-

18 September 2025 23:10:22

- Source: Sharecast

中國國際航空股份有限公司 (short name: 中國國航) (English name: Air China Limited, short name: Air China) is the only national flag carrier of China.

As the old saying goes, "Phoenix, a bird symbolizing benevolence" and "The whole world will be at peace once a phoenix reveals itself". The corporate logo of Air China is composed of an artistic phoenix figure, the Chinese characters of "中國國際航空公司" in calligraphy written by Deng Xiaoping, by whom the China's reform and opening-up blueprint was designed, and the characters of "AIR CHINA" in English. Signifying good auspices in the ancient Chinese legends, phoenix is the king of all birds. It "flies from the eastern Happy Land and travels over mountains and seas and bestows luck and happiness upon all parts of the world". Air China advocates the core spirit of phoenix which is to "serve the world, to lead and move forward to higher goals". By virtue of the immense historical heritage, Air China strives to create perfect travel experience and keep passengers safe by upholding the spirit of phoenix of being a practitioner, promoter and leader for the development of the Chinese civil aviation industry. The Company is also committed to leading the industrial development by establishing itself as a national brand, at the same time pursuing outstanding performance through innovation and excelling efforts.

Air China was listed on The Stock Exchange of Hong Kong Limited (stock code: 00753) and the London Stock Exchange (stock code: AIRC) on 15 December 2004, and was listed on the Shanghai Stock Exchange (stock code: 601111) on 18 August 2006.

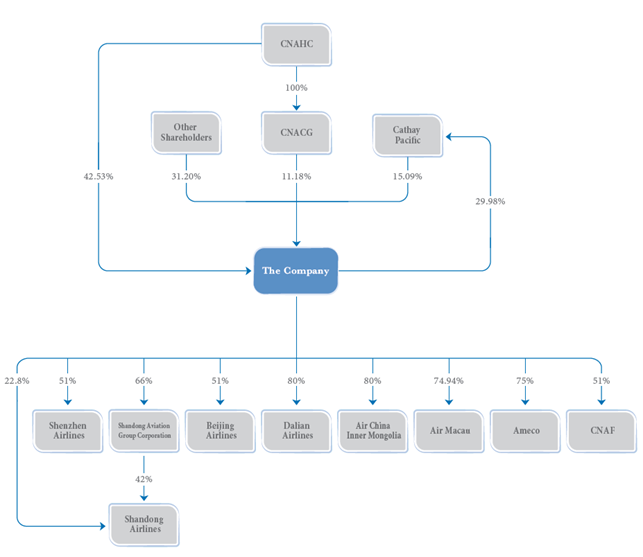

Headquartered in Beijing, Air China has set up branches in Southwest China, Zhejiang, Chongqing, Tianjin, Shanghai, Hubei, Xinjiang, Guangdong, Guizhou, Tibet and Wenzhou. As at the end of the Reporting Period, the major subsidiaries of Air China are Shenzhen Airlines Company Limited (including Kunming Airlines Company Limited), Shandong Aviation Group Company Limited (including Shandong Airlines Co., Ltd.), Air Macau Company Limited, Beijing Airlines Company Limited, Dalian Airlines Company Limited, Air China Inner Mongolia Co., Ltd., Aircraft Maintenance and Engineering Corporation, Air China Import and Export Co., Ltd., Chengdu Falcon Aircraft Engineering Service Co., Ltd., Air China Shantou Industrial Development Company; its joint ventures mainly include Sichuan Services Aero-Engine Maintenance Co., Ltd, Beijing Aero-Engine Services Co., Ltd. and GA Innovation China Co., Ltd; and its associates mainly include Cathay Pacific Airways Limited and Tibet Airlines Co., Ltd.

With the goal of becoming "the world's leading airline", Air China remains committed to the mission of "put safety first, serve passengers with credibility, convenience, comfort and choice, maintain stable development, help employees achieve success and fulfill corporate responsibilities", advocates the values of "people-oriented, accountable, excelling efforts and enjoyable flights" and positions the brand as "professional and reliable with both international quality and Chinese temperament".

TABLE OF CONTENTS

|

Corporate Information |

2 |

|

Summary of Financial Information |

3 |

|

Summary of Operating Data |

4 |

|

Development of Fleet |

6 |

|

Business Overview |

7 |

|

Management Discussion and Analysis |

14 |

|

Corporate Governance and Other Information |

22 |

|

Independent Review Report |

30 |

|

Condensed Consolidated Financial Statements |

|

|

- Consolidated Statement of Profit or Loss |

31 |

|

- Consolidated Statement of Profit or Loss and |

32 |

|

- Consolidated Statement of Financial Position |

33 |

|

- Consolidated Statement of Changes in Equity |

36 |

|

- Condensed Consolidated Statement of Cash Flows |

37 |

|

- Notes to the Unaudited Interim Financial Report |

38 |

|

Glossary of Technical Terms |

62 |

|

Definitions |

63 |

Corporate Information

REGISTERED CHINESE NAME:

中國國際航空股份有限公司

ENGLISH NAME:

Air China Limited

REGISTERED OFFICE:

1st Floor-9th Floor 101

Building 1

30 Tianzhu Road

Shunyi District

Beijing, the PRC

PRINCIPAL PLACE OF BUSINESS IN HONG KONG:

5th Floor

CNAC House

12 Tung Fai Road

Hong Kong International Airport

Hong Kong

WEBSITE:

www.airchina.com.cn

DIRECTORS:1

Mr. Ma Chongxian

Mr. Wang Mingyuan

Mr. Cui Xiaofeng

Mr. Patrick Healy

Mr. Xiao Peng

Mr. Xu Niansha*

Mr. He Yun*

Ms. Winnie Tam Wan-chi*

Mr. Gao Chunlei*

LEGAL REPRESENTATIVE OF THE COMPANY:

Mr. Ma Chongxian

COMPANY SECRETARY:

Mr. Xiao Feng

AUTHORISED REPRESENTATIVES:

Mr. Ma Chongxian

Mr. Xiao Feng

LEGAL ADVISERS TO THE COMPANY:

DeHeng Law Offices

(as to domestic laws)

Jingtian & Gongcheng LLP

(as to overseas laws)

INTERNATIONAL AUDITOR:

KPMG

Public Interest Entity Auditors registered in accordance with the Accounting and Financial Reporting Council Ordinance

H SHARE REGISTRAR AND TRANSFER OFFICE:

Computershare Hong Kong Investor Services Limited

Rooms 1712-1716, 17th Floor, Hopewell Centre

183 Queen's Road East

Wanchai

Hong Kong

LISTING VENUES:

Hong Kong, London and Shanghai

* Independent Non-executive Director

1 For details of changes in Directors of the Company during the Reporting Period, please refer to page 22 of this report. This page sets out the list of Directors of the Company as of the date of this interim report (i.e. 28 August 2025).

