-

01 September 2025 07:06:12

- Source: Sharecast

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

|

FOR IMMEDIATE RELEASE |

|

PANTHER METALS PLC

("Panther" or the "Company")

(Incorporated in the Isle of Man with company number 009753V)

1 September 2025

Winston Tailings Project Update and Warrant Expiry

Permitting Process Commenced

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce the formal commencement of the Application for Recovery of Minerals Permit (the "Recovery Permit") process which is part of a series of workstreams to quantify, evaluate and permit the contained high-grade gold (Au), gallium (Ga), silver (Ag), zinc (Zn), copper (Cu) and cobalt (Co) and other recoverable minerals located within the historic Winston Lake Mine tailings storage facility ("TSF"), comprising the Winston Tailings Project in Ontario, Canada.1, 2

Panther gives notice that a total of 1,067,764 warrants expired unexercised during August 2025. These comprised of 834,909 warrants issued in connection with the 2022 placing and 232,855 warrants issued pursuant to the 2023 Convertible Loan Note. The expiry of these warrants reduces the potential future dilution within the Company's capital structure.

Summary

· Recovery Permit application for the Winston Tailings Project has formally commenced with the Ontario Ministry of Energy and Mines (the "Ministry").

· Panther has held a Pre-Submission Meeting with the Ministry and will now be assigned a dedicated single point of contact to support an efficient pathway through the regulatory process.

· The Pre-Submission Meeting is the first in a series of four stages leading to the decision to issue the Recovery Permit. A Recovery Permit allows its holder to recover minerals from tailings or other mine waste materials.

· Winston's active Mine Closure Plan should facilitate the Recovery Permit application process, as the associated ongoing monitoring and environmental studies, will feed into and help streamline the required assessment reports.

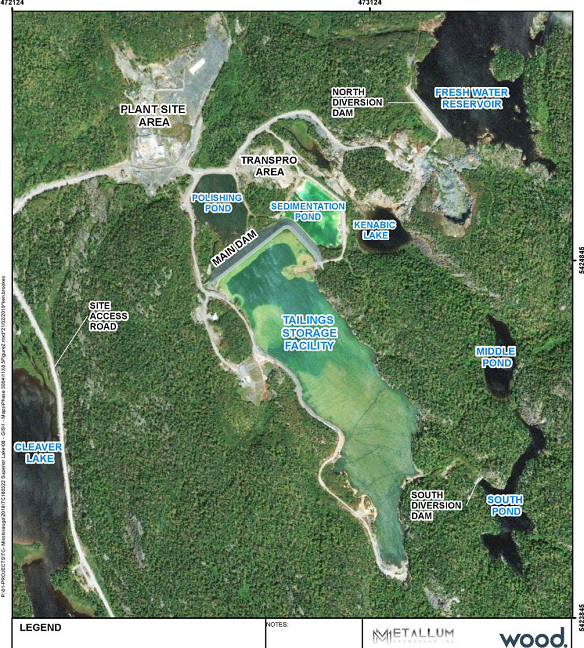

· Excellent existing onsite infrastructure (Figure 1) will support the Recovery Permit business case and will greatly assist the development of the tailings reprocessing opportunity, including:

o Connected power with 115kv supply powerline and transformer.

o Prepared level construction ground at site of former Winston processing plant.

o All weather access road, directly connected to the trans-Canada highway and railroad sidings.

o Freshwater dam and surface water infrastructure.

o Active water treatment plant.

o Site office.

o Security fencing.

o Less than 200km drive from Thunder Bay which is a major centre of engineering service providers and a major transport hub.

The Recovery Permit application is one of four concurrent workstreams, announced 8 August 2025, which are currently progressing in parallel as the Company advances towards commencing a systematic drilling programme across the tailings storage facility during September 2025.

The grid drill sampling programme will support a series of metallurgical testwork and reprocessing optimisation studies as well as the definition of a compliant Mineral Resource estimate for the tailings deposit.3 Further details will be announced in the near term.

Darren Hazelwood, Chief Executive Officer, commented:

"The application for the Recovery of Minerals Permit is one of four parallel and interconnected workstreams designed to fast-track the assessment and build a robust economic case to reprocess and extract value from the historical Winston Lake Mine tailings storage facility.

