-

18 September 2025 23:10:11

- Source: Sharecast

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

18 September 2025

Capital Metals PLC

("Capital Metals" or the "Company")

Project Updates:

Significant Progress Towards Project Development

Capital Metals (AIM: CMET), a mineral sands company approaching Final Investment Decision ("FID") which requires all studies to be complete and Project approvals and funding in place in order to commence construction at the high-grade Taprobane Minerals Project in Sri Lanka (the "Project"), is pleased to provide the following Project updates.

Highlights

· Substantial Engineering/Studies Progress Towards FID:

o Process Flow Diagram for Wet Concentrator Plant ("WCP") completed

o WCP process design criteria established for a range of throughput scenarios

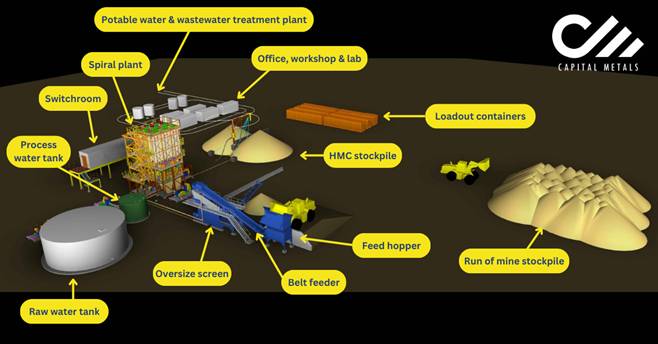

o 3D model and general arrangement drawings for WCP completed (Figure 1)

o Mechanical equipment list and electrical load demand compiled

o Improved capex precision and schedules

o Logistics study for road haulage and export shipments completed

o Hydrogeology field activities completed (reporting in progress)

· Two Key Pending Approvals: Positive discussions ongoing regarding the:

o Additional adjacent Industrial Mining Licence ("IML") to expand initial mining area

o Ability to export Heavy Mineral Concentrate in Stage 1

· Project Funding Advancing: Ongoing discussions for debt/equity as well as expressions of interest from strategic industry investors and offtakers

· Building Community Support: Proactive and focussed community educational initiatives continue to strengthen the Company's social licence to operate

· Growing Sri Lanka Team: In-country team expanded with key technical hires and recruitment underway for senior roles, alongside new training programmes and upgraded office facilities

· Improved Economics: Updated internal financial model adjusted for reduced capex, more advanced technical studies, greater capacity, and expected increase in total resources:

o Base case NPV8 of $180 million with an IRR of 73%, a significant increase on the previously reported (2022 Preliminary Economic Assessment) $155m and 56%

o Upside case NPV8 of $289 million with an IRR of 98% (previously $235 million and 73%)

o Updated NPV8 per share of 27p and 44p for Base and Upside cases, respectively

· Fully Funded through FID: The recently completed strategic Ambeon Capital PLC investment, together with the ongoing support from Sheffield Resources (ASX: SFX) and other existing shareholders, sees the Company comfortably funded through and beyond FID

Technical Progress to FID

The Company is pleased to advise that engineering, studies and Project activities with Mineral Technologies and Access Group are progressing in line with expectations, with substantial progress made towards FID. Recent key outcomes include:

· Completion of the Process Flow Diagram for the WCP

· Establishment of WCP process design criteria, following modelling, for low (150 tph), base (175 tph) and high (200 tph) throughput scenarios to accommodate variable feed grades as mining progresses

· Completion of 3D model and general arrangement drawings for the WCP (Figure 1)

· Compilation of mechanical equipment list and electrical load demand for the WCP

· Improved capex precision and schedules following completion of engineering studies

· Completion of logistics study for road haulage and export shipments, with further work continuing to assess the preferred site access route

· Completion of hydrogeology field activities, with reporting currently in progress

· Assessment of heavy mobile equipment requirements

Capital Metals has engaged local and international experts to complete two critical studies in logistics and hydrogeology. The logistics study, covering transport within Sri Lanka and export options, has been completed, with further assessment underway on the preferred access route to the initial mining area. The logistics study has confirmed that containerised exports via Colombo Port represents the most economical and practical solution for the Project. Colombo offers the scale, efficiency, and infrastructure needed to support export volumes reliably. Other Sri Lankan ports, including Oluvil, will continue to be reviewed for potential future economic viability as the Project scales and logistics options evolve.

The hydrogeology study is in its final stages, with a formal report expected by the end of September. This study will inform the Company's water management strategy for the proposed mining method.