Summary of Financial Information

|

(RMB'000) |

Six months ended |

Six months ended |

|

(Unaudited) |

(Unaudited) |

|

|

|

|

|

|

Revenue |

80,757,434 |

79,520,332 |

|

Loss from operations |

(1,696,430) |

(1,081,972) |

|

Loss before taxation |

(2,787,902) |

(3,286,075) |

|

Loss for the period |

(2,710,105) |

(3,538,611) |

|

Loss attributable to non-controlling interests |

(905,285) |

(759,658) |

|

Loss attributable to equity shareholders of the Company |

(1,804,820) |

(2,778,953) |

|

EBITDA(1) |

13,141,208 |

12,943,313 |

|

EBITDAR(2) |

13,849,545 |

13,551,345 |

|

Loss per share attributable to equity shareholders of the Company (RMB) |

(0.11) |

(0.18) |

|

Return on equity attributable to equity shareholders (%) |

(4.23) |

(7.60) |

|

|

|

|

(1) EBITDA represents earnings before finance income and finance costs, net exchange gains/losses, income tax, share of results of associates and joint ventures, depreciation and amortisation as computed under IFRS Accounting Standards.

(2) EBITDAR represents EBITDA before deducting aircraft and engine lease expenses as well as other lease expenses.

|

(RMB'000) |

30 June 2025 |

31 December 2024 |

|

(Unaudited) |

(Audited) |

|

|

|

|

|

|

Total assets |

347,539,122 |

345,750,173 |

|

Total liabilities |

309,309,125 |

304,824,203 |

|

Non-controlling interests |

(4,393,572) |

(4,202,202) |

|

Equity attributable to equity shareholders of the Company |

42,623,569 |

45,128,172 |

|

Equity attributable to equity shareholders of the Company per share (RMB) |

2.44 |

2.71 |

|

|

|

|

Summary of Operating Data

The following is the operating data summary of the Company, Shenzhen Airlines (including Kunming Airlines), Shandong Airlines, Beijing Airlines, Dalian Airlines, Air China Inner Mongolia and Air Macau.

|

|

January to |

January to |

Increase/(decrease) |

|

|

|

|

|

|

Capacity |

|

|

|

|

|

|

|

|

|

ASK (million) |

177,576.14 |

171,790.89 |

3.37% |

|

|

|

|

|

|

International |

51,445.77 |

44,082.60 |

16.70% |

|

|

|

|

|

|

Mainland China |

121,132.50 |

122,675.40 |

(1.26%) |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

4,997.87 |

5,032.90 |

(0.70%) |

|

|

|

|

|

|

AFTK (million) |

6,425.74 |

6,122.03 |

4.96% |

|

|

|

|

|

|

International |

3,055.74 |

2,577.25 |

18.57% |

|

|

|

|

|

|

Mainland China |

3,246.51 |

3,409.83 |

(4.79%) |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

123.50 |

134.96 |

(8.49%) |

|

|

|

|

|

|

ATK (million) |

22,428.25 |

21,606.69 |

3.80% |

|

|

|

|

|

|

Traffic |

|

|

|

|

|

|

|

|

|

RPK (million) |

143,336.58 |

136,213.57 |

5.23% |

|

|

|

|

|

|

International |

39,337.74 |

33,625.02 |

16.99% |

|

|

|

|

|

|

Mainland China |

100,349.17 |

98,966.23 |

1.40% |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

3,649.66 |

3,622.31 |

0.75% |

|

|

|

|

|

|

RFTK (million) |

2,408.59 |

2,237.13 |

7.66% |

|

|

|

|

|

|

International |

1,560.66 |

1,409.88 |

10.69% |

|

|

|

|

|

|

Mainland China |

817.46 |

795.51 |

2.76% |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

30.47 |

31.74 |

(4.01%) |

|

|

|

|

|

|

Passengers carried (thousand) |

77,114.33 |

74,959.47 |

2.87% |

|

|

|

|

|

|

International |

8,939.31 |

7,535.97 |

18.62% |

|

|

|

|

|

|

Mainland China |

65,835.77 |

65,161.14 |

1.04% |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

2,339.26 |

2,262.37 |

3.40% |

|

|

|

|

|

|

Cargo and mail carried (tonnes) |

735,334.14 |

701,598.29 |

4.81% |

|

|

|

|

|

|

Kilometres flown (million) |

922.72 |

896.88 |

2.88% |

|

|

|

|

|

|

Block hours (thousand) |

1,465.36 |

1,438.31 |

1.88% |

|

|

|

|

|

|

Number of flights |

504,285 |

498,613 |

1.14% |

|

|

|

|

|

|

International |

56,194 |

47,201 |

19.05% |

|

|

|

|

|

|

Mainland China |

430,131 |

434,608 |

(1.03%) |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

17,960 |

16,804 |

6.88% |

|

|

|

|

|

|

RTK (million) |

15,050.36 |

14,229.30 |

5.77% |

|

|

|

|

|

|

Load factor |

|

|

|

|

|

|

|

|

|

Passenger load factor (RPK/ASK) |

80.72% |

79.29% |

1.43 pp |

|

|

|

|

|

|

International |

76.46% |

76.28% |

0.19 pp |

|

|

|

|

|

|

Mainland China |

82.84% |

80.67% |

2.17 pp |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

73.02% |

71.97% |

1.05 pp |

|

|

|

|

|

|

Cargo and mail load factor (RFTK/AFTK) |

37.48% |

36.54% |

0.94 pp |

|

|

|

|

|

|

International |

51.07% |

54.70% |

(3.63 pp) |

|

|

|

|

|

|

Mainland China |

25.18% |

23.33% |

1.85 pp |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

24.67% |

23.52% |

1.15 pp |

|

|

|

|

|

|

Overall load factor (RTK/ATK) |

67.10% |

65.86% |

1.25 pp |

|

|

|

|

|

|

Utilisation |

|

|

|

|

|

|

|

|

|

Daily utilisation of aircraft (block hours per day per aircraft) |

8.76 |

8.79 |

(0.03 hours) |

|

|

|

|

|

|

Yield |

|

|

|

|

|

|

|

|

|

Yield per RPK (RMB) |

0.5107 |

0.5369 |

(4.88%) |

|

|

|

|

|

|

International |

0.4889 |

0.4927 |

(0.77%) |

|

|

|

|

|

|

Mainland China |

0.5134 |

0.5475 |

(6.23%) |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

0.6683 |

0.6578 |

1.60% |

|

|

|

|

|

|

Yield per RFTK (RMB) |

1.4853 |

1.4878 |

(0.17%) |

|

|

|

|

|

|

International |

1.7344 |

1.7792 |

(2.52%) |

|

|

|

|

|

|

Mainland China |

0.9419 |

0.9035 |

4.25% |

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

3.3024 |

3.1906 |

3.50% |

|

|

|

|

|

|

Unit cost |

|

|

|

|

|

|

|

|

|

Operating expenses per ASK (RMB) |

0.4791 |

0.4881 |

(1.84%) |

|

|

|

|

|

|

Operating expenses per ATK (RMB) |

3.7930 |

3.8809 |

(2.26%) |

|

|

|

|

|

Development of Fleet

During the first half of 2025, the Group introduced a total of nine aircraft, including one A320 series aircraft, five B737 series aircraft, one C919 aircraft and two C909 aircraft, and phased out a total of five aircraft, including one A330 series aircraft, three A320 series aircraft and one business jet. As at the end of the Reporting Period, the Group had a total of 934 aircraft with an average age of 10.28 years, of which the Company operated a fleet of 510 aircraft in total, with an average age of 9.92 years. During the Reporting Period, the Company introduced eight aircraft and phased out two aircraft.