As an integral part of the permit application and reprocessing evaluation process, preparations are currently underway for an upcoming tailings drill sampling programme which will provide the necessary sample material and data for the planned metallurgical testwork and a Mineral Resource estimate. Further details of this exciting programme will be provided soon, as the various parameters are finalised.

It is positive to note that during August, a total of 1,067,764 warrants expired unexercised, reducing the potential for shareholder dilution within the Company's tightly controlled capital structure."

Recovery of Minerals Permit Application Process

The Recovery of Minerals Permit is under the legislation prescribed by the Mining Act (R.S.O. 1990, Chapter M.14), Ontario Regulation 463/24 Recovery Of Minerals.4

A Recovery Permit allows its holder to recover minerals from tailings or other mine waste materials at a given location without having first obtained an exploration permit or a filed closure plan. If the tailings or other mine waste materials are located on Crown land, the holder can also recover minerals and exploit them commercially without a mining claim or mining lease.

The Recovery Permit application is a five step process (Table 1), and Panther has now completed the Pre-Submission Meeting with the Ministry, which has confirmed that the Company will be assigned a dedicated single point of contact, within an expected 10 days, to support an efficient pathway through the regulatory process, as Panther assembles the required documentation and undertakes the Supporting Technical Studies (as set out in Table 2).

As the Winston TSF is subject to an active Mine Closure Plan and is located on patented land, based on preliminary discussions, Panther considers that a number requirements for the Supporting Technical Studies may already be, or partially be addressed, subject to confirmation with the associated regulatory parties.

Table 1: Recovery of Minerals Permit Application Steps

|

Permit Application Steps |

Status |

|

1. Pre-Submission Meeting with the Ministry |

Complete. Awaiting dedicated Ministry point of contact. |

|

2. Application Screening |

|

|

3. Circulation and Feedback Consideration |

|

|

4. Decision on Permit Application |

|

|

5. Submit Financial Assurance (if needed) |

|

Table 2: Summary of Supporting Technical Studies which may be required for the Recovery of Minerals Permit

|

Supporting Technical Study |

When is study required? |

Company Comment |

|

Geochemical Assessment Report |

May be required to provide an assessment of whether the activities have the potential to negatively impact the chemical stability of the land. |

Inputs for the Geochemical Assessment Report will be provided from the upcoming drilling programme and the resultant Mineral Resource estimate and metallurgical characterisation studies. |

|

Groundwater Characterisation Study |

May be required to provide an assessment of whether the activities have the potential to negatively impact groundwater quality. |

Panther envisages these studies can be fast-tracked using the ongoing and historical testing conducted as part of the site's active Mine Closure Plan.

Initial observations are that the tailings re-processing activities can be designed so that they will not negatively impact on the existing site and it is Panther's view that such activities will provide a positive environmental benefit. |

|

Surface water Characterisation Study |

May be required to provide an assessment of whether the activities have the potential to negatively impact surface water quality. |

|

|

Metal leaching or acid rock drainage (ML/ARD) |

May be required to provide an assessment of whether the activities have the potential to impact metal leaching or acid rock drainage from the project site. |

|

|

Hydrogeological Study |

May be required if the activity has the potential to negatively impact the chemical stability of the site drainage and underlying groundwater quality. |

|

|

Tailings Stability Assessment Report |

Required if the activity occurs on or near a tailings dam or tailings storage facility to determine if the work has the potential to impact the physical stability of the dam or the environment. Further studies would follow on if any stability issues are identified. |

The TSF dam and surrounds are regularly inspected and reported on as part of the active Mine Closure Plan. There are no issues with the stability of the TSF or dam. |

Table Notes: all studies will be signed off by a professional engineer or professional geoscientist. A "professional engineer" is a professional engineer as defined under the Professional Engineers Act. A "professional geoscientist" is a member of the Association of Professional Geoscientists of Ontario.

Outlook

Panther remains focused on advancing the Winston Tailings Project through its technical and permitting milestones. The combination of existing site infrastructure (Figure 1), systematic drilling, multi-stream metallurgical testing, and streamlined regulatory engagement provides a strong foundation as the Company progresses towards establishing a maiden Mineral Resource and positions itself for future growth opportunities, including a potential dual listing.

