-

15 August 2025 22:59:48

- Source: Sharecast

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN OR INTO THE UNITED STATES

Sequoia Economic Infrastructure Income Fund Limited ("SEQI" or the "Company")

Monthly NAV and portfolio update - July 2025

The NAV per share for SEQI, the largest LSE listed infrastructure debt fund, increased to 91.82 pence per share from the prior month's NAV per share of 90.84 pence, (being the 30 June 2025 cum-income NAV of 92.56 less the dividend of 1.71875 pence per share declared in respect of the quarter ended 30 June 2025 and payable on 22 August 2025), representing an increase of 0.98 pence per share.

|

|

pence per share |

|

30 June NAV |

92.56 |

|

Interest income, net of expenses |

0.60 |

|

Asset valuations, net of FX movements |

0.36 |

|

Subscriptions / share buybacks |

0.02 |

|

Dividend |

-1.72 |

|

31 July NAV |

91.82 |

No expected material FX gains or losses as the portfolio is approximately 100.8% currency-hedged. However, the Company's NAV may include unrealised short-term FX gains or losses, driven by differences in the valuation methodologies of its FX hedges and the underlying investments - such movements will typically reverse over time.

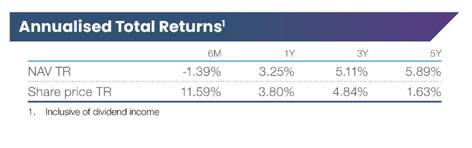

Well positioned to benefit from high interest rates; 57.5% of portfolio is in fixed rate investments as of July 2025.

Market Summary - July 2025

Tariff Impact & Geopolitical Analysis

|

· |

On 28 July, the U.S. and E.U. reached a trade framework that averted escalating tariff threats, finalising the deal just days before the 1 August deadline for new duties to take effect.

|

|

· |

On 11 August (after month-end), President Trump signed an executive order extending the temporary pause on increased tariffs on Chinese goods by 90 days, deferring the potential implementation to November 2025 and prompting cautious optimism for a more constructive, negotiated trade environment.

|

|

· |

These actions have eased trade tensions, improved market sentiment, and reduced near-term volatility, providing a more stable backdrop for credit markets.

|

Interest Rate Announcements and Inflation Data

|

· |

During July, the Bank of England, the Federal Reserve and European Central Bank all maintained policy rates, at 4.25%, 4.25% and 2.0% respectively. On 7 August (after month-end), the Bank of England reduced its policy rate by 0.25% to 4.00%.

|

|

· |

U.K. Gilts yields trended upwards during July, by approximately 0.2% to 4.7%. In the U.S., yields on Treasury notes ranged between 4.2% and 4.5% and closing at 4.4%, due to the ongoing tariffs concerns. The yield on the German Bund ranged between 2.5% and 2.7% during the same period, closing at 2.6%.

|

|

· |

Despite higher yields across all three regions at month-end, the valuation of most fixed rate instruments still increased during the month, due to a sustained reduction in benchmark spreads, which was only partially offset by an increase in base rates.

|

|

· |

In the U.K., the most recent data on CPI inflation shows that it rose from 3.4% in May to 3.6% in June. In the US, CPI inflation held steady, at 2.7% in July. In the Eurozone, it rose from 1.9% in June to 2.0% in July.

|

|

· |

In the near term, de-escalation of trade tensions is expected to help ease inflationary pressures. However, the impact of pre-tariff inventory building has made it harder to assess the true effect of tariffs on inflation and growth. Central banks are treading a very difficult tightrope between avoiding a recession and not reigniting inflation.

|

|

· |

The pace and size of any interest rate reductions will vary across the Company's different investment jurisdictions, but the general consensus remains one of gradual easing over the course of the year, which would make alternative investments such as infrastructure relatively more attractive when compared to liquid debt.

|

Portfolio Update - July 2025

Revolving Credit Facility and Cash Holdings

|

· |

As of 31 July 2025, the Company had drawn £114.5 million on its revolving credit facility of £300.0 million and had cash of £33.6 million (inclusive of interest income), and net undrawn investment commitments of £45.1million.