Details of the fleet of the Group are set out in the table below:

|

|

30 June 2025 |

||||

|

|

Sub-total |

Self-owned |

Finance leases |

Operating leases |

Average age (year) |

|

|

|

|

|

|

|

|

Airbus |

430 |

196 |

115 |

119 |

10.14 |

|

|

|

|

|

|

|

|

A320 |

347 |

165 |

90 |

92 |

10.35 |

|

|

|

|

|

|

|

|

A330 |

53 |

21 |

5 |

27 |

12.18 |

|

|

|

|

|

|

|

|

A350 |

30 |

10 |

20 |

- |

4.13 |

|

|

|

|

|

|

|

|

Boeing |

462 |

191 |

97 |

174 |

11.11 |

|

|

|

|

|

|

|

|

B737 |

410 |

156 |

88 |

166 |

11.08 |

|

|

|

|

|

|

|

|

B747 |

10 |

8 |

2 |

- |

15.97 |

|

|

|

|

|

|

|

|

B777 |

28 |

17 |

5 |

6 |

11.21 |

|

|

|

|

|

|

|

|

B787 |

14 |

10 |

2 |

2 |

8.36 |

|

|

|

|

|

|

|

|

COMAC |

39 |

27 |

12 |

- |

2.02 |

|

|

|

|

|

|

|

|

C909 |

35 |

23 |

12 |

- |

2.19 |

|

|

|

|

|

|

|

|

C919 |

4 |

4 |

- |

- |

0.52 |

|

|

|

|

|

|

|

|

Business jets |

3 |

1 |

- |

2 |

9.31 |

|

|

|

|

|

|

|

|

Total |

934 |

415 |

224 |

295 |

10.28 |

|

|

|

|

|

|

|

|

|

Introduction Plan |

Phase-out Plan |

||||

|

|

2025 |

2026 |

2027 |

2025 |

2026 |

2027 |

|

|

|

|

|

|

|

|

|

Airbus |

22 |

27 |

24 |

13 |

13 |

3 |

|

|

|

|

|

|

|

|

|

A320 |

22 |

27 |

24 |

9 |

13 |

3 |

|

|

|

|

|

|

|

|

|

A330 |

- |

- |

- |

4 |

- |

- |

|

|

|

|

|

|

|

|

|

Boeing |

13 |

2 |

21 |

5 |

1 |

1 |

|

|

|

|

|

|

|

|

|

B737 |

13 |

- |

12 |

4 |

1 |

1 |

|

|

|

|

|

|

|

|

|

B747 |

- |

- |

- |

1 |

- |

- |

|

|

|

|

|

|

|

|

|

B787 |

- |

2 |

9 |

- |

- |

- |

|

|

|

|

|

|

|

|

|

COMAC |

12 |

10 |

10 |

- |

- |

- |

|

|

|

|

|

|

|

|

|

C909 |

2 |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

C919 |

10 |

10 |

10 |

- |

- |

- |

|

|

|

|

|

|

|

|

|

Total |

47 |

39 |

55 |

18 |

14 |

4 |

|

|

|

|

|

|

|

|

Note: Please refer to the actual operation for the introduction and phase-out of the Group's fleet in the future.

Business Overview

Safe Operations

Comprehensively implementing the holistic approach to national security, the Group reinforced safety accountability with resolute political commitment, unwaveringly upholding the principle of "safety first". The annual key safety tasks were rigorously advanced, with the Group's leadership team conducting safety supervision and field research at seven subsidiaries and branches. Steady progress was made in the three-year action plan for fundamental improvement in workplace safety. This included formulating implementation plans for safety production, comprehensively strengthening process management, and continuously enhancing safety operation systems across key areas such as safety management, flight training, operational management, aircraft maintenance, risk identification and hidden hazard identification and mitigation, dangerous goods air transportation, aviation security as well as fire and construction safety. Focusing on complex operational environments and critical production processes, the Group applied to "human error, equipment failure, environmental factors and deficiencies management (人、機、環、管)" framework to rigorously enforce risk controls. During the Reporting Period, the Group achieved 1.465 million safe flight hours while successfully executing multiple charter flights and special missions including repatriation of overseas cultural relics, earthquake relief and rescue in Myanmar and Tibet and emergency evacuations from Iran, all demonstrating the Group's strong political accountability and commitment to social responsibilities.

Operational Performance

The Group made solid strides in enhancing quality and efficiency, steadfastly anchoring its efforts to achieve the annual business objectives. The Group adhered to implementing the "Four Maximizations" production organization principle to increase the scale of effective input. The hub network strategy was further advanced, with continuous optimization of the flight route network and meticulous development of domestic express routes to strengthen competitive edges. The Group steadily pushed forward the launch of new international routes and resumption of suspended ones, prioritizing market expansion along the "Belt and Road" initiative. The Group continuously enhanced its product marketing and innovation capabilities. Product design was continually refined to cater to passengers' differentiated needs, with innovative upgrades to distinctive tailored offerings such as the "Phoenix Junior Program

(新生旅客計劃)", the "Silver Age Plan (活力銀齡計劃)" and the "Student Zone (學生專區)". The Group also deepened customer orientation by implementing a dedicated client manager system, elevating the experience of core customer groups and bolstering the Company's reputation. The Group continued to reinforce synergistic development to extend the breadth and depth of the route network, and conducted joint thematic marketing initiatives to sharpen the core competitiveness. Cost control was advanced, with focused efforts on unlocking potential savings and enhancing overall profitability. The Group continuously strengthened the financial coordination, enhanced debt risk management, improved capital utilization efficiency while ensuring fund security to reduce financial costs.

Quality Service

Guided by the "people-centered" development philosophy and anchored to the goal of building a world-class aviation transportation group, the Group made steady progress in its annual priority tasks of creating "Four First-class (四個一流)" services. By continuously advancing the development of the service quality management system, enhancing service standards, deepening product and service innovation and focusing on driving digital upgrades across the entire service process, the Group promoted its high-quality development through service excellence.

Adhering to a problem-oriented approach, the Group revised its key service standards such as service compensation policies, optimized satisfaction survey analysis and established coordinated ticketing policy and payment monitoring mechanisms to precisely improve passenger experiences. Branded service products were further developed, including the launch of the new "Zichen (紫宸)" premium lounge in Urumqi and the addition of "Hangzhou-Chengdu" express route and "Chongqing-Shenzhen" city express route, enriching the express route portfolio. To enhance passenger convenience, the Group enriched in-app payment methods and introduced multiple features such as passport chip scanning and cross-airline special service bookings, extended intercity air-rail intermodal service coverage to 73 cities and expanded domestic through-check-in flight services to 21 locations. The Group accelerated the development and rollout of service system platforms, with the officially full operation of an end-to-end passenger notification system. In-flight meal reservation service was extended to all domestic flights, providing superior service to passengers. Intelligent customer service provides passengers with inquiry and response services including flight status queries and pre-flight instructions. The passenger service compensation system, service knowledge database and other service production support systems have been upgraded, further enhancing digital capabilities in both service and management.

