiently.

Bullish Outlook for Gold and Market Context: It would be remiss not to comment on the broader market environment, particularly the strong performance of gold in 2024. Over the course of the year, gold prices climbed significantly, reaching new all-time highs in the latter part of 2024. After beginning the year around the $1,850-$1,900/oz range, gold steadily appreciated and ultimately broke through the $2,000/oz level, with the average price in Q4 2024 setting record levels. At the time of writing the gold price has crossed $3,200. This rally has been fuelled by persistent global inflation, economic uncertainty, and geopolitical tensions, which led investors and even central banks to increase gold purchases at a historic pace. The result was a powerful reaffirmation of gold's role as a store of value and an effective hedge against inflation and volatility. For a company like First Class Metals-focused on gold exploration in a top-tier jurisdiction-this macro trend is extremely encouraging. We maintain a very optimistic long-term outlook on gold. High gold prices improve the economics of any discoveries we make, attract greater investor interest to gold exploration companies, and can drive industry consolidation or partnerships as larger producers look to secure future resources. While prices will naturally fluctuate, we believe the fundamental support for gold remains strong going forward, given factors such as ongoing inflationary pressures, currency market dynamics, and robust demand from emerging markets and central banks. In short, gold is shining bright, and FCM is well-positioned to benefit from this bullish climate through our expanding gold project pipeline.

It is also notable that interest in critical minerals (like lithium, nickel, and copper) stayed high throughout 2024, supported by the global push for electrification and renewable energy. The Canadian government and Ontario province have continued to champion critical metals projects (evidenced by grants like the one we received), creating a supportive backdrop for our Zigzag and Quinlan initiatives. FCM's dual focus albeit with a main focus on gold but with an element of critical metals exposure remains a core strength of our strategy, providing exposure to two complementary sectors and insulating us against single-commodity risk. We are very encouraged by the market's recognition of the value in both these areas and foresee sustained interest as the world navigates energy transition on one hand and economic uncertainty on the other.

Looking Ahead-Cautious Optimism and Long-Term Value Creation: The Board and management of First Class Metals remain cautiously optimistic and resolutely focused on our mission. The achievements of 2024 have laid a strong foundation. We have built considerable momentum in our exploration programmes, forged beneficial partnerships, and upheld financial prudence. Our task now is to carry this momentum forward into the coming year and beyond, converting our exploration success into tangible value for our shareholders. While also remaining open to strategic transactions that can accelerate value realisation (such as joint ventures, complete sale or partial divestments on the right terms). We will continue to evaluate all options dispassionately, with the core aim of maximising the return on every asset in our portfolio. The flexibility we've cultivated allows us to adapt our plans as needed, which is especially important in the ever-evolving landscape of the junior mining sector.

As part of this, our focus will remain firmly on advancing our core assets, North Hemlo, Sunbeam, Kerrs and Zigzag, which we believe offer the strongest potential for near and longer-term value creation. Each of these properties continues to show encouraging progress, and we are committed to prioritising their development in line with our strategic objectives. In parallel, we will undertake a measured review of the wider portfolio, with a view to identifying opportunities to realise value from selected holdings that may no longer align with our near-term focus. This considered approach will allow us to maintain a streamlined, high-quality portfolio, while creating optionality for future transactions that support shareholder value.

In summary, First Class Metals has a sharpened strategic focus, a rich set of opportunities in our project pipeline, and a supportive market backdrop for our commodities. While we remain mindful of the challenges that can affect early-stage exploration companies, such as market volatility, regulatory hurdles, and operational risks, we are confident that FCM is equipped to navigate these challenges. Our prudent yet proactive strategy has positioned us to capitalise on the hard work done to date. The Board truly believes that the long-term value being created through our projects will ultimately be reflected in our Company's valuation.

I would like to conclude by expressing my sincere gratitude to our shareholders for their continued support and patience. It is your confidence in our vision that enables us to pursue ambitious goals. I also thank our dedicated team of geologists, field staff, and advisers-notably our exploration teams in Canada (led by Emerald Geological Services), who have shown unwavering commitment and expertise throughout the year. Their efforts have been the driving force behind the successes outlined in this statement. Lastly, I acknowledge our various partners, including local First Nation communities and industry collaborators, for their cooperation and trust as we advance our projects responsibly and respectfully.

Looking ahead, I am enthusiastic about FCM's prospects. We will carry forward the cautious optimism that served us well this year, always balancing ambition with due diligence. By doing so, I am confident that First Class Metals will continue to grow and thrive, delivering on our strategic goals and, most importantly, creating enduring value for our shareholders.

Thank you for your continued support. We look forward to an exciting and productive year ahead.

James Knowles

Chairman

OPERATIONS REPORT

CEO's Review on the Company Portfolio, Strategy and Operations

BACKGROUND

First Class Metals is a Canadian focused gold and critical metals explorer. The Company is focused on exploring the northern region of Ontario. As at 31 December 2024, FCM, through its wholly owned subsidiary First Class Metals Canada Inc ("FCMC"), holds five properties which it owns 100%, with a further four under option agreements and a joint venture on an additional property. Geologically, these blocks lie within highly mineralised and prospective greenstone belts.

During the reporting period, two of the claim blocks 100% owned at listing in 2022 were sold to 79TH Group, these were the Enable and McKellar properties. This is in line with the Company's business model to develop assets and then to monetise the assets (properties).

Additionally, during the reporting period, FCMC has entered into an agreement, for the Quinlan property, situated in northwest Ontario, with potential for hard rock lithium discovery and the Kerrs Gold Project near Timmins, which contains a compliant, if historic, gold resource.

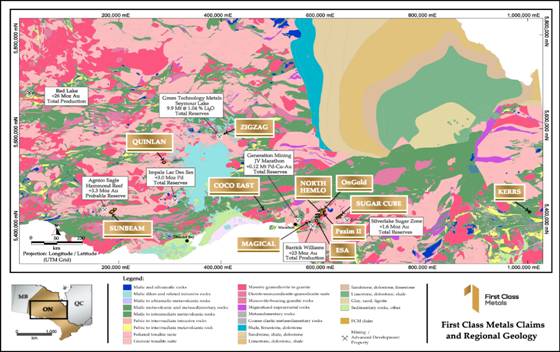

Option agreements are also active with Nuinsco Resources Limited ('Nuinsco') in relation to the Sunbeam property, central area, as well as the Zigzag property and a third agreement with a private company, OnGold Invest Corp ('OnGold') over the OnGold property contiguous to the north of the North Hemlo block. All properties are located in north-west Ontario, see Figure 01. The details of all these transactions have been provided in press releases.

Figure 01 showing the ten property blocks (11 properties) currently under the control of FCMC. Note: North Hemlo and OnGold are contiguous and is considered one project, note the Enable and McKellar properties are not shown.