|

Portfolio Composition

|

· |

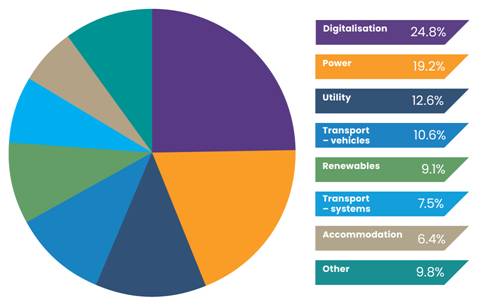

The Company's invested portfolio consisted of 56 private debt investments and 3 infrastructure bonds, diversified across 8 sectors and 29 sub-sectors.

|

|

· |

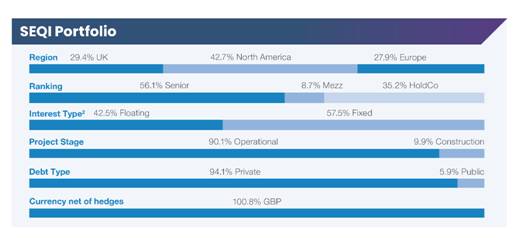

56.1% of the portfolio is comprised of senior secured loans reflecting the Company's defensive positioning.

|

|

· |

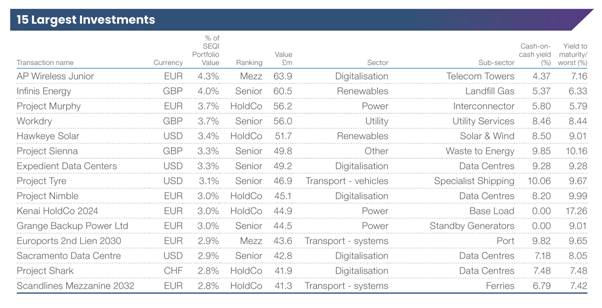

It had an annualised yield-to-maturity (or yield-to-worst in the case of callable bonds) of 9.91% and a cash yield of 7.34% (excluding deposit accounts).

|

|

· |

The portfolio pull-to-par, which is incremental to NAV as loans mature, is 4.4 pence per share as of July 2025.

|

|

· |

The weighted average loan life is 3.0 years as of July. This short maturity profile means that as loans mature, the Company can take advantage of new lending opportunities.

|

|

· |

Private debt investments represented 94.1% of the total portfolio, allowing the Company to capture illiquidity yield premiums.

|

|

· |

The Company's invested portfolio currently consists of 42.5% floating rate investments and remains geographically diversified with 42.7% located across the U.S., 29.4% in the U.K. and 27.9% in Europe.

|

Portfolio Highly Diversified by Sector and Size

Share Buybacks

|

· |

The Company bought back 2,051,766 of its ordinary shares at an average purchase price of 80.91 pence per share in July 2025.

|

|

· |

The Company first started buying back shares in July 2022 and has bought back 226,680,968 ordinary shares as of 31 July 2025, with the buyback continuing into August 2025. This share repurchase activity by the Company continues to contribute positively to NAV accretion.

|

New Investment Activity During July 2025

|

· |

A HoldCo loan for €65.0 million to Project Murphy to support a bid for a majority stake in an interconnector between U.K. and Ireland. This is the first privately-owned project to benefit from cap & floor regulatory support jointly backed by U.K. and Irish regulators, making it a critical piece of energy infrastructure with strong downside protection. The loan, which has a total term of 18 months, is projected to deliver a YTM of approximately 7.5% upon redemption.

|

|

· |

An additional senior loan to Tracy Hills Holdings Company LLC Facility B for $5.0 million. The borrower is a residential infrastructure developer in California. The YTM on this loan is 10.77%.