Further updates will be provided as drilling commences and metallurgical studies advance.

Background

The Winston Tailings Project entails a series of workstreams to quantify, evaluate and permit the contained high-grade gold (Au), gallium (Ga), silver (Ag), zinc (Zn), copper (Cu) and cobalt (Co) and other recoverable minerals located within the historic Winston Lake Mine tailings storage facility. Reprocessing the mine tailings, potentially offers Panther the opportunity to unlock residual metal value and contribute to the long-term environmental rehabilitation of the Winston Project site.1, 2

The Winston Lake Mine was operational from 1988 to 1998, producing approximately 3.3 million tonnes of ore and yielding zinc, copper, silver, and gold. Based on historic recoveries from mining activities in the 1980s and 1990s, it is believed that a significant quantity of valuable material remains in the tailing storage facility.

Source: NI 43-101 Technical Report Feasibility Study for the Superior Zinc and Copper Project, 2021. Site is connected to high-voltage grid power.

Figure 1: Existing Infrastructure at Winston Tailings Storage Facility

References

1. Panther Metals PLC, announcement, Winston Tailings Assays Confirm Gold, Gallium, Silver, Zinc, Copper & Cobalt, Tailings Sample Assay Results Exceed Expectations, dated 31 July 2025 ( https://polaris.brighterir.com/public/panther_metals/news/rns/story/w00eo6w )

2. Panther Metals PLC, announcement, Tailings Sampling Programme Underway at Winston Project, dated 15 July 2025 (https://polaris.brighterir.com/public/panther_metals/news/rns/story/w606ngw )

3. Panther Metals PLC, announcement, Winston Tailings: Gold & Critical Mineral Reprocessing, Evaluation and Permitting Workstreams Commencing, dated 8 August 2025

( https://polaris.brighterir.com/public/panther_metals/news/rns/story/rm7movr )

4. Recovery of Minerals Permitting process details available at https://www.ontario.ca/page/recovery-minerals

For further information, please contact:

Panther Metals PLC:

Darren Hazelwood, Chief Executive Officer: +44(0) 1462 429 743

+44(0) 7971 957 685

Broker:

SI Capital Limited

Nick Emerson +44(0) 1438 416 500

Winston Project

The Panther Metals Winston Project, located 150km east of Thunder Bay, Ontario, Canada, is an advanced stage polymetallic zinc, copper and precious metal property comprising a high-grade critical mineral mine redevelopment and resource building opportunity. Based on a Feasibility Study published in 2021 the Project is expected to generate average life of mine ("LOM") annual EBITDA of C$67.64 million (M) and have a pre-tax NPV8% of C$ 175.8 M and IRR of 26%, with further strong exploration potential for defining additional Mineral Resources and Mineral Reserves from the two main deposits as well as additional near-mine volcanogenic massive sulphide ("VMS") exploration targets.

2021 Feasibility Study Headline Metrics

· NPV8%: C$175.8M pre-tax, assuming zinc priced at US$2,700/t, copper at US$7,300/t, gold at US$1,635/oz & silver at US$21/oz. At a derisked 6% discount Pre-tax NPV = C$213.2M.

· IRR: 26% pre-tax

· EBITDA : C$574.9M (gross), C$67.64M (annual). Gross revenue: C$983.3M

· CAPEX: C$145.1 M

· OPEX: C$65.17/t

· LOM: Initial 8.5 year life of mine, with 3.5 year pay-back period. Strong potential to increase LOM.

· Producing an average 33.40ktpa contained zinc,1.3ktpa contained copper, 698oz recovered gold and 90.8koz recovered silver (after ramp-up), from an onsite processing facility with an annualised 326ktpa capacity.

· The unit pricing for copper, gold and silver, concentrate payable percentages and exchange rates, are positively different from 2021 in today's dollars, providing scope for additional value uplift.

· Indicated Resource 2.07 Million Tonnes @ 18% Zn

· Volcanogenic Massive Sulphide mineralisation well understood by Panther.

· Panther plans to build value through extending the mine life utilising the Company's strong local exploration network and leveraging institutional, governmental and critical mineral programme support.

· No name discussions in Canada have indicated strong support for this deal on an asset base previously supported by industry heavyweights, including Sprott.