Digital Transformation

The Group accelerated the digital and intelligent transformation across all business domains. In terms of safety operations, the global ground flight support platform achieved full coverage across all branches, enabling flight monitoring visualization, intelligent shift scheduling and mobile operations for frontline staff, significantly enhancing ground support capabilities. Supported by the intelligent route engineer platform, engineers were empowered to formulate fault response plans, enhance maintenance efficiency, and boost safety management capabilities through technological innovation. In terms of marketing and services, all business model phase II projects were launched, delivering enhanced precision marketing and diversified product management, enabling rapid and flexible configuration of air tickets and products and expanded sales channels. The Group actively promoted artificial intelligence (AI) adoption, developing key applications including intelligent customer service and smart maintenance. In-flight meal reservation services achieved full coverage across all domestic flights, with intelligent customer service providing passengers with smart voice-enabled Q&A support. The centralized departure control business attained complete implementation at all Air China's flight destinations. Service production support systems, including the passenger service compensation systems, service knowledge database and others, underwent upgrades and iterations. The Group also established a comprehensive AI+ platform to enable centralized and intensive sharing of AI resources across the organization, providing foundational support for the implementation of AI applications throughout all operational domains.

Brand Value

Aligned with the goal of building a "world-renowned brand" as part of its world-class enterprise development strategy, the Group continuously strengthened its integrated online-offline and air-ground synergistic three-dimensional communication system, focusing on creating a globally leading brand. Participating in the 20th Western China International Fair, under the theme "Harnessing Western Momentum for Global Connections (乘西部之風 赴世界之約)", the Group showcased its role as the national flag carrier in serving national strategies and empowering regional economies with solid results. The Group actively carried out its overseas brand promotion, accelerating the establishment of a brand management and international communication framework. At the 2025 Brand Global Communication Conference (2025品牌全球傳播力大會), Air China ranked 26th on the "2025 China Brands Global Influence Index (2025中國品牌全球傳播力總榜)", as the only airline included in the ranking. According to the evaluation released by World Brand Lab, Air China ranked 25th in the "China's Top 500 Most Valuable Brands" for 2025 with a brand value of RMB275.576 billion, maintaining its leading position in China's aviation service industry.

Review of Enhancing Quality And Efficiency to Boosting Returns

During the Reporting Period, the Group expedited the improvement of the quality and efficiency of its core business operations, continued to enhance profitability, and implemented comprehensive and systematic measures to elevate quality and efficiency, resulting in a notable improvement in operating performance. During the Reporting Period, the Group's cumulative available seat kilometers (ASK) reached 177.576 billion, representing a year-on-year increase of 3.37%. The Group transported 77.114 million passengers, representing a year-on-year increase of 2.87%. During the Reporting Period, the Group recorded revenue of RMB80,757 million, representing a year-on-year increase of RMB1,237 million; and recorded a net loss attributable to equity shareholders of the listed company amounted to RMB1,805 million, representing a reduction in loss of RMB974 million.

Continuously improving the efficiency of core resource utilization and accelerating the expansion of routes under the "Belt and Road" initiative, Air China has now reached 40 destinations in "Belt and Road" countries. The Group enhanced its precision control capabilities and adopted multiple measures to stabilize revenue. It further strengthened the top-level design for strategic synergy, enhanced coordination within the Air China family airlines in areas such as capacity allocation and yield management, as well as marketing products and services, thereby coordinating the regional resources to foster economies of scale. Through the implementation of "intensive, coordinated and refined" management, costs in major areas such as jet fuel, takeoffs and landings, in-flight catering and aircraft maintenance were reduced, while refined cost control were continuously deepened across the entire operational chain.

Adhering to standardized operation, the Group continuously improved the corporate governance mechanisms. By giving full play to the leadership role of the Party Committee, the Group strictly implemented the requirement that material operational and management matters must undergo preliminary research and discussion by the Party Committee. As of the end of the Reporting Period, the Board held six meetings, at which 34 resolutions were considered and approved. Among these, the Party Committee made pre-decisions on 2 proposals, and conducted preliminary research and discussion on 13 major resolutions; and the Board received 11 special reports. In February 2025, the Board re-election was completed, and the seventh session of the Board was established with adjustments made to the composition of its various special committees and joint working groups. The Company implemented measures to align with the provisions of newly amended Company Law and the latest regulatory requirements, systematically amended the Articles of Association, the Rules and Procedures of Shareholders' Meetings, the Rules and Procedures of Meetings of the Board and the Working Rules of the Nomination Committee, thereby supporting the establishment of a governance-compliant Board. All information related to the Company's production and operations that could have a material impact on share price was disclosed in a truthful, accurate, complete and timely manner, ensuring that all shareholders have equal access to the information of the Company and safeguarding the rights and interests of investors. During the Reporting Period, the Company completed the preparation and disclosure of periodic reports, ad hoc announcements and circulars of high quality. The Company's information disclosure work for the year 2023-2024 was rated as Grade A by the Shanghai Stock Exchange, indicating excellence in information disclosure.

Efforts in investor relations were actively promoted to establish bridges and communication channels with the capital market. The Company organized and held the 2024 online results briefings to fully address market concerns. By conducting the 2024 results roadshow in Hong Kong and Shanghai and visiting 12 major institutional investors, the Company provided thorough and in-depth responses to various questions of concern of investors to boost investor confidence. The Company actively participated in institutional strategy conferences and organized or took part in nearly 20 investment conferences or telephone research meetings during the Reporting Period. Using platforms such as the SSE E-Interactive and the investor relations section of the Company's official website, the Company promptly updated various types of corporate information and actively responded to investor inquiries, placing strong emphasis on the needs of small- and medium-sized investors. Additionally, the Company scientifically managed its market value and formulated the Work Plan on the Market Value Management of Air China Limited (《中國國際航空股份有限公司市值管理工作方案》) to promote high-quality development of the Company.

The Company strengthened responsibilities of the key minorities to promote the robust development of the Company. The Company's controlling shareholders, CNAHC and CNACG, maintain a long-term positive outlook on the China's aviation industry. Based on their confidence in the future prospects of the Company's development and recognition of its intrinsic investment value, they have committed not to reduce their holdings of the Company's tradable shares that are not subject to selling restrictions in any manner for a period of 18 months commencing from 8 April 2025.

MAJOR SUBSIDIARIES AND ASSOCIATES AND THEIR OPERATING RESULTS

|

|

Note: As at the end of the Reporting Period, CNACG is a wholly-owned subsidiary of CNAHC. Accordingly, CNAHC is directly and indirectly interested in 53.71% of the shares of the Company.