FCM, whilst constantly on the 'look-out' for quality properties, considers the two 'flagship' properties of North Hemlo and Sunbeam contain significant potential and the business model adopted is to add value to the properties and then monetise the asset by structured sale or joint venture (JV), as was the case with Enable and McKellar.

The following table and narrative details the portfolio of the ten properties.

|

Area |

Owner |

Number of Claims |

Area (km2) |

Claim Types |

Minimum Expenditure required (CAD$) |

|

Sunbeam |

FCM |

104 |

21.7 |

104 Single Cell Mining Claims |

41,600 |

|

Sunbeam extn |

FCM |

9 |

24.8 |

8 Multi-cell Mining Claim, 1 Single Cell Mining Claims |

46,800 |

|

Sunbeam new |

FCM |

119 |

25.2 |

119 Single Cell Mining Claims |

47,600 |

|

Zigzag |

others |

6 |

1.2 |

2 Boundary Cell Mining Claims, 4 Single Cell Mining Claims |

1,200 |

|

Coco East |

FCM |

30 |

6.3 |

30 Single Cell Mining Claims |

12,000 |

|

Magical |

FCM |

14 |

3.0 |

14 Single Cell Mining Claims |

5,600 |

|

Esa |

FCM |

86 |

20.6 |

1 Multi-cell Mining Claim, 85 Single Cell Mining Claims |

38,800 |

|

North Hemlo |

FCM |

399 |

84.0 |

399 Single Cell Mining Claims |

159,600 |

|

OnGold |

OnGold* |

163 |

34.4 |

163 Single Cell Mining Claims |

65,200 |

|

Sugar Cube |

FCM |

81 |

17.2 |

81 Single Cell Mining Claims |

32,400 |

|

Quinlan |

BRR |

106 |

20.0 |

106 Single Cell Mining Claims |

42,400 |

|

Kerrs Gold |

others |

11 |

10.4 |

8 Multi-cell Mining Claim, 3 Single Cell Mining Claims |

24,000 |

|

TOTALS |

|

1128 |

268.8 |

|

517,200 |

Overview of Operations

The 2024 field season was a very successful one for First Class Metals, the focus being on the flagship properties with significant field work being conducted on the North Hemlo property.

Major geological advances were achieved on the Sunbeam and North Hemlo properties. FCM, through its 100% owned subsidiary FCMC, continued to explore these two properties. A low-level helicopter borne geophysical survey was conducted over the Kerrs property to fulfil work undertakings as part of the option agreement in connection with the property, as well as for assessment credits. Minor work was also conducted at Coco East for assessment credits as well as prospecting work at Esa. Otherwise, as all the properties were in good standing, no other field work was conducted.

The business / exploration strategy of FCM is similar in rationale and execution as that of many listed junior exploration companies: to value add to an exit event, by JV or structured sale. This approach can equally apply to the Company itself or individual projects in the Company's portfolio.

The field season's results reported to date for 2024 have advanced this business strategy significantly. The notable acquisition of the Quinlan and Kerrs Gold Project also broadened the Company's appeal to investors.

FCM intends to continue this business model in 2025: to add value to the existing portfolio as well as to review other opportunities in Ontario that will add potential to the company. However, the focus of any exploration company is the timely undertaking of drilling. In 2025 it will be the aim of FCM to advance the two major properties to a point whereby drilling could be planned.

Whilst the Company is monitoring its land position as well as expansion opportunities, the possibility of developing parts of our portfolio by JV is always a consideration. The West Pickle Lake project area under JV with GT Resources Inc. (previously to 'Palladium One Inc.') in the north-east of the North Hemlo property is a clear example of the success of this aspect of the Company's strategy.

The following is an overview of the Company's field activities resulting from the 2024 field season and details the ten properties in a rough ranking order, from 'core' to 'non-core' but does not include the two sold properties (Note: no work was undertaken on McKellar and Enable during the year prior to their sale.) Whilst most activities fall within the reporting period, events noteworthy after 31 December 2024 are also included in order to present an accurate up to date account of activities.

Property wide review

The claim blocks are detailed below from core to non-core. The ten claim blocks, (OnGold being contiguous to North Hemlo), cover ~270km² and is distanced by about 900km from Sunbeam in the west to Kerrs in the east.

1. Hemlo area

The Hemlo Schreiber greenstone belt has two broad divisions, the south and the north limbs.

The Barrick Hemlo producing gold mine is located on the south limb and is associated in a macro sense with shearing and increased molybdenum values. The Hemlo north limb in which the Esa and the North Hemlo (OnGold) properties are located has three distinct structures identified by previous explorers. The structures, interpreted to potentially be shears, in part transect both properties, see Figure 02.

Figure 02 showing the regional geological and structural setting of the North Hemlo OnGold and Esa block (Hemlo 'north limb'), relative to the Hemlo gold mine. Note also the Magical claim block.

North Hemlo

The North Hemlo property historically comprised of three claim areas: Pezim I & II, and Wabikoba, that weren't contiguous. However, the addition of the Hemlo North block, acquired from Power Metals Plc., pre-IPO brought North Hemlo together as one cohesive block.

The entire property as of the date of this report, extends across 399 claims covering ~84km², with the signing Agreement with OnGold the property area was extended by 34.4km² (163 claims) which are contiguous to the north, see Figure 02. Note: 33 claims are under effectively a Joint Venture agreement with GT Resources and FCMC's ownership is reduced as per the terms in the Joint Venture agreement signed in 2021. Note also that a number of low strategic and non-geological interest claims were 'abandoned' under the MLAS system. These claims were considered 'conflict claims' and in line with the terms of the Exploration Permit and Exploration Agreement FCMC had agreed with the relevant First Nations not to undertake work on them. Hence as a cost saving and good will gesture FCMC abandoned the claims in March 2025

There were limited historical showings on the properties, the most important being the gold / molybdenum showing at Dead Otter Lake which reported 3.1ppm Au, 0.59%Mo. Also, the geology / geophysical signature of the Dotted Lake / Fairservice prospect continues onto the North Hemlo block. Furthermore, the JV - Earn-in with GT Resources Inc. has significantly enhanced the base, battery, and critical metal potential of the block. The anomalous gold showings of Barbara lake close to Esa also enhance the property's potential.

Exploration potential is enhanced by the arcuate inferred shears which mimic the shear hosting the Hemlo gold mine, see Figure 02.

An Exploration permit, required for 'invasive' exploration such as trenching, stripping, and drilling, granted for both the North Hemlo and Esa blocks is valid until October 2026. This grant by the Provincial authorities was closely followed by the execution of an Exploration Agreement with Netmizaaggamig Nishnaabeg First Nation (NNFN) in November 2023 (the agreement also covers the Esa and Sugar Cube claim blocks).

Exploration to date by FCM has focussed in the southern sector around the Dead Otter Lake showing 3.7g/t gold 'Au' and 0.59% molybdenum 'Mo' and the discoveries by FCM along strike to the southeast to outcrop 3.7km away that reported 19.6g/t Au. This is referred to as the Dead Otter trend. ('DOT')

Exploration property wide was enhanced with the low-level high-resolution helicopter borne magnetic survey, flown in late 2022, though this did not cover the OnGold block.