· Strong prospects to increase Mineral Resources and Mineral Reserves through exploration down-dip and along strike of the current Resources.

· Zinc and Copper deemed Critical Minerals in Canada, eligible for enhanced tax-efficient flow-through funding.

· Positive First Nation engagement.

· Strong Institutional and Governmental support for future financing options.

· Existing historical tailings storage facility offers potential for near-term cash-flow subject to further studies.

Highly prospective near mine exploration targets include the Pick Lake Deposit which is not fully constrained and is considered to be open down-plunge; the Winston Lake Deposit where there are strong electromagnetic ("EM") geophysics conductive bodies adjacent to the current Resource; and in the vicinity of historical Zenith deposit. The wider project area is relatively underexplored and there are several prospective surface zinc targets, including Anderson, Trial and Ciglen, and the VMS hosting horizons along strike strongly warranting geophysical investigation.

The 2021 Feasibility Study1 for the Winston Project detailed a strong economic case for mine redevelopment for a 1,000 tonnes per day underground operation with a net present value (NPV8%) of C$171.5M and pre-tax internal rate of return (IRR) of 26% based on an Ore Reserve of 1.96Mt @ 13.9% Zn, 0.6% Cu with significant gold and silver credits (Table 1) producing an expected 69.8 thousand tonnes per year (ktpa) of zinc concentrate and 5.3 ktpa of copper concentrate over an initial 8.5 year mine life. The Project boasts a high-grade CIM compliant Indicated Mineral Resource2 of 2.07Mt averaging 17.9% zinc, 0.8% copper, 0.4 g/t gold, and 34 g/t silver plus Inferred 0.27Mt @ 16.2% Zn, 1.0% Cu, 0.3g/t Au & 37.2g/t Ag (Table 2). Project is located only 20km from the trans-Canada highway and infrastructure including power, tailings storage facility, transport links and underground development are already in place. The previous mining operation closed in February 1999 due to very low zinc prices at the time. In total, 3.4 million tonnes grading 1.0% copper and 16% zinc was mined and processed. The total project area covers approximately 60.4km2 and comprises both patented freehold, leased and Crown-land mining claims.

Table 1: Winston Project Mineral Reserve

|

Winston Project |

Ore Reserve |

Million Tonnes |

Zinc Grade |

Copper Grade |

Gold Grade |

Silver Grade |

|

Classification |

(Mt) |

(Zn %) |

(Cu %) |

(Au g/t) |

(Ag g/t) |

|

|

Proven |

- |

- |

- |

- |

- |

|

|

Probable |

1.96 |

13.9 |

0.6 |

0.2 |

26.2 |

|

|

Total |

1.96 |

13.9 |

0.6 |

0.2 |

26.2 |

Notes: JORC (2012) compliant Mineral Reserve effective date 5 July 2019. Ore Reserves are based solely on Indicated Mineral Resources and are reported above an average net smelter return (NSR) cut-off grade of US$98 /t equivalent to 5.2% Zn. 1

Table 2: Winston Project Mineral Resource Estimate at 3% Zn cut-off grade

|

Resource Areas |

Mineral Resource Classification |

Million Tonnes |

Zinc Grade |

Copper Grade |

Gold Grade |

Silver Grade |

|

(Mt) |

(Zn %) |

(Cu %) |

(Au g/t) |

(Ag g/t) |

||

|

Pick Lake |

Indicated |

1.78 |

19.20 |

0.90 |

0.3 |

36.1 |

|

Inferred |

0.27 |

16.40 |

1.00 |

0.3 |

38 |

|

|

Winston Lake |

Indicated |

0.29 |

10.40 |

0.70 |

0.9 |

18.4 |

|

Inferred |

0.01 |

8.90 |

0.60 |

0.5 |

11.9 |

|

|

Winston Project |

Total Indicated |

2.07 |

17.90 |

0.80 |

0.4 |

33.6 |

|

Total Inferred |

0.27 |

16.20 |

1.00 |

0.3 |

37.2 |

Notes: Effective date 15 October 2020. Stated at 3% zinc cut-off grade. Mineral Resource estimate is compliant with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions. Mineral resources which are not mineral reserves do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources tabulated above as an indicated or measured mineral resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Technical References:

1 NI 43-101 Technical Report Feasibility Study for the Superior Zinc and Copper Project, dated 13 October 2021, prepared for Metallum Resources Inc by DRA Global ("DRA").