The Company has entered into the next stage of service agreements with Mineral Technologies and Access Group. Both partners will continue to support the engineering and study works required to achieve FID. Under the agreement, Mineral Technologies will provide a fixed price for the fabrication and supply of key Stage 1 equipment, including the pre-designed Flex-Series WCP, feed hopper and screening unit.

The flowsheet remains a simple three-stage spiral plant with feed hopper, vibrating screen and ancillary equipment, as illustrated from the 3D model in Figure 1 below.

Figure 1: 3D model

Advancing Two Main Approvals Required for FID

The Company is participating in positive discussions with all relevant ministries and departments to create a framework for the mining sector - and mineral sands sector in particular - to be a focus for new foreign direct investment. As such, the Company is awaiting the publication a new National Minerals Policy which is expected to provide a path to guidance on the export of Heavy Mineral Concentrate, as envisaged in Stage 1.

Capital Metals is also seeking an additional IML adjacent to the two existing approved IMLs in order to expand the initial mining area for Stage 1.

Given its connections in Sri Lanka, the Company's largest shareholder, Ambeon Capital PLC ("Ambeon"), is already assisting in improving the speed and flow of information and communication with national stakeholders on matters which are required for FID.

Funding Plans for FID

Capital Metals is in ongoing discussions with banks and other investors to provide project debt and equity. The Company is also engaged in active discussions with preferred potential offtakers, with a focus on those that may also provide project equity or working capital funding. The recognised high quality of the Project's mineral products has attracted broad market interest, and counterparties have expressed positive interest in long-term supply arrangements. The Company is prioritising offtakers prepared to provide upfront investment in equity or prepayments on offtake as an alternative source of funding.

Following further discussions on a possible listing of the Project-holding entity on the Colombo Stock Exchange, the Board and Ambeon will continue these discussions but will not rely on this for FID funding given the potential for delays, and are holding numerous alternate discussions for funding the Project equity requirement, in which case the listing will still be considered value-adding at a later stage.

In support of Project financing and other pre-FID workstreams, the Company has engaged Nord Commodities Limited ("Nord") to provide consulting and advisory services. Nord's principals are well connected within Sri Lanka's financial services sector and are connected with a shareholder of Ambeon.

Building Trust Through Action in Local Communities

The Company continues to prioritise strong relationships with host communities in Sri Lanka's Eastern Province. Recent initiatives include sponsorship of spiritual events, fishing societies, sporting associations, local schools and A-Level education programmes, as well as the installation of community suggestion boxes to encourage open dialogue and support for environmental activities such as coastal beach clean-ups.

In addition, a Reverse Osmosis plant at Thirukkovil Hospital, funded by the Company, is nearing completion and will provide safe drinking water for patients, staff and the local community. The Company has also helped women's groups and small-scale agricultural projects to support local livelihoods. These activities reflect Capital Metals' commitment to delivering sustainable, long-term benefits for local stakeholders alongside the advancement of the Taprobane Minerals Project.

Mineral sands, and mining more broadly, are not common industries in Sri Lanka, particularly in the Project area. This presents challenges in terms of awareness and understanding of the Company's proposed activities. The Company therefore continues to prioritise education and awareness programmes, both locally within the Project area and more broadly across the country, recognising that education is key to building long-term understanding and support.

Capital Metals is also working to establish a Coastal Rehabilitation Centre, which will serve a dual purpose of supporting research and future rehabilitation, while also providing a platform for students and the wider public to learn more about the Company's environmental practices.

In-Country Team Expansion and Capacity Building

The Company continues to strengthen its in-country capability as it advances towards the development stage of the Project. Recent appointments include a Mining Engineer, Project Manager and Processing Specialist, the latter having more than 20 years of valuable experience with Lanka Mineral Sands.

Recruitment is ongoing for a Financial Controller to expand financial and operational expertise within Sri Lanka, and for a Manager of Environment to lead the development of the operational Environmental Management Plan and detailed rehabilitation plans in coordination with the mine engineering team.

The team is also developing a heavy equipment training programme to upskill local employees and build long-term operational capacity. In addition, upgraded offices are being prepared in both Colombo and at site. The Colombo office relocation to the same building as Ambeon will position the Company closer to Ambeon and facilitate strategic synergies.

Updated Financial Model and Increase in NPV

With support from Mineral Technologies, the Company has developed a new financial model. The key upgrade is the application of a first principles approach specific to the Project, rather than reliance on industry ratios. This has significantly improved the accuracy and robustness of the financial outcomes.