The magnetic survey indicated that there are additional linear anomalies which require further exploration throughout the property, especially where intersected by north south and northwest structures. The survey also highlighted the structure hosting the DOT.

The intersections of the N-S and NW-SE structures in the central north sector remain veritable exploration targets as are the structures paralleling the DOT in the south. The magnetic interpretation undertaken by Paterson, Grant & Watson ('PGW') confirms the belief that two arcuate structures, refer to Figure 02, pass through the claim block, the southern structure coinciding with the DOT and the northern structure with the extension of the Fairservice showings at Dotted Lake.

The Dead Otter Lake area is situated about 20km north of the iconic Barrick Hemlo 23Moz Au producing mine. During the 2024 season extensive work: prospecting, 'stripping' channel sampling and an orientation soil sampling grid, have been undertaken along the Dead Otter Trend, the focus has been around the historical showing and the area reporting 19.6ppm Au over three kilometres to the southeast.

Furthermore, the trend is reporting very high values of pathfinder elements including molybdenum as well as telluride which is strongly associated with gold deposits, especially in the Hemlo area. Additionally, over 750m SE along strike from the historic showing an isolated outcrop returned 2.29ppm Au. This confirms the trend is auriferous. Furthermore, in the area of the 19.6ppm sample other samples have reported 13.6ppm and 4.6ppm Au, see Figure 03.

Prospecting and the soil sampling results have significantly increased the potential width of the DOT, in the area of the 2.29ppm a grab sample reported highly anomalous Au result, 30m from the structure in the stripped area. The soil lines in the area of the 19.6g/t sample returned anomalous gold in a sample at the end of the soil line (100m from the 19.6g/t sample).

Future work will include further detailed prospecting along the trend to prove the continuity of the structure along strike from the known gold occurrences, leading probable to stripping with the ultimate aim being drilling.

In summary, the identification of a +3km long gold anomalous trend extending from the historic Dead Otter Lake occurrence along with a grab sample recording 19.6g/t Au along the same geological trend with a potential width of ~30m is considered a significant 'new discovery'. Whilst the trend is discontinuous, in a geochemical sense, owing to the lack of exposure, very encouraging gold and pathfinder elements have been reported.

Figure 03 showing the Dead Otter Trend with the historic showing in the north-west extending for >3km to the 19.6g/t Au sample in the south-east. Also shown are the soil orientation lines and recent grab samples. The area of the soil sampling was also the focus of the stripping.

Exploration of the Dead Otter trend was the focus of activities in 2024 on the North Hemlo block of claims. Work included the stripping at three locations (one area subsequently extended) soil sampling in the vicinity of the three stripped areas as well a further prospecting around the 2.3ppm Au sample (a stripped locality).

Gold assay results from the channel samples, as well as the base metal values, including additional channels cut at the Dead Otter and 19 grammer showing, have all been received. It is encouraging that most samples are anomalous to highly anomalous in gold, though no values exceeded one ppm (1 g/t). Given the high grades in previous grab samples (see figure 1) and the fact that the Photon assay results validated those grabs it further emphasises the 'spotty' nature of the gold reporting and therefore the requirement to fully understand the geochemical distribution of the gold. From the stripping and other field work it is also now believed that a strong structural component exists controlling the gold emplacement, as such a firm structural understanding will greatly enhance the potential success of any drill programme targeting the Dead Otter trend.

Subsequent to the initial stripping and trenching a further short extension and sampling programme was completed at two locations. These results further validate the robust gold anomalous characteristics of the trend. In conjunction with this follow-up programme and prior to the soils sampling orientation survey, prospecting was undertaken in the vicinity of the 2.3ppm sample / trenches. This resulted in further anomalous but sub 1ppm Au results. However, the pathfinder element molybdenum (characteristically associated with the gold at the Hemlo mine) reported high (2290ppb) in the grab samples to the north of the Dead Otter trench, where some of the higher gold in soils were also reported. Additionally, there were anomalous gold in soil samples from the end of the line to the south of the 19 grammer.

West Pickle Lake ('WPL')

The WPL JV with GT Resources Inc. ('GT Resources') covers 33 claims contiguous to the main North Hemlo claim block. The JV agreement was signed in 2021 and after undertaking a 6,766m drill programme in 32 drillholes, utilising NQ core size as well as other exploration GT Resources achieved 80% ownership and continued management of the project.

Drilling at West Pickle Lake by GT Resources has demonstrated that the high-grade nickel-copper sulphide occurrence hold potential to be extended both east towards their RJ showing as well as west onto or close to the 100% owned FCM North Hemlo property, see Figure 04. This area will also be a focus for reconnaissance in a future field season as well as follow up of the anomalous lake sediment samples and grab samples.

Furthermore, interpretation of the VTEM data by GT Resources infers there is potential for further discoveries, specifically to the west of WPL, in the area of TK22-076 which was drilled just off the 100% owned FCM North Hemlo Property boundary which intercepted 46.3m of 'anomalous nickel mineralisation' in an east west trending structure

Work is currently on hold on the project whilst GT Resources negotiates with the provincial authorities and the First Nations in respect to Exploration Permits.

Figure 04. Area map showing the location of the West Pickle Lake Discovery as significant drill results

OnGold

The property is located contiguous to the North Hemlo claims as well as those of GT Resources and consists of 163 single cell mining claims, comprising 34.5km², refer to Figures 2.

The property is located roughly 21 kms southeast from the town of Manitouwadge, Ontario and all mining claims are in good standing through the 2024 field season.

Previous prospecting has identified eleven high priority targets on the property, predominantly base metals anomalies.

This Option agreement which had a zero cash component, significantly increases FCM's footprint in a district that holds numerous high grade nickel copper sulphide and gold discoveries.

Limited previous exploration has been focussed to investigate several discreet magnetic anomalies thought to be associated with Ni-Cu-PGE mineralised mafic-ultramafic intrusions. Similar rock types comprise the Tyko, RJ, Smoke Lake and the more recently discovered WPL massive sulphide discovery.

FCM conducted a lake sediment sampling campaign in the winter of 2022/23 as access is far easier in the winter months. The results from this campaign reported gold grades of up to 103ppb.

The program was led under the supervision of Bruce MacLachlan, the principal of Emerald Geological Services (EGS). Bruce has been quoted as saying "To the best of our knowledge the 103ppb Au Lake sediment value is the highest lake sediment value collected in the Hemlo Belt outside of the deposit area".

Whilst at a very early stage, these initial results are extremely encouraging and add to the potential for the prospectivity of the property as the 103ppb Au Lake sediment sample result also now shows the gold potential of the area.