During the Reporting Period, the operating results of the major subsidiaries and associates of the Company affecting more than 10% of the Company's net profit were as follows:

|

|

Shenzhen Airlines |

Shandong Aviation Group Corporation |

Beijing Airlines |

Dalian Airlines |

Air China Inner Mongolia |

Air Macau |

Ameco |

CNAF |

Cathay Pacific |

|

|

|

|

|

|

|

|

|

|

|

|

Company Type |

Subsidiary |

Subsidiary |

Subsidiary |

Subsidiary |

Subsidiary |

Subsidiary |

Subsidiary |

Subsidiary |

Associate |

|

|

|

|

|

|

|

|

|

|

|

|

Year of establishment |

1992 |

1995 |

2011 |

2011 |

2013 |

1994 |

1989 |

1994 |

1946 |

|

|

|

|

|

|

|

|

|

|

|

|

Place of domicile |

Shenzhen |

Shandong |

Beijing |

Dalian |

Inner Mongolia |

Macau |

Beijing |

Beijing |

Hong Kong |

|

|

|

|

|

|

|

|

|

|

|

|

Principal business |

Air passenger and air cargo services |

Air passenger and air cargo services |

Business charter and public air passenger and air cargo services |

Air passenger and air cargo services |

Air passenger and air cargo services |

Air passenger and air cargo services |

Repair and overhaul of aircraft, engines and components |

Provision of financial services to CNAHC Group and the Group |

Air passenger and air cargo services |

|

|

|

|

|

|

|

|

|

|

|

|

Registered capital |

RMB5,360,000,000 |

RMB10,454,489,846.24 |

RMB1,000,000,000 |

RMB3,000,000,000 |

RMB2,000,000,000 |

MOP2,379,415,900 |

USD300,052,800 |

RMB1,127,961,864 |

6,439,409,250 shares in issue |

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of shareholding |

51% |

66% |

51% |

80% |

80% |

74.94% |

75% |

51% |

29.98% |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets (RMB100 million) |

671.76 |

350.70 |

10.17 |

31.57 |

28.24 |

68.95 |

76.42 |

175.06 |

1,553.07 |

|

|

|

|

|

|

|

|

|

|

|

|

Net assets (RMB100 million) |

(142.09) |

24.53 |

4.94 |

22.81 |

19.52 |

16.32 |

14.51 |

20.32 |

471.12 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (RMB100 million) |

164.02 |

100.38 |

2.32 |

9.83 |

7.89 |

15.02 |

64.98 |

0.79 |

499.10 |

|

|

|

|

|

|

|

|

|

|

|

|

Year-on-year changes (%) |

2.39 |

2.63 |

0.23 |

3.76 |

(8.50) |

1.97 |

13.65 |

8.65 |

10.64 |

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) attributable to parent company (RMB100 million) |

(8.33) |

(3.08) |

(0.48) |

(0.83) |

0.09 |

(3.86) |

1.91 |

0.27 |

33.55 |

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) attributable to parent company in the corresponding period of last year |

(13.74) |

0.26 |

(0.40) |

(1.21) |

(0.59) |

(3.78) |

2.66 |

0.26 |

30.67 |

|

|

|

|

|

|

|

|

|

|

|

The fleet information and operating data of the major subsidiaries and associates of the Company were as follows:

|

As at the end of the Reporting Period/During the Reporting Period |

Shenzhen Airlines |

Shandong Airlines |

Beijing Airlines* |

Dalian Airlines |

Air China Inner Mongolia |

Air Macau |

Cathay Pacific |

|

|

|

|

|

|

|

|

|

|

Fleet size (unit) |

234 |

138 |

6 |

13 |

11 |

22 |

234 |

|

|

|

|

|

|

|

|

|

|

Average age (year) |

10.45 |

11.20 |

12.45 |

11.73 |

11.53 |

9.04 |

11.5 |

|

|

|

|

|

|

|

|

|

|

ASK (100 million) |

386.40 |

236.63 |

4.06 |

21.56 |

16.96 |

34.56 |

667.92 |

|

|

|

|

|

|

|

|

|

|

Year-on-year changes (%) |

4.66 |

4.12 |

(13.42) |

3.63 |

(4.00) |

(0.51) |

26.3 |

|

|

|

|

|

|

|

|

|

|

RPK (100 million) |

327.19 |

197.31 |

2.79 |

17.06 |

13.20 |

26.18 |

566.51 |

|

|

|

|

|

|

|

|

|

|

Year-on-year changes (%) |

8.17 |

4.92 |

(10.27) |

6.26 |

(2.98) |

2.39 |

30.0 |

|

|

|

|

|

|

|

|

|

|

Passengers carried (10 thousand) |

2,037.16 |

1,326.97 |

25.61 |

123.19 |

100.37 |

156.53 |

1,362.7 |

|

|

|

|

|

|

|

|

|

|

Year-on-year changes (%) |

7.05 |

3.35 |

13.62 |

8.09 |

(2.52) |

5.83 |

27.8 |

|

|

|

|

|

|

|

|

|

|

Average passenger load factor (%) |

84.68 |

83.4 |

68.62 |

79.11 |

77.84 |

75.74 |

84.8 |

|

|

|

|

|

|

|

|

|

|

Year-on-year changes (pp) |

2.74 |

0.64 |

2.41 |

1.96 |

0.81 |

2.14 |

2.4 |

|

|

|

|

|

|

|

|

|

*Note: As at the end of the Reporting Period, Beijing Airlines operated a fleet of two entrusted business jets and one self-owned business jet with an average age of 9.31 years. During the Reporting Period, in terms of business charter service, Beijing Airlines completed 117 flights, representing a year-on-year decrease of 4.88%; it completed 541.08 flying hours, representing a year-on-year increase of 16.30%; it transported a total of 1,292 passengers, representing a year-on-year increase of 33.75%.

EMPLOYEES

As at the end of the Reporting Period, the Company had a total of 47,073 employees, and the subsidiaries of the Company had a total of 58,475 employees.

REMUNERATION POLICY AND TRAINING

The Company upholds the concept of "compensation based on job value, individual competence as well as performance appraisal". During the Reporting Period, the Company strengthened full-level management and supervision of total payroll, remuneration of heads of subsidiaries and employee remuneration. It further emphasized performance-driven compensation distribution, implemented differentiated salary reforms and promoted the distribution of salary resources to core and key talents in the field of scientific and technological innovation and those who have made outstanding contributions, as well as front-line positions involving arduous, dirty, hazardous and high-intensity work. With continuous efforts in deepening the reform of gross payroll management, the Company improved the compensation control mechanisms for enterprise heads at all levels to promote more rational and orderly income distribution.

The training programs of the Company are the same as those disclosed in the 2024 annual report of the Company published on 23 April 2025.

Management Discussion and Analysis

The following discussion and analysis are based on the Group's interim condensed consolidated financial statements and notes thereto which were prepared in accordance with International Accounting Standard 34, Interim Financial Reporting, as well as the applicable disclosure requirements under Appendix D2 to the Listing Rules and are designed to assist the readers in further understanding the information provided in this report so as to better understand the financial conditions and results of operations of the Group as a whole.

Revenue

During the Reporting Period, the Group's revenue was RMB80,757 million, representing a year-on-year increase of RMB1,237 million or 1.56%. Among them, air traffic revenue was RMB76,774 million, representing a year-on-year increase of RMB308 million or 0.40%; other operating revenue was RMB3,983 million, representing a year-on-year increase of RMB929 million or 30.41%.