Key updates in the model include:

· Reduced Stage 1 capex of $20.9 million, consistent with prior market guidance

· Refinement of heavy equipment requirements using a first-principles approach

· Detailed build-up of mining and processing operating costs

· Updated logistics costs following completion of logistics studies

· Resource increase to reflect indications from recent drilling results, with Base and Upside case resources modelled at 1.33x and 1.67x the existing MRE respectively

· Updated increased corporate tax and royalty assumptions

Updated Project economics:

· Base case NPV8 (post tax) has increased to $180m compared to $155m

· Upside case NPV8 (post tax) has increased to $289m compared to $235m

· Base case IRR (post tax) has increased to 73% compared to 56%

· Upside case IRR (post tax) has increased to 98% compared to 73%

· Base case payback period has remained steady at 3.9 years compared to 3.7 years

· Upside case payback period has remained steady at 2.8 years compared to 3.2 years

· Updated NPV8 per share of 27p and 44p for Base and Upside cases, respectively

Premium Garnet Quality Confirmed by Independent Testing

Since the 2022 Preliminary Economic Assessment, the Company has commissioned an independent expert study on its garnet product. The results confirm that the garnet is of a more premium quality than previously thought and suitable for use as an industrial abrasive. Key outcomes from the assessment include: premium quality confirmed; clean mineralogy; favourable particle size, hardness and distribution for premium end-uses; and favourable proximity to key end-user markets.

The assessment supports the Company's expectation that it will be able to attract premium prices for garnet produced from the deposit and it is now in discussions with a leading global garnet distributor regarding a potential offtake agreement.

FID

The Company continues to work towards achieving FID by 31 December 2025 in order to commence construction, with an expected 9-12-month construction period until first production.

Greg Martyr, Executive Chairman of Capital Metals, commented:

"I'm delighted with the progress being made together with our consultants on technical, engineering and logistics aspects required for FID. This work, alongside the recent successful drilling, is contributing to more favourable financial modelling as we get closer to development. I would like to commend Stuart Forrester and our growing team in Sri Lanka for the excellent community work they are doing which is so important for the Company's social licence to operate. With project funding and approvals discussions also advancing, we are doing everything in Capital Metals' control to position the Company to achieve FID this year."

Investor Webinar

Capital Metals announces that the Company's Executive Chairman, Greg Martyr, will host a webcast and Q&A for investors to discuss these Project Updates. The webcast will be conducted via the Investor Meet Company platform on Tuesday, 23 September 2025 at 10 a.m. BST. A recording of the webcast, along with the latest investor presentation to be given, will be made available on the Company's website later that day.

Investors can sign up to Investor Meet Company for free and add Capital Metals in order to attend the webcast via: https://www.investormeetcompany.com/capital-metals-plc/register-investor.

Investors who already follow Capital Metals on the Investor Meet Company platform will automatically be invited. Questions can be submitted pre-event via the Investor Meet Company dashboard up until 9 a.m. BST on 22 September 2025, or at any time during the live presentation. No material new financial or other information will be provided.

For further information, please visit www.capitalmetals.com or contact:

|

Capital Metals plc Greg Martyr (Executive Chairman) |

Via Vigo Consulting |

|

Vigo Consulting (Investor Relations) Ben Simons / Peter Jacob |

+44 (0)20 7390 0234 capitalmetals@vigoconsulting.com |

|

Strand Hanson Limited (Nominated Adviser) Ritchie Balmer / Christopher Raggett / David Asquith |

+44 (0) 20 7409 3494 |

|

Hannam & Partners (Broker & Financial Adviser) |

+44 (0)20 7907 8500 |

About Capital Metals

Capital Metals is a UK company listed on the London Stock Exchange (AIM: CMET). We are developing the Taprobane Minerals Project in Sri Lanka, approximately 220km east of Colombo, containing industrial minerals including ilmenite, rutile, zircon, and garnet. The Project is one of the highest-grade mineral sands projects globally, with potential for further grade and resource expansion. In 2022, a third-party Preliminary Economic Assessment provided a Project NPV of US$155-235m based on existing resources, with further identified optimisation potential. We are committed to applying modern mining practices and bringing significant positive benefits to Sri Lanka and the local community. We expect over 300 direct new jobs to be created and over US$150m in direct government royalties and taxes to be paid.

Visit our website:

www.capitalmetals.com

Follow us on social media:

X: @MetalsCapital

LinkedIn: @Capital Metals plc

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.