Post year end, OnGold has been issued the £100,000 worth of shares (totalling 5,882,353 shares) which fulfils all terms of the revised agreement. The claims are in the process of being transferred to FCMC.

There remains a 2% NSR on southern block with 50% buy back for $500k, which is transferred to FCM. OnGold holds a 2% NSR on northern block with 50% buy back of $500k

Post the reporting period a 'winter programme' of VLF at North Hemlo included work on the OnGold claim block specifically several lines of VLF were 'walked' on and across the small lake (frozen) which returned the 103ppm Au sample. The traverses extended onto the land around the lake shore. Final results from this work programme are as yet pending.

2. Sunbeam

The Sunbeam Gold Property includes the historic Sunbeam Mine a high-grade underground gold mine which operated from 1898 to 1905. The property now comprises three blocks of claim, all in the name of FCMC. The core of the Property consists of 104 unpatented mining claims covering 20.2km² with the 'English option claims encircling and the 'newly staked' claims contiguous to the northeast, totalling ~72km². The Option to purchase was signed with Nuinsco in October 2022. Nuinsco held the claims through an underlying agreement with several prospectors who originally held the claims. In February 2023, FCM made a second payment to Nuinsco, and the 'core' claim ownership was transferred to FCMC. The Sunbeam extended (English Option extending over 24.8km²) was part of the same Option agreement with Nuinsco and the claim owner, which FCMC has now paid out in full

In November 2023, FCMC staked a further 119 claims, covering 25km² and contiguous to the northeast of the English option area. see Figure 05

The newly staked claims remain in good standing until October 2025 without assessment credit (field work) requirement. Additionally, as they are contiguous to the 'English option' assessment credits can be spread across the new claims.

Figure 05 showing the Sunbeam Property including the Sunbeam extended 'English option' and the new claims.

Both these areas are covered by an Exploration Permit, granted to FCMC in June 2023 valid for three years. Furthermore, the area is also under two distinct (though similar) MoU's with the two prominent First Nations in the area who have traditional land claims which include the Sunbeam property.

The Sunbeam property is dominated by three mineralised structures each identified over 10km traversing the property; these are inferred to continue to the northeast into the new area where prospective structural features are inferred. All three structures host significant gold anomalism as well as historic development, including the, Roy, Pettigrew and Sunbeam shafts which reportedly produced multi ounce material, see figure 06

Figure 06 showing the three district, sub parallel structure transecting the enlarged Sunbeam Property. Note the significant number of anomalous gold 'showings' as well as historic development on each structure.

An orientation soil sampling programme was undertaken late in 2024. This focussed on several of the historic gold developments. The rationale was, based on the gold identified in the host porphyry, to see whether assaying soil samples in lines orthogonal to the trends would highlight wider areas of increased anomalism which could then be explored by ground prospecting and stripping where permitted, see Figure 06 for the location of the soil survey areas and results. Considering this was an orientation survey the results indicated areas of Au anomalism not previously identified as well as indicating that some of the classic pathfinder elements, such as arsenic (As) copper and lead (Pb) require further modelling.

Additional soil sampling will be considered which might result in further stripping along strike from known gold occurrences, the objective is a better geological as well as geochemical understanding of the mineralisation on the Sunbeam property ahead of drilling.

The updated Exploration Permit granted in June 2023 is valid through to the end of year 2025.

Figure 07 showing a selection of the orientation soil lines on the Sunbeam property.

Earlier in 2024, off site a detailed review of the Nuinsco and available TerraX core. As background it should be noted that in 2023 stripping and associated grab sampling in the areas of the Roy and Pettigrew developments on the Sunbeam property identified anomalous (4.98 g/t Au over 0.5m) in the 'host' / wall rock porphyry. This discovery was an important development in the exploration on the Sunbeam property. Whilst it is known that the quartz veining variously hosted by sheared mafic volcanics contains significant gold (one Nuinsco drillhole sample reported 93.3g/t over 0.44m), the gold bearing potential of the porphyry was not documented.

The review and associated assay result supports the theory of a broad alteration halo in the host porphyry around the high-grade veins. For example, historic hole TX-57751 intersected 19.4 g/t Au over 0.63 m and 15.17 g/t over 1.37 m, but the new review noted a >10 m wide alteration zone around those intersections. This suggests potential for wider lower-grade mineralisation enveloping the high-grade shoots, a positive sign for bulk-mining potential.

All the core was (re)logged, photographed and is now securely stored under FCM control. This asset will be invaluable as we advance the property's exploration.

During the review of the Nuinsco and TerraX cores, 80 core samples were collected (including standards and blanks) of intervals deemed to be significantly altered and mineralized, or adjacent to intervals which returned anomalous historical gold results, (>50 ppb Au generally considered to be anomalous). A combination of new and historic results highlights the presence of relatively wide zones of low-grade gold. Roy zone: from 38m 0.71g/t Au over 13.8m and from 41.0m 0.43g/t Au over 12.3m, other notable zones:

· WN2 zone: from 28.8m 0.33g/t Au over 11.8m

· AL198 zone: from 63.3m 0.30g/t Au over 10.3m

· Rubble Zone: from 20.3m 0.61g/t Au over 12.3m.

Pettigrew: no new samples were taken from Pettigrew, (Nuinsco did not undertake any drilling there). However, historic results by TerraX confirm that there are high grade intersections:

· Hole 57751: 19.4 g/t Au over 0.63m at 5.33m and 15.17 g/t Au over 1.37m at 21.44m

The 'new' and historic zones when considered with the known high grade gold intersections both in drill hole and in the stripping, combined with the robust nature of the three mineralised structures makes the Sunbeam property a significant district scale target.

Note: many of the assay results for the stripping undertaken in 2023 were reported in 2024.

The field work and results of 2023 should be reviewed in order to emphasise the potential of the (district scale) Sunbeam property:

Stripping and channel sampling programmes at the historic production sites of Pettigrew and Roy were completed. The results from Roy indicate a semi continuous zone across strike of multi-gramme material. The two stripping campaigns were successful in not only identifying gold bearing structures but also enhancing the understanding of the geology of the mineralisation. At Roy, most of the samples were 1m or less, with a minimum of 0.1m and a maximum of 1.4 m. The results have defined a broad zone of shearing, alteration, and mineralization, peaking at 18.8 g/t (ppm) Au. There are a significant number of other results exceeding 1ppm Au that define the anomalous structure over a strike of 100m between the existing shafts and open along strike.

The high-grade gold mineralisation is hosted in quartz veining in sheared 'mafics' within a sheared, folded felsic to intermediate porphyry which often exhibits quartz veining, silicification and ankerite alteration, and which also frequently contains anomalous gold.

Figure 08 showing the stripped area at Roy with channel sample results.

A similar situation exists at Pettigrew, where historical drilling was encouraging, with two holes returning significant gold assays including: Hole 57751: 19.4 g/t Au over 0.63m at 5.33m

Results from the samples taken from the stripping have confirmed high grade gold assays up to 18.8 g/t gold (Au) / 0.3m channel sample at Roy.