|

|

· |

An additional senior loan to Sunrun Radcliffe for $1.4 million. The borrower is a leader in the U.S residential solar market. The YTM on this loan is 13.42% |

|

|

|

Investments that repaid during July 2025

|

· |

The Company completed the full sale of Rand Parent LLC (Atlas Air) bonds for $28.9 million at a weighted average price of 99.95. The borrower is a New York-based global operator in the airfreight transportation services sector. The Investment Adviser took advantage of heightened market volatility to exit the position at an attractive valuation, mitigating potential impacts from further tariff announcements and broader market sell-offs. The annualised return on the investment was 12.54%.

|

|

· |

A full repayment of ETT bonds for €19.4 million, a Term Loan B acquisition financing to a leading multi-utility service provider in the Netherlands.

|

|

|

|

Non-performing Loans

The Company continues to work towards maximising recovery from the non-performing loans in the portfolio (equal to 0.6% of NAV): There are no new announcements this month.

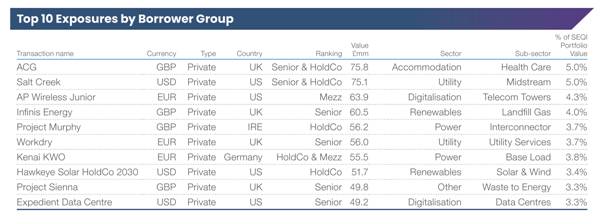

Top Holdings

Valuations are independently reviewed each month by PWC.

Full list of SEQI's Portfolio Holdings and SEQI Monthly Factsheet:

http://www.rns-pdf.londonstockexchange.com/rns/4312V_1-2025-8-14.pdf

http://www.rns-pdf.londonstockexchange.com/rns/4312V_2-2025-8-14.pdf

About Sequoia Economic Infrastructure Income Fund Limited

|

· |

SEQI is the U.K.'s largest listed debt investor, investing in economic infrastructure private loans and bonds across a range of industries in stable, low-risk jurisdictions, creating equity-like returns with the protections of debt. |

|

· |

It seeks to provide investors with regular, sustained, long-term income with opportunity for NAV upside from its well diversified portfolio. Investments are typically non-cyclical, in industries that provide essential public services or in evolving sectors such as energy transition, digitalisation or healthcare. |

|

· |

Since its launch in 2015, SEQI has provided investors with ten years of quarterly income, consistently meeting its annual dividend per share target, which has grown from 5 pence in 2015 to 6.875 pence per share in 2023. |

|

· |

The fund has a comprehensive sustainability framework combining sustainability goals, a proprietary ESG scoring methodology, alongside processes and metrics with alignment to key global initiatives. |

|

· |

SEQI is advised by Sequoia Investment Management Company Limited (SIMCo), a long-standing investment advisory team with extensive infrastructure debt origination, analysis, structuring and execution experience. |

|

· |

SEQI's monthly updates are available here: Monthly Updates - seqi.fund/investors/monthly-updates |

|

|

|

For further information please contact:

|

Investment Adviser Sequoia Investment Management Company Limited Steve Cook Dolf Kohnhorst Randall Sandstrom Anurag Gupta Matt Dimond |

+44 (0)20 7079 0480 pm@seqimco.com |

|

|

|

|

Joint Corporate Brokers and Financial Advisers Jefferies International Limited Gaudi Le Roux Harry Randall |

+44 (0)20 7029 8000 |

|

J.P. Morgan Cazenove William Simmonds Jérémie Birnbaum

|

+44 (0)20 7742 4000 |

|

Public Relations Teneo (Financial PR) Elizabeth Snow Colette Cahill

|

+44 (0)20 7260 2700 sequoia@teneo.com |

|

Alternative Investment Fund Manager (AIFM) FundRock Management Company (Guernsey) Limited Dave Taylor Chris Hickling

|

+44 (0)20 3530 3600 sequoia-aifm@fundrock.com |

|

Administrator / Company Secretary Apex Fund and Corporate Services (Guernsey) Limited

|

+44 (0)20 3530 3600 Admin.Sequoia@apexgroup.com

|

|

|

This announcement is not for publication or distribution, directly or indirectly, in or into the United States of America. This announcement is not an offer of securities for sale into the United States. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States, except pursuant to an applicable exemption from registration. No public offering of securities is being made in the United States.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.