Revenue Contributed by Geographical Segments

|

|

For the six months ended 30 June |

|

|||

|

|

2025 |

2024 |

|

||

|

(in RMB'000) |

Amount |

Percentage |

Amount |

Percentage |

Change |

|

|

|

|

|

|

|

|

International |

21,940,162 |

27.17% |

19,075,627 |

23.99% |

15.02% |

|

|

|

|

|

|

|

|

Mainland China |

56,277,430 |

69.69% |

57,960,673 |

72.89% |

(2.90%) |

|

|

|

|

|

|

|

|

Hong Kong SAR, Macau SAR |

2,539,842 |

3.14% |

2,484,032 |

3.12% |

2.25% |

|

|

|

|

|

|

|

|

Total |

80,757,434 |

100.00% |

79,520,332 |

100.00% |

1.56% |

|

|

|

|

|

|

|

Air Passenger Revenue

During the Reporting Period, the Group recorded an air passenger revenue of RMB73,196 million, representing a year-on-year increase of RMB59 million. Among the air passenger revenue, the increase of capacity resulted in an increase in revenue of RMB2,463 million, and the increase of passenger load factor resulted in an increase in revenue of RMB1,361 million, while the decrease of passenger yield resulted in a decrease in revenue of RMB3,765 million. The capacity, passenger load factor and yield per RPK of air passenger business during the Reporting Period are as follows:

|

|

For the six months ended 30 June |

|

|

|

|

2025 |

2024 |

Change |

|

|

|

|

|

|

Available seat kilometres (million) |

177,576.14 |

171,790.89 |

3.37% |

|

|

|

|

|

|

Passenger load factor (%) |

80.72 |

79.29 |

1.43 pp |

|

|

|

|

|

|

Yield per RPK (RMB) |

0.5107 |

0.5369 |

(4.88%) |

|

|

|

|

|

Air Passenger Revenue Contributed by Geographical Segments

|

|

For the six months ended 30 June |

|

|||

|

|

2025 |

2024 |

|

||

|

(in RMB'000) |

Amount |

Percentage |

Amount |

Percentage |

Change |

|

|

|

|

|

|

|

|

International |

19,233,312 |

26.28% |

16,567,178 |

22.65% |

16.09% |

|

|

|

|

|

|

|

|

Mainland China |

51,523,843 |

70.39% |

54,187,183 |

74.09% |

(4.92%) |

|

|

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

2,439,221 |

3.33% |

2,382,755 |

3.26% |

2.37% |

|

|

|

|

|

|

|

|

Total |

73,196,376 |

100.00% |

73,137,116 |

100.00% |

0.08% |

|

|

|

|

|

|

|

Air Cargo and Mail Revenue

During the Reporting Period, the Group's air cargo and mail revenue was RMB3,577 million, representing a year-on-year increase of RMB249 million. Among which, the increase of capacity contributed to an increase in revenue of RMB165 million, and the increase of cargo and mail load factor resulted in an increase in revenue of RMB90 million, while the decrease of yield of cargo and mail business resulted in a decrease in revenue of RMB6 million. The capacity, cargo and mail load factor and yield per RFTK of air cargo and mail business during the Reporting Period are as follows:

|

|

For the six months ended 30 June |

|

|

|

|

2025 |

2024 |

Change |

|

|

|

|

|

|

Available freight tonne kilometres (million) |

6,425.74 |

6,122.03 |

4.96% |

|

|

|

|

|

|

Cargo and mail load factor (%) |

37.48 |

36.54 |

0.94 pp |

|

|

|

|

|

|

Yield per RFTK (RMB) |

1.4853 |

1.4878 |

(0.17%) |

|

|

|

|

|

Air Cargo and Mail Revenue Contributed by Geographical Segments

|

|

For the six months ended 30 June |

|

|||

|

|

2025 |

2024 |

|

||

|

(in RMB'000) |

Amount |

Percentage |

Amount |

Percentage |

Change |

|

|

|

|

|

|

|

|

International |

2,706,850 |

75.67% |

2,508,449 |

75.36% |

7.91% |

|

|

|

|

|

|

|

|

Mainland China |

769,997 |

21.52% |

718,726 |

21.59% |

7.13% |

|

|

|

|

|

|

|

|

Hong Kong SAR, Macau SAR and Taiwan, China |

100,621 |

2.81% |

101,277 |

3.05% |

(0.65%) |

|

|

|

|

|

|

|

|

Total |

3,577,468 |

100.00% |

3,328,452 |

100.00% |

7.48% |

|

|

|

|

|

|

|

Operating Expenses

During the Reporting Period, the Group's operating expenses increased by RMB1,217 million on a year-on-year basis to RMB85,070 million, representing an increase of 1.45%. The breakdown of the operating expenses is set out below:

|

|

For the six months ended 30 June |

|

|||

|

|

2025 |

2024 |

|

||

|

(in RMB'000) |

Amount |

Percentage |

Amount |

Percentage |

Change |

|

|

|

|

|

|

|

|

Jet fuel costs |

24,327,485 |

28.60% |

27,132,269 |

32.36% |

(10.34%) |

|

|

|

|

|

|

|

|

Take-off, landing and depot charges |

10,613,810 |

12.48% |

9,963,482 |

11.88% |

6.53% |

|

|

|

|

|

|

|

|

Depreciation and amortisation |

14,837,638 |

17.44% |

14,025,285 |

16.73% |

5.79% |

|

|

|

|

|

|

|

|

Aircraft maintenance, repair |

7,292,075 |

8.57% |

6,862,447 |

8.18% |

6.26% |

|

|

|

|

|

|

|

|

Employee compensation costs |

17,849,218 |

20.98% |

16,953,921 |

20.22% |

5.28% |

|

|

|

|

|

|

|

|

Air catering charges |

2,104,979 |

2.47% |

1,973,435 |

2.35% |

6.67% |

|

|

|

|

|

|

|

|

Selling and marketing expenses |

2,410,378 |

2.83% |

2,275,875 |

2.71% |

5.91% |

|

|

|

|

|

|

|

|

General and administrative expenses |

797,634 |

0.94% |

780,314 |

0.93% |

2.22% |

|

|

|

|

|

|

|

|

Others |

4,836,492 |

5.69% |

3,886,126 |

4.64% |

24.46% |

|

|

|

|

|

|

|

|

Total |

85,069,709 |

100.00% |

83,853,154 |

100.00% |

1.45% |

|

|

|

|

|

|

|

- Jet fuel costs decreased by RMB2,805 million on a year-on-year basis, mainly due to the combined effect of the decrease in the prices of jet fuel and increase in the consumption of jet fuel.

- Take-off, landing and depot charges increased by RMB650 million on a year-on-year basis, mainly due to the year-on-year increase in the number of take-offs and landings.

- Depreciation and amortisation expenses increased by RMB812 million on a year-on-year basis, mainly due to the expansion of fleet as well as the year-on-year increase in flying hours.

- Aircraft maintenance, repair and overhaul costs increased by RMB430 million on a year-on-year basis, mainly due to the year-on-year increase in flying hours.

- Employee compensation costs increased by RMB895 million on a year-on-year basis, mainly due to the year-on-year increase in flight hour fees.

- Air catering charges increased by RMB132 million on a year-on-year basis, mainly due to the increase in the number of passengers.

- Selling and marketing expenses increased by RMB135 million on a year-on-year basis, mainly due to the increase in booking fees resulting from the increase in the sales volumes and the number of passengers.

- Other operating expenses mainly included the Civil Aviation Development Fund and ordinary expenses arising from the core air traffic business that are not included in the aforementioned specific items, which increased by RMB950 million on a year-on-year basis, mainly due to the effect of the increase in the investment in production and operation and changes in contract performance costs of aircraft maintenance subsidiaries.

Net Exchange Gain and Finance Costs

During the Reporting Period, the Group recorded a net exchange gain of RMB176 million, as compared to the net exchange loss of RMB360 million for the same period last year. The Group incurred finance costs of RMB2,891 million (excluding those capitalised) during the Reporting Period, representing a year-on-year decrease of RMB375 million.