Other highlights include:

· 6.27 g/t Au channel / 0.35m in mafic schist with quartz veins

· 4.98 g/t Au channel / 0.5m in sheared porphyry; and

· 5.58g/t Au channel / 0.5m within a quartz vein.

At Pettigrew channel and grab samples returned significant gold grades, including:

· 13.0 g/t Au grab sample from quartz rubble dug up beside the stripped outcrop.

· 3.5 g/t Au channel / 0.2m in a quartz vein with galena and chalcopyrite;

· 1.82 g/t Au channel / 0.75m in sheared porphyry; and

· 0.32 g/t Au channels / 3.95 m within sheared porphyry.

Significantly the host porphyry reported up to 5ppm. This factor is what precipitated the core review and sampling.

Figure 09, showing the stripping exposing the outcrop at Roy, note the sawn cuts in the outcrop.

Post report period, in March 2025 a lake sediment sampling programme was undertaken, primarily on the 'new claims' but with additional samples from the core area and the English option blocks in order to give relevance. In total 79 lake sediment samples (including 2 for QA/QC) were collected. Results are not yet available.

3. Esa

The Esa property contains 86 claims, covers 20.6km², and is located approximately 11km northeast from the Barrick Hemlo gold mine, immediately south of FCM's North Hemlo property

Geologically, the property sits between the Cedar Lake Pluton and the Musher Lake Pluton, such intrusions are considered important components for driving mineral-rich fluids and economic mineralisation is often associated with the contacts or structures associated with the intrusive event.

A prominent geophysical / geological feature transects the claim block. This structure adds significant merit to the block's potential, as its continuation outside the Esa boundary is associated with gold occurrences, see Figure 10.

Figure 10 the Esa block with geophysics overlay as well as anomalous Au soil sample results, note as well the Au 'showings' to the west.

This structure is considered one of three subparallel, arcuate trends contained in the Hemlo 'north limb', which mirror the Hemlo trend to the south, (see Figure 02). There are also a number of N-S and NW-SE structures, these too are often associated with mineralisation and in other locations referred to as the 'Harvey faults'. Re-interpretation of geophysical data further verified the structure's presence enhancing the property's prospectivity.

In 2022 and 2023 soil sampling programmes along this feature collectively totalled over 1,000 soil samples along lines on average 200m apart, orthogonal to the inferred 4km shear. Prospecting also identified sheared metasedimentary / mafic volcanic boulders anomalous in trace elements in the area interpreted to contain the Hemlo style shear zone.

Ground reconnaissance identified 'Hemlo-look-alike rock' in the form of an angular boulder which returned anomalous gold value of 0.7ppm Au.

The results of the soil sampling defined a geochemically anomalous zone mimicking the inferred position of the shear and validate the presence of a geochemically anomalous structure displaying elevated gold and pathfinder element such as arsenic molybdenum and antimony, see Figure 11.

Figure 11 showing the structure transecting the property and the trends of the anomalous gold and pathfinder elements

Limited exploration work was conducted on the property in 2024. This included prospecting around the 0.7ppm boulder. The work very limited work (two man days) did not report any further anomalous results.

Owing to available assessment credits the property remained in 'good standing' for 2024 and into 2025.

Future work is intended follow up on the shear zone and other structures identified, as well as to include trenching / stripping. Till sampling is also proposed for the northern area.

Recent logging activities have also opened up sections of the southern property which will be prospected.

The property is covered by a three year Exploration Permit, (granted in October 2023) and is required for 'invasive' exploration such as trenching, stripping, and drilling.

4. Kerrs

The Kerrs Gold Project in northeastern Ontario holds a historic resource estimate of 386,467 Oz (ounces) of Au (gold) as per the NI-43-101 standard.

In April 2024, FCM executed an option to purchase agreement with the 100% owners of the Kerr gold property claims. The deal outline is summarised below.

|

Due Date |

Share Payments |

Cash Payment (CAD) |

|

Upon signing the Agreement |

- |

$6,000 ($10,000 less $4,000 exclusivity deposit) |

|

Six months after effective date |

|

$10,000 |

|

Within four months of signing the Agreement on the publication of a prospectus |

CAD20,000 in share value |

|

|

On the 1st anniversary of the Effective Date |

CAD30,000 in share value |

$30,000 |

|

On the 2nd anniversary of the Effective Date |

CAD40,000 in share value |

$40,000 |

|

On the 3rd anniversary of the Effective Date |

CAD60,000 in share value |

$60,000 |

|

Total |

CAD150,000 in share value |

$150,000 |

On completion of the terms of the Agreement FCM will control 100% of the Kerrs Gold Project located in northeastern Ontario in the Timmins Mining Camp which is one of the most prolific camps for gold production in Canada. Nearby producing gold mines are operated by Newmont (Hoyle Pond & Hollinger) and McEwan Mining (Black Fox Complex).

The road accessible Kerrs Gold Deposit consists of 36 units totalling approximately 665 hectares and lies 90 kilometres east-northeast of Timmins, in the Larder Lake Mining Division.

Geologically the Project is located in the Abitibi Greenstone Gold Belt, see Figure 12.

Figure 12 showing the district scale location of the Kerrs gold property as well as significant producing mines in the area.

The occurrence was discovered by Noranda in the late 1970's and early 1980's by following glacial dispersion trains 'up-ice' to the source. Drilling continued into the late 1980's, with further drilling in the early to late-2000 and early 2011. The drilling database was used to calculate the 2011 historic resource estimate, with further drilling completed subsequent to the release of the estimate, see Figure 13.

Figure 13 Showing the significant historical sampling as well as the drill grid

Kerrs Gold is considered a stratabound deposit, occurring at the contact of a thick, mafic pillow flow sequence overlying an ultramafic, magnetite-rich flow sequence. Quartz feldspar porphyry sills are spatially located above and below the breccia zones. This stratigraphy is synclinally folded with the deposit lying 350m to 425m below surface. Drilling has traced the main zone 800 metres and remains open in both directions and at depth.

Gold mineralisation occurs as pyritized quartz vein replacement breccias enveloped by quartz fuchsite carbonate vein breccias averaging approximately 10 m and alteration envelopes varying up to 40 m in thickness. Gold tenure is proportional to the pyrite content ranging up to 10% which is commonly disseminated and crystal aggregates in the sheeted, quartz vein replacement breccias. These breccias, averaging 31% quartz, exhibit reasonable correlation conforming to volcano-stratigraphic contacts as well as moderate to good continuity in grade correlations at the lower and upper boundaries of the vein breccia and alteration envelope assemblages.

The Kerrs Gold historical resources estimate of 386,467 Oz Au was disclosed in "NI 43-101 Resource Estimation on the Kerr's Gold Deposit, Matheson, Ontario" prepared for Sheltered Oak Resources Inc. by Garth Kirkham, P. Geo of Kirkham Geosystems Ltd. And dated June 10, 2011.