2 NI 43-101 Technical Report on the Mineral Resource Estimation of the Pick Lake and Winston Lake Properties, Ontario, Canada, dated 15 October 2020, prepared for CROPS Inc. (renamed Metallum Resources Inc) by MASSA Geoservices.

Competent Person Statement

Technical information in this announcement has been reviewed by Nicholas O'Reilly BSc (Hons) MSc DIC MIMMM QMR MAusIMM FGS, a director of the Company. Mr O'Reilly is principal geologist and a director of Mining Analyst Consulting Ltd. He has over 20 years' experience in mining, exploration and development across all major commodities. As a qualified geologist, he can act as Competent Person for JORC Code and UK Listing Rules purposes.

Obonga Project - Expanding Canada's Next VMS and Critical Minerals District

Panther Metals' Obonga Project in Ontario continues to demonstrate significant potential as a leading exploration initiative targeting both base and critical minerals. Since acquiring the Obonga Greenstone Belt in July 2021, the Company has rapidly advanced five high-priority targets: Wishbone, Awkward, Survey, Ottertooth, and Silver Rim.

In June 2024, Panther secured a key Exploration Permit for the Wishbone Prospect, valid through 2027, authorizing extensive drilling and geophysical surveys. Previous campaigns confirmed compelling volcanogenic massive sulphide (VMS)-style mineralisation, highlighted by intercepts such as 27.3m of massive sulphide and 51m of sulphide-dominated mineralisation with multiple mineralised lenses. High-grade copper anomalies in lake sediment further enhance the prospectivity of this landmark target.

July 2024 saw Panther awarded an Exploration Permit for Awkward West, supporting an aggressive exploration program including up to 31 drill holes. Historic drilling here revealed notable graphite mineralisation-27.2m at 2.25% Total Graphitic Carbon (TGC) with zones exceeding 5% TGC-alongside promising signs of nickel, copper, and platinum group elements, aligning with Panther's strategic focus on critical minerals.

Additional exploration efforts include high-resolution magnetic geophysical surveys across key prospects, optimizing drill targeting and advancing the geological model. Survey and Ottertooth remain highly prospective, with multiple magnetic and electromagnetic anomalies and historic intercepts of massive sulphides, many targets still largely untested.

Obonga's combination of VMS-style base metals and critical mineral potential, situated in a stable and mining-friendly jurisdiction with strong infrastructure, positions Panther Metals to unlock a district-scale mineral system with significant commercial upside.

Dotted Lake Project - Hemlo-Adjacent Gold Opportunity with Growing Momentum

Panther Metals' Dotted Lake Project, acquired in July 2020, lies just 16km from Barrick Gold's renowned Hemlo Mine, in one of Canada's premier gold-producing regions. The project offers a strategically located and scalable gold exploration play.

Initial soil sampling in 2021 identified numerous gold and base metal targets, and subsequent access improvements facilitated an initial drilling program that confirmed gold mineralisation with anomalous values extending along strike.

In early 2025, Panther completed a follow-up campaign featuring detailed geological mapping, trenching, and targeted diamond drilling. These efforts extended mineralisation both laterally and at depth, identified new structural controls, and reinforced the potential for a broader, high-grade gold system. Multiple zones have been prioritised for expanded drilling, underscoring Dotted Lake's significant upside.

The project's proximity to established infrastructure and Hemlo's extensive mining operations, combined with robust recent results, makes Dotted Lake a key asset in Panther's growth portfolio.

Commercial Strategy - Discovery-Driven Value Creation

Panther Metals is committed to creating substantial shareholder value through focused exploration and disciplined capital management. The Company combines deep geological expertise with an understanding of market and financing dynamics to advance high-potential projects efficiently.

With access to a global network of industry leaders and a rigorous operational focus on drilling, Panther prioritises activities that directly contribute to discovery and resource growth. The drill hole remains the ultimate validation in mineral exploration, and Panther's strategy is to fast-track world-class targets into drill-ready assets - delivering tangible results that underpin long-term value creation for shareholders.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.