Share of Results of Associates and Joint Ventures

During the Reporting Period, the Group's share of profits of its associates was RMB1,220 million, representing a year-on-year increase of RMB135 million. The Group recognised share of profit from Cathay Pacific of RMB1,174 million during the Reporting Period, representing a year-on-year increase of RMB106 million.

During the Reporting Period, the Group's share of profits of its joint ventures was RMB117 million, representing a year-on-year increase of RMB26 million.

MATERIAL ACQUISITIONS AND DISPOSALS

The Company did not make any material acquisitions or disposals of subsidiaries, associates or joint ventures during the Reporting Period.

Assets Structure Analysis

At the end of the Reporting Period, the total assets of the Group were RMB347,539 million, representing an increase of 0.52% from that as at 31 December 2024. Among them, the current assets accounted for RMB47,750 million or 13.74% of the total assets, while the non-current assets accounted for RMB299,789 million or 86.26% of the total assets.

Among the current assets, cash and cash equivalents were RMB25,331 million, representing an increase of 20.40% from that as at 31 December 2024, which was mainly due to the Company's flexible adjustment of its funds according to its capital arrangements.

Among the non-current assets, the book values of property, plant and equipment and right-of-use assets as at the end of the Reporting Period amounted to RMB237,141 million, representing a decrease of 1.61% from that as at 31 December 2024.

Asset Mortgage/Pledge

At the end of the Reporting Period, the Group, pursuant to certain bank loan agreements, had secured aircraft and buildings with an aggregate book value of approximately RMB4,669 million (RMB3,825 million as at 31 December 2024) and land use rights with book value of approximately RMB23 million (RMB23 million as at 31 December 2024). Meanwhile, the Group had restricted monetary funds of approximately RMB2,591 million (RMB1,428 million as at 31 December 2024), which were mainly statutory reserves deposited in the People's Bank of China, pledged bank deposits, security deposits and time deposits with a maturity of more than three months.

Capital Expenditure

During the Reporting Period, the Group's capital expenditure amounted to a total of RMB5,859 million. Among this, aircraft-related investments totalled RMB2,362 million, primarily covering the acquisition of aircraft and engines, aircraft modifications and retrofitting, as well as flight simulators. Cash portion of long-term investment projects amounted to RMB2,726 million, including capital injection projects for Air Macau, Air China Inner Mongolia and Sichuan Airlines Co., Ltd. Other capital expenditure project investments amounted to RMB771 million, mainly covering infrastructure construction, information system development and ground equipment procurement.

Equity Investment

As at the end of the Reporting Period, the Group's equity investment in its associates amounted to RMB14,286 million, representing a decrease of 2.37% from that of 31 December 2024. Among this, the balance of the equity investment of the Group in Cathay Pacific amounted to RMB13,951 million.

As at the end of the Reporting Period, the Group's equity investment in its joint ventures was RMB2,486 million, representing an increase of 2.57% from that as at 31 December 2024.

Debt Structure Analysis

At the end of the Reporting Period, the Group's total liabilities were RMB309,309 million, representing an increase of 1.47% from that as at 31 December 2024. Among them, current liabilities amounted to RMB126,209 million, accounting for 40.80% of the total liabilities; and non-current liabilities amounted to RMB183,100 million, accounting for 59.20% of the total liabilities.

Among the current liabilities, interest-bearing debts (including interest-bearing borrowings and lease liabilities) amounted to RMB76,696 million, representing a decrease of 16.64% from that as at 31 December 2024.

Among the non-current liabilities, interest-bearing debts (including interest-bearing borrowings and lease liabilities) amounted to RMB159,483 million, representing an increase of 10.77% from that as at 31 December 2024.

Details of interest-bearing liabilities of the Group categorised by currency are set out below:

|

|

30 June 2025 |

31 December 2024 |

Change |

||

|

(in RMB'000) |

Amount |

Percentage |

Amount |

Percentage |

|

|

|

|

|

|

|

|

|

RMB |

209,851,014 |

88.85% |

205,662,318 |

87.15% |

2.04% |

|

|

|

|

|

|

|

|

US dollars |

25,877,883 |

10.96% |

29,874,295 |

12.66% |

(13.38%) |

|

|

|

|

|

|

|

|

Others |

449,659 |

0.19% |

443,893 |

0.19% |

1.30% |

|

|

|

|

|

|

|

|

Total |

236,178,556 |

100.00% |

235,980,506 |

100.00% |

0.08% |

|

|

|

|

|

|

|

Details of the interest-bearing borrowings of the Group (including the range of interest rates) are set out in note 18 to the condensed consolidated financial statements of this interim report.

As at the end of the Reporting Period, the Group did not use financial instruments for hedging purposes.

Commitments

The Group's capital commitments, which mainly consisted of the expenditure in the next few years for purchasing certain aircraft and related equipment, decreased by 2.07% from RMB95,175 million as at 31 December 2024 to RMB93,200 million as at the end of the Reporting Period. The Group's investment commitments, which were mainly used for the investment agreements that have been signed and come into effect, amounted to RMB267 million as at the end of the Reporting Period, as compared with RMB313 million as at 31 December 2024.

Contingent Liabilities

At the end of the Reporting Period, the Group had no material contingent liabilities.

Gearing Ratio

As at the end of the Reporting Period, the Group's gearing ratio (total liabilities divided by total assets) was 89.00%, representing an increase of 0.84 percentage points from that as at 31 December 2024.

Working Capital and Its Sources

As at the end of the Reporting Period, the Group's net current liabilities (current liabilities less current assets) were RMB78,459 million, representing a decrease of RMB18,464 million from that as at 31 December 2024. The Group's current ratio (current assets divided by current liabilities) was 0.38, representing an increase of 0.08 as compared to that as at 31 December 2024.

The Group meets its working capital needs mainly through its operating activities and external financing activities. During the Reporting Period, the Group's net cash inflow from operating activities was RMB14,828 million, representing an increase of 4.03% from RMB14,253 million for the corresponding period in 2024. Net cash outflow from investing activities was RMB7,338 million, representing a decrease of 10.26% from RMB8,177 million for the corresponding period in 2024, mainly due to a year-on-year decrease in expenditures for the purchase of debt instruments measured at amortised cost. Net cash outflow from financing activities amounted to RMB3,218 million, representing an increase of 178.99% from RMB1,154 million for the corresponding period in 2024, mainly due to the repayment of bank loans and other borrowings during the current period.

At the end of the Reporting Period, the Company has obtained certain bank facilities of up to RMB278,622 million granted by several banks in the PRC, among which approximately RMB98,529 million has been utilised and approximately RMB180,093 million remained unutilised. The remaining amount is sufficient to meet its demands on liquidity and future capital commitments.

POTENTIAL RISKS

1. Risks of External Environment

Market Fluctuation

Relying on the super-sized domestic demand market, the domestic aviation market is expected to achieve steady growth. Against the backdrop of rapidly evolving global political, economic and trade dynamics, uncertainties persist in the development of the Company's traditionally strong international markets, particularly in North America. The Group will fully, precisely and comprehensively implement the new development philosophy, proactively support and integrate into the new development paradigm, anchor efforts on the domestic circulation, better support high-standard opening up, increase the international fleet capacity deployment, optimize its structure, and actively explore and cultivate emerging markets relating to the "Belt and Road" initiative.