Whilst there was further drilling completed after the historic estimate was released FCM is not aware of any more recent resource estimates.

The resource estimation methods and parameters were as follows:

· Forty-one drill holes were utilized to interpolate the KBX Zone.

· Composite length of 2 m was chosen and composites were weighted by length.

· Sectional interpretations were wire-framed to create 3-D solids of the zones.

· Zones were coded to the composites, and the block model, to constrain the modelling process.

· Composites for the mineralised zone were used to interpolate into the blocks foreach zone.

· Ordinary kriging was used as the interpolator.

· Relative elevation modelling was used to guide the ellipse orientation that accounts for the variation in dip due to the synclinal structure.

· A minimum of two composites were used for each block and a maximum of two composites were used per drill hole; a maximum of 12 composites were used per hole.

· A cutting factor was applied for gold with outlier composites limited to 10 g/t Au based on cumulative frequency plots. A zero cut-off grade was used for the manual polygonal method.

The Kerrs historic estimate is an inferred resource as defined in National Instrument 43-101. The table below shows the potential ounces with differing cut of grades. FCM would look at remodelling the resource in order to identify higher grade envelopes for targeting in any proposed future drilling.

|

Kerrs Resources Estimate Cut-Off Grade |

TONNES |

GOLD (g/t) |

Metal (OZ.) |

|

0.5 |

7,041,460 |

1.71 |

386,467 |

|

1 |

5,237,213 |

2.04 |

342,856 |

|

1.5 |

3,375,361 |

2.47 |

268,468 |

|

2 |

1,936,189 |

3.04 |

188,972 |

|

2.5 |

1,165,664 |

3.57 |

133,778 |

|

3 |

818,171 |

3.94 |

103,622 |

In August 2024 FCM undertook a low level, hi resolution geophysics survey of 736 l-km over the Kerrs Gold Project.

Post report period the magnetic data was interpreted by PGW of Toronto, who have previously worked on North Hemlo, Esa Sunbeam and Sugar Cube. Their interpretation, see Figure 14 has identified several targets worthy of follow-up drilling.

Figure 14 Showing magnetic susceptibility inversion model with key interpreted structural elements overlain. The constrained inversion is show with isovalues clipped to 0.15 SI. Viewed from the SW looking to the NE

The Kerrs property is not currently permitted and once the data review has been completed in conjunction with ground appraisal a permit will be drafted for consultation with the local First Nations.

Post reporting period, FCM has commissioned a review / update of the 2011 resource estimate to define target areas to potentially expand the historic resource as well as a view to 'high grading' the resource. If available, it will include drilling after the 2011 Resource estimate.

5. Zigzag

The project is less than 100km from Armstrong in northwest Ontario in the Seymour Lake area, a district already proven to be prospective for hard rock, pegmatite hosted lithium. Existing infrastructure currently in place in the local area is expected to be further bolstered in the future by the planned Jackfish Hydro project and a Spodumene Process Plant at the Green Technology Metals, Seymour site which is just over 10km away by gravel road.

Figure 15 showing the regional setting of the Zigzag claim block.

The six-unit claim group spans approximately 1.2km² and includes a mapped structure of 800m which (Tebishogeshik occurrence) is wholly contained within the claim block, the lithium-tantalum mineralization is pegmatite-hosted with significant rubidium and caesium mineralisation also reported. All of which are 'critical minerals' as identified by the Canadian and United Kingdom Governments.

Previous workers of the Tebishogeshik occurrence have identified Li2O and Ta2O5 mineralization along the entire length of the showing from sampling at surface, grading up to 1.68% Li2O over 7.9m and 0.168% Ta2O5 over 2.54m in separate channels samples. Several shallow historic drill holes along the occurrence have returned significant intersections, including, (in separate drill holes) an intersection grading 1.08% Li2O over 6.1m and a separate intersection of 399.8ppm Ta2O5 over 2.92m. Both intersections were less than 20m down hole. The structure is open along strike and to depth and remains to be fully evaluated.

The claims were optioned from Nuinsco in March 2023 and reported in detail in a news release.

The work commitment over 4 years is Cdn$550,000 and to 31 December FCMC had expended Cdn$ 485,673 on exploration.

Prospecting of the Zigzag property commenced early in the 2023 field season in association with reconnaissance for access to the claim area. Initial prospecting returned very encouraging results which validated and enhanced the historic reported assays.

As follow up to this initial systematic sampling programme the team undertook furthermore systematic sampling in parallel with preparing for and undertaking a sawn channels sampling programme across the prospective outcrop. Note as an Early Exploration Agreement was not then in place no stripping to enlarge outcrop exposure was permitted.

The sawn channel sampling programme was along a ~150m strike at intervals across the exposed pegmatite outcrop.

The results from the channels were very encouraging. The results have not only vindicated the grab samples in respect to the lithium oxide content but also highlighted again the presence of other important, critical minerals such as tantalum, gallium, and rubidium, see table below for highlights of the reported assays.

Prior to the drill programme in December 2023 a further prospecting campaign was undertaken. This was dominated by soil sampling, the sample lines focussed on the open eastern and western extent of the 'core area' as well as a postulated subparallel structure or splay to the south of the main structure.

Figure 16 showing the main zone at Zigzag with locations of channels and drill holes, as well as the MMI soil sampling lines.

The results of the mobile metal ion (MMI) soil sampling assays gives support that the main structure continues along strike from the known (sampled by FCM) outcrop.

A significant silver anomaly was identified over the two eastern most MMI lines off the main zone. This also requires further investigation.

Furthermore, there is strong geochemical support for a sub parallel trend about 200m to the south of the main zone. Additional work is needed to expand and confirm the anomalism identified. As well follow up sampling is required to confirm the presence of a possible third trend currently identified in anomalous rare element results in grab samples.

Drilling

The drilling targeted the 400m central section of the property which had been subject to a non-mechanised stripping and channel sampling programme reporting up to 2.36% lithium (Li2O) over 5.5m, see Figure 17.

Figure 17 Drilling covered the area of channel sampling and 'grabs' on roughly 50 m centres (note historic grid lines are on 200ft (60m) centres).

