-

09 September 2025 23:05:48

- Source: Sharecast

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION.

9 September 2025

Cobra Resources plc

("Cobra" or "Company")

Exercise of Warrants, Block Listing and Total Voting Rights

Cobra (LSE: COBR), a mineral exploration and development company, announces that it has received notice of exercise of a total of 1,084,783 warrants with an exercise price of 2.3p per share, raising £24,950 for the Company. The Company has also received a further notice of exercise of a total of 1,666,667 warrants with an exercise price of 3p per share, raising £50,000 for the Company (together the "Warrant Exercise")

The Company's issued share capital currently consists of 877,863,899 ordinary shares of 1 pence each ("Ordinary Shares"), each with voting rights. The Company does not hold any shares in treasury. The total number of voting rights in the Company following the Warrant Exercise will be 880,615,349. The above figure of 880,615,349 may be used by shareholders of the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company under the Financial Conduct Authority's ("FCA") Disclosure Guidance and Transparency Rules.

An application has been made to the London Stock Exchange for a block admission of 47,698,117 Ordinary Shares to be admitted to listing on the equity shares (transition) category of the Official List of the FCA and to trading on the main market for listed securities of London Stock Exchange plc (the "Block Listing").

The Block Listing relates to Ordinary Shares that will be issued from time to time in accordance with the exercise of warrants issued by the Company, which includes the admission of the new Ordinary Shares to be issued on pursuant to the Warrant Exercise. All Ordinary Shares issued pursuant to the Block Listing above will rank pari passu with the existing Ordinary Shares.

It is expected that the Block Listing will become effective on or around 11 September 2025 and allows for the conversion of an outstanding 43,280,000 warrants at an exercise price at 3p whose exercise period expires on 26 October 2025.

The Company further advises that it has granted an extension to the expiry of certain options held by directors that were due to expire in July. The expiry date has been extended to the 14 July 2026, as these options are held by parties who were deemed to be in possession of inside information (as defined in UK MAR) when the options originally expired, where under the terms of the Option Scheme Rules the exercise period shall be extended to 365 days to enable the holders to be able to exercise the options during a period that that would no longer constitute a breach of the UK MAR. The extensions of these options are set out below:

|

Name |

No. of Existing Options |

Exercise price |

Grant date |

Existing Expiry date |

New Expiry |

|

Greg Hancock.................... |

3,000,000 |

3p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

|

|

2,000,000 |

4p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

|

Daniel Maling..................... |

3,000,000 |

2p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

|

|

2,000,000 |

3p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

|

David Clarke. |

3,000,000 |

2p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

|

|

2,000,000 |

3p |

15/07/2020 |

14/07/2025 |

14/07/2026 |

For the purposes of UK MAR, the person responsible for arranging for the release of this announcement on behalf of the Company is Rupert Verco, Managing Director.

Enquiries:

|

Cobra Resources plc Rupert Verco (Australia) Dan Maling (UK)

|

via Vigo Consulting +44 (0)20 7390 0234

|

|

SI Capital Limited (Joint Broker) Nick Emerson Sam Lomanto

|

+44 (0)1483 413 500

|

|

Global Investment Strategy (Joint Broker) James Sheehan |

+44 (0)20 7048 9437 james.sheehan@gisukltd.com |

|

Vigo Consulting (Financial Public Relations) Ben Simons

|

+44 (0)20 7390 0234 cobra@vigoconsulting.com |

The person who arranged for the release of this announcement was Rupert Verco, Managing Director of the Company.

About Cobra

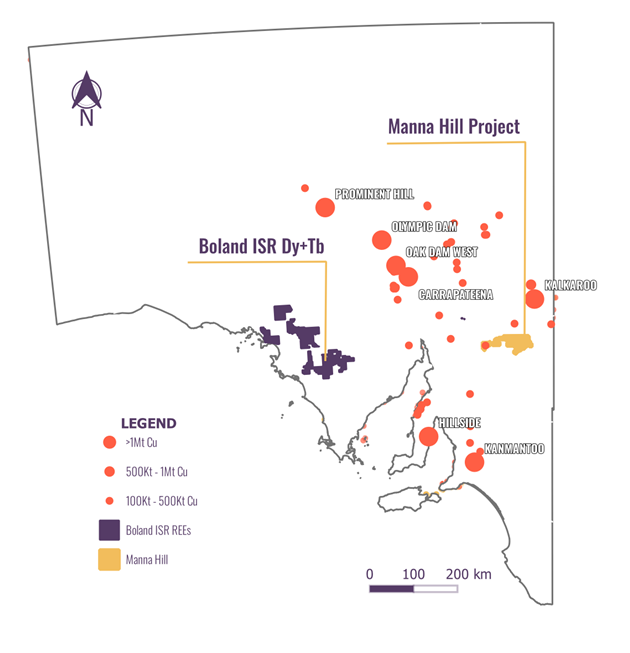

Cobra Resources is a South Australian critical minerals developer, advancing assets at all stages of the pre-production pathway.

In 2023, Cobra identified the Boland ionic rare earth discovery at its Wudinna Project in the Gawler Craton - Australia's only rare earth project suitable for in situ recovery (ISR) mining. ISR is a low-cost, low-disturbance extraction method that eliminates the need for excavation, positioning Boland to achieve bottom-quartile recovery costs.

In 2025, Cobra further expanded its portfolio by optioning the Manna Hill Copper Project in the Nackara Arc, South Australia. The project contains multiple underexplored prospects with strong potential to deliver large-scale copper discoveries.

In 2025, Cobra sold its Wudinna Gold Assets to Barton Gold (ASX: BDG) for up to A$15 million in cash and shares.

Regional map showing Cobra's projects - The Boland Rare Earth Project & The Manna Hill Copper Project

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.