Historic drill holes also reported an intersection grading 1.08% Li2O over 6.1m from 12.45m and a separate intersection of 399.8ppm Ta2O5 over 2.92m from 15.50m. The results from the maiden drill programme by FCM were most encouraging and the significant intersections appear in the table below

|

Drill Hole |

Metal |

Depth From |

Width |

Grade |

|

ZIG-23-01 |

Li₂O |

12.7m |

4.3m |

1.65% |

|

|

|

incl. |

1.0m |

2.93% |

|

|

Rb₂O |

11.7m |

5.3m |

0.21% |

|

|

|

|

|

|

|

ZIG-23-02 |

Li₂O |

15.0m |

5.0m |

1.5% |

|

|

|

incl. |

0.2m |

5.19% |

|

|

Rb₂O |

14.25m |

5.75m |

0.21% |

|

|

|

incl. |

0.3m |

0.54% |

|

|

Cs |

14.25m |

3.25m |

132 ppm

|

|

|

|

incl. |

0.25m |

430 ppm |

|

|

Ta |

14.0m |

6.8m |

90 ppm |

|

|

|

incl. |

0.2m |

235 ppm |

|

|

Ga |

15.5m |

0.2m |

144 ppm

|

|

Drill Hole |

Metal |

Depth From |

Width |

Grade |

|

ZIG-23-03 |

Li₂O |

14.7m |

0.75m |

2.1% |

|

|

Rb₂O |

12.6m |

2.1m |

0.16% |

|

|

Cs |

12.0m |

5.0m |

151 ppm

|

|

|

|

incl. |

0.45m |

480 ppm |

|

|

Ta |

12.6m |

3.9m |

164 ppm |

|

|

|

incl. |

0.45m |

624 ppm |

|

|

Ga |

21.9m |

0.25m |

127 ppm |

|

and |

|

|

|

|

|

ZIG-23-03 |

Li₂O |

28.4m |

1.6m |

0.46% |

|

|

Rb₂O |

27.8m |

2.2m |

0.17% |

|

|

|

|

|

|

|

ZIG-23-04 |

Li₂O |

20.0m |

1.6m |

0.79% |

|

|

Rb₂O |

20.0m |

1.6m |

0.21% |

|

|

Ta |

15.3m |

7.8m |

165 ppm |

|

|

|

incl. |

1.0m |

347 ppm |

|

|

|

|

|

|

|

ZIG-23-05 |

Li₂O |

7.6m |

6.0m |

1.13% |

|

|

|

incl. |

1.0m |

2.17% |

|

|

Rb₂O |

5.7m |

3.8m |

0.16% |

|

|

Ta |

4.8m |

9.9m |

167 ppm |

|

|

|

incl. |

0.4m |

401 ppm |

|

|

|

|

|

|

|

ZIG-23-06 |

Li₂O |

28.8m |

2.2m |

1.09% |

|

|

|

incl. |

0.3m |

2.26% |

|

|

Rb₂O |

28.8m |

2.2m |

0.19%

|

|

|

|

|

|

|

|

ZIG-23-07 |

Li₂O |

9.9m |

6.5m |

1.09% |

|

|

|

incl. |

0.5m |

2.76% |

|

|

Rb₂O |

10.4m |

6.6m |

0.21% |

|

|

|

incl. |

1.0m |

0.41% |

|

|

Cs |

13.0m |

4.0m |

126 ppm |

|

|

Ta |

9.0m |

7.4m |

131 ppm |

|

|

|

incl. |

0.6m |

177 ppm

|

|

|

|

|

|

|

|

Drill Hole |

Metal |

Depth From |

Width |

Grade |

|

ZIG-23-08 |

Li₂O |

65.5m |

3.0m |

1.28% |

|

|

Rb₂O |

65.5m |

3.4m |

0.11% |

|

|

Ga |

65.5m |

3.0m |

98 ppm |

|

|

|

incl |

1.0m |

114 ppm |

|

|

|

|

|

|

|

ZIG-23-09 |

Li₂O |

47.25m |

4.75m |

0.52% |

|

|

|

incl. |

0.8m |

1.06% |

|

|

Rb₂O |

47.25m |

4.75m |

0.14% |

Table shows assays from the (nine) hole drill programme at Zigzag, every hole had reportable intersections of Li₂O with significant 'credits' from the accessory critical elements / metals, specifically rubidium oxide, Rb₂O.

The presence of abundant spodumene in the core, see Figure 18 below, is reflected in the assays.

Figure 18-Shallow intersection of pegmatite hosting spodumene (pale green 'blades' in hole ZIG-23-01).

Two (shallow) step-back holes were conducted as well as a scissor hole to confirm the dip of the structure. Further drilling is warranted both along the (open) strike to the west and east as well as down dip.

· Future work planned will include:

· Possible stripping alone strike to the west and east where anomalous MMI results indicate a continuation of the structure.

· Infill MMI sampling of the inferred southern sub parallel structure.

· Metallurgical work on benefaction of the potential ore.

Post the reporting period, FCM has engaged with SGS Lakefield for a quote to undertake a preliminary metallurgical assessment of the lithium baring rock.

6. McKellar

The McKellar property, comprised 66 claims, covering 12.5km² was sold to 79TH Group in June 2024.

7. Enable

The Enable property comprising 41 claims covers around 8.7km² was sold to 79TH Group in June 2024.

8. Coco East

The Coco East block of 30 claims covering ~6.3km² is located on the eastern sector of the Big Duck Lake Porphyry, which contains several historic showings as well as the Coco Estelle deposit. This porphyry, as well as other similar intrusions, are strongly spatially associated with Archean lode gold deposits.

There is only one showing located within the Coco East property boundary, the Big Birch Occurrence. Two pits are reported with a 5m spacing, striking east-west. The main pit exposes a 10cm-wide quartz and calcite vein and contains pyrite and possible chalcopyrite mineralisation, and historic assay results have returned values of 0.56 g/t Au and 2.83 g/t Ag.

Figure 19 showing the regional setting of the Coco East claim block with OMI showings.

Limited field work was conducted during the season in 2024 in order to keep the property in good standing. Otherwise, the assessment credits accrued from 2022 field work extend into 2024.

Prospecting in the northern area around the geophysical anomaly collected twelve rock grab samples were collected from float and outcrop. Assay results from Actlabs reveal the highest assay value recorded for Au was <1ppm, for Cu was 7370ppm (0.7%) and Zn at 145ppm.

While Au and Cu values obtained to date are not strongly anomalous, they are associated with anomalous pathfinders for intrusion-related or orogenic gold mineralization (Ag, As, Bi, Te, Mo, Cu, Zn, W) and locally intense quartz veining in shear zones within the metavolcanic rocks. There are also numerous mapped units of felsic porphyry on the Property which have not been thoroughly investigated. Therefore further, more systematic work is warranted and it is recommended that from a base on the east shore of Big Duck Lake, to conduct a 1 or 2 week mapping, prospecting and sampling project near and along strike from the Big Birch Occurrence, and in the latest target area around a possible adit found in claim 609727.

9. Magical

Located only 9km northwest of the Barrick Hemlo gold mine, these 14 claims which are 2.9km² and are also situated on a compelling geological contact which potentially represents a district scale geological structure, which could be an extension of one of the inferred North Limb shears, (see Figure 02). The enigmatic 'Valley Float' less than 1km off the property boundary to the northeast has reported >16g/t Au, whilst the Gowan Lake showing to the southwest, also on the inferred contact, reports ~1.5g/t Au and the Kusins showing also associated with the contact reports 70.1 g/t Ag, 10.7% Zn and 8.9% Pb, see Figure 20.

|

No field work was undertaken in 2024, however, assessment credits from previous work ensure that the property remains in good standing.

Figure 20 showing the Magical claim block in a geological district scale with pertinent 'showings'.

Geologically, the area contains a northeast trending sequence of clastic sediments, plus subordinate amphibolite. These are bounded by the Gowan Lake Pluton in the northwest and the Cedar Lake Pluton in the southeast. The contact between the Gowan Lake Pluton and metavolcanics is found in the east and southern areas of the property. On the basis of nearology / vector, this is considered a potential host for gold mineralisation.

During the 2022 field season 11 rock chip samples and 56 soil samples were collected out of a helicopter supported 'fly' camp. The latter was analysed by the mobile metal ion ("MMI") methodology, see Figure 33.

|

Figure 21 MMI sampling on the Magical property

The anomalous molybdenum ("Mo") and arsenic ("As") close to the northwest end of the MMI survey at the contact of the Gowan Lake Pluton is of interest and, given the gold occurrence to the northeast and southwest, on trend (but off property). This is a significant encouragement for the property's potential.

For planned future work it is proposed that the soils lines are extended as well as further lines in the southwest to validate the anomalism associated with the contact / shear as well as prove strike continuity.

10. Quinlan

The Quinlan property is located to the northwest of Thunder Bay.

In March 2024 FCM and Broken Rock Resources Inc. entered into an option - buyout agreement, in respect to the Quinlan property, the details of which are tabulated below.

A total number of 98 single cell claims are involved in the transaction with FCM staking 50 claims and 48 claims being optioned from BRR.

Table: Option costs for the Quinlan property

|

|

Cash (CAD$) |

Ordinary FCM Shares (CAD$) |

Annual Work Commitment (CAD$) |

|

On signing |

10,000 |

15,000 |

0.00 |

|

Within one year anniversary |

5,000 |

10,000 |

50,000 |

|

Within two-year anniversary |

10,000 |

5,000 |

50,000 |

|

Within three-year anniversary |

15,000 |

10,000 |

150,000 |

|

Within four-year anniversary |

100,000 |

NIL |

150,000 |

|

Total |

140,000 |

40,000 |

400,000 |

There is also an NSR in favour of BRR

Quinlan lake reported one of the highest lake sediment lithium values (966.3 ppm- constituting the 'Nine-Sixty-Six lake sediment' anomaly) recorded in the Province from an Ontario Geological Survey (OGS) survey. (OGS sample site 1109, Jackson and Dyer 2000b; 287642E 5527869N) was collected from a small lake north of Kashishibog Lake. The sample also returned 38.57 ppm Rb and 9.53 ppm Cs. The area surrounding site Nine-Sixty-Six is covered by thick till and a few granitic pegmatite boulders. Most of these pegmatitic boulders are rounded, ranging in size from 0.5 to 2 m, and composed mainly of quartz and feldspar with local minor biotite.

Although no outcrop was found in the area of the lake area, large outcrops of granitic pegmatite were observed in an area 2 km to the northwest.

Historically, the Kashishibog Lake area has seen very little exploration and geological mapping. According to the Ontario Geological Survey in 1964, vast areas of granite pegmatite dike sheets occur in the vicinity of Sparkling and Mountairy lakes, 12 to 30 km west of Kashishibog Lake, respectively. The pegmatites are situated near the Western Wabigoon-Winnipeg River terrane boundary and along the northeast-trending regional-scale faults that extend for more than 30 km in the Kashishibog and Awkward lakes area

The property's potential was further highlighted by the annual Ontario Thunder Bay OGS Resident Geologist Program (Target 11) 'Recommendations for Exploration' publication to be a prime under explored potential new pegmatite corridor.

The Company now holds a significant land package, providing a cost-effective entry into an area that is highly favoured by the Provincial OGS Resident Geologists for its lithium prospectivity.

Post reporting period, 4 claims in the core of the property became vacant and were staked by BRR, as they fall within the 'buffer zone' designated in the Agreement they will form part of the Option arrangement.

Additionally in March 2025 a one-day helicopter supported visit to the property resulted in 16 lake sediment samples being collected. Assays are not yet available.

11. Sugar Cube

The Sugar Cube claim block of 205 claims, covering ~43km², is contiguous to the north-west of Silver Lake's 1.6Moz+ Sugar Zone gold mine. Sugar Cube was one of the 'seed' properties that formed the pre-IPO package. Previous workers interpreted from the limited geological information that the property could potentially contain the remnants of a (subparallel, arcuate) greenstone belt.

No field work has been conducted in the reporting period.

The previous work included a helicopter borne magnetic/ VTEM geophysics survey undertaken in early 2023 which provided insufficient credits to maintain this entire block through 2023 and into 2024, accordingly after the geophysical interpretation only the central section was retained.

Figure 22: Interpretation provided by PGW of the EM survey conducted on the reduced Sugar Cube property.

The survey was successful in so much no obvious remnants of greenstone geology were evident. However, the central sector of the block which contains northwest south east orientated structures (elsewhere referred to as 'Harvy faults' and potential auriferous), merits further work and will be a focus for a future exploration programme. Other sectors were not apportioned assessment credits and hence lapsed.

Summary, strategy, and conclusions

In line with FCM's future corporate plans and divestment strategies across the wider portfolio, it is crucial for the Company to maintain a continuous flow of high-quality prospects that can grow in value over time. The acquisition of additional property assets like Kerrs and Quinlan ensures that FCM is well-positioned for future growth and development.

First Class Metals, through its Canadian subsidiary, controls nine claim blocks totalling ~230km² in northwest Ontario, Canada. Seven of the nine blocks are 100% owned. Two claim blocks (North Hemlo and Sunbeam) account for well over half of the total area.

The four core properties have sufficient assessment credits generated by field work in 2024, to keep them in good standing through to proposed field work in 2025. The Sugar Cube block is now impaired as a result of the magnetic survey results. Regardless, FCM holds funds or has conducted the exploration required to keep all the claims in good standing for the year 2025.

FCM continued its systematic diligent exploration programme covering the core (North Hemlo, Sunbeam, Kerrs and Zigzag), properties in 2024. The results were sufficiently encouraging to warrant further follow-up exploration in the upcoming field season. Particularly successful were the drilling at Zigzag and the stripping at Sunbeam, and the 'new discovery' on the Dead Otter trend. However, it must be noted that most properties explored still have areas requiring prospecting and whilst the cornerstone of the exploration is gold, FCM contains in its portfolio precious, base (battery) and critical (lithium) mineral targets.

Whilst the annual commitment to maintain the claims is circa CAD$450,000, this is not a required spend given that credits from 2023 and 2024 carry over to the 2025 season and in some instances into 2026. FCM intends to build off the positive exploration results and progress the exploration of the properties by drilling where permitting, funding and logistics allow, to a monetising event.