Oil Price Fluctuation

Jet fuel is one of the major operating costs of the Group. The performance of the Group is affected to a certain extent by fluctuations in jet fuel prices. During the Reporting Period, with all other variables remaining unchanged, a 5% increase or decrease in the average jet fuel price would lead to a corresponding approximate increase or decrease of RMB1,216 million in the Group's jet fuel costs. The introduction of fuel surcharges has alleviated the Group's jet fuel cost pressure to some extent.

Exchange Rate Fluctuation

The Group's certain assets and liabilities are denominated in US dollar, while a portion of international revenue and expenses of the Group are settled in currencies other than RMB. Assuming all other risk variables remain unchanged, a 1% appreciation or depreciation of RMB against the US dollar would result in an increase or decrease of RMB133 million in the Group's net profit and shareholders' equity as of 30 June 2025. As of the end of the Reporting Period, the Group had no foreign exchange hedging instruments.

2. Risks of Competition

Industry competition

During the Reporting Period, as there was no significant reduction in the number of operating entities in the market, the Company continued to face relatively intense industry competition. The domestic market maintained a supply-demand imbalance characterized by increasing volume but declining prices. Influenced by market recovery, traffic right allocation and other factors, the resumption and launch of new international routes mainly concentrated in destinations such as Central Asia, West Asia and Europe, resulting in an intense competition in certain regions. Adhering to its strategy for hub network, the Company will devote efforts to building the Beijing-Chengdu dual-hub with a focus on developing strategic markets including the "Four-Pole Clusters" and Xinjiang, thereby achieving differentiated development from other market competitors. Consistent efforts will be made to optimize competitive domestic and international route networks centering around hubs as well as principal bases and markets, while introducing efficient and convenient domestic route and express route products to strengthen core market competitiveness through high-quality products and services.

Alternative competition

As the world's largest high-speed railway network further expanded, there is an ongoing risk of passenger diversion in short- and medium-distance transportation. In the long run, high-speed railway will reshape China's economic geography. The civil aviation sector shall give full play to its comparative advantages within the comprehensive transportation system by increasing fleet capacity on domestic long-haul and international routes, and expanding public travel services to remote regions. Meanwhile, leveraging air-rail intermodal transport as a key support for the development of aviation hubs, advancing the optimization and upgrade of transit products, and delivering universally accessible, high-quality integrated transportation services to the public.

Corporate Governance and Other Information

CHANGES IN THE INFORMATION OF DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT OF THE COMPANY

1. On 25 February 2025, Mr. Ma Chongxian, Mr. Wang Mingyuan, Mr. Cui Xiaofeng and Mr. Patrick Healy were elected as non-independent Directors of the seventh session of the Board of the Company at the 2025 first extraordinary general meeting of the Company. Mr. Xu Niansha, Mr. He Yun, Ms. Winnie Tam Wan-chi and Mr. Gao Chunlei were elected as the independent non-executive Directors of the seventh session of the Board of the Company. Mr. Xu Junxin ceased to be an independent non-executive Director of the Company due to expiry of term of office. The thirteenth meeting of the third session of the employee representatives congress of the Company elected Mr. Xiao Peng as the employee representative Director of the seventh session of the Board of the Company. For details, please refer to the announcements of the Company dated 27 January 2025 and 25 February 2025.

In addition, on 30 August 2024, Mr. Li Fushen resigned as an independent non-executive Director of the Company as well as from other duties. In subsequent months, the Company has been actively considering and processing the adjustment of the composition of the Audit and Risk Management Committee (the Supervision Committee) and the Nomination Committee, including but not limited to exploring the candidate who will fill the vacancy resulted from Mr. Li Fushen's resignation. As such, the Company has applied to the Hong Kong Stock Exchange and the Hong Kong Stock Exchange has agreed to grant a waiver from strict compliance with Rules 3.21 and 3.27A of the Listing Rules, and extend the deadline for filling the vacancy from 30 November 2024 to 28 February 2025. Immediately following the election of Directors of the seventh session of the Board and the change of the Board committee members, the Company has fully complied with the requirements as set out in Rules 3.21 and 3.27A of the Listing Rules. For details, please refer to the announcements of the Company dated 30 August 2024, 27 December 2024 and 25 February 2025.

2. On 24 June 2025, the resolution on the amendments to the Articles of Associations and the abolishment of the Supervisory Committee was approved at the 2024 annual general meeting of the Company. Since 24 June 2025, the Company no longer maintains the Supervisory Committee and Supervisor positions. For details, please refer to the announcement of the Company dated 24 June 2025.

3. On 31 July 2025, Mr. Huen Ho Yin ("Mr. Huen") resigned as the joint company secretary of the Company with effect from 1 August 2025. Mr. Xiao Feng continues to serve and act as the sole company secretary of the Company after the resignation of Mr. Huen. Mr. Xiao Feng has been admitted as a fellow of both The Hong Kong Chartered Governance Institute and The Chartered Governance Institute. Mr. Leung Yik Fung replaced Mr. Huen as the agent of the Company for accepting service of process and notices on behalf of the Company in Hong Kong under Rule 19A.13(2) of the Listing Rules with effect from 1 August 2025. For details, please refer to the announcement of the Company dated 31 July 2025.

SHAREHOLDINGS OF DIRECTORS, CHIEF EXECUTIVE AND SUBSTANTIAL SHAREHOLDERS OF THE COMPANY

INTERESTS OF DIRECTORS AND CHIEF EXECUTIVE

As at the end of the Reporting Period, none of the Directors or the chief executive of the Company had interests or short positions in the shares, underlying shares and/or debentures (as the case may be) of the Company or its associated corporations (within the meaning of Part XV of the SFO) which shall be recorded and maintained in the register kept by the Company pursuant to section 352 of the SFO, or which shall be notified to the Company and the Hong Kong Stock Exchange pursuant to the Model Code.

Cathay Pacific is currently a substantial shareholder of the Company holding 2,633,725,455 H Shares of the Company as at the end of the Reporting Period. Such interests are required to be disclosed to the Company in accordance with Divisions 2 and 3 under Part XV of the SFO. During the Reporting Period, Mr. Ma Chongxian, Mr. Wang Mingyuan (executive Directors of the Company) and Mr. Patrick Healy (non-executive Director of the Company) also served as directors of Cathay Pacific. Cathay Pacific competes or is likely to compete either directly or indirectly with some aspects of the business of the Company as it operates airline services to certain destinations, which are also served by the Company.

Save as disclosed above, none of the Directors of the Company and their respective close associates (as defined in the Listing Rules) has any competing interests which shall be disclosed under Rule 8.10 of the Listing Rules.

SUBSTANTIAL SHAREHOLDERS' INTERESTS IN THE COMPANY

As at the end of the Reporting Period, to the knowledge of the Directors and chief executive of the Company, the following persons (other than the Directors or chief executive of the Company) had interests or short positions in the shares or underlying shares of the Company as recorded in the register required to be kept pursuant to Section 336 of the SFO:

|

Name |

Type of interests |

Type and number of shares held by the Company |

Percentage of the total issued shares of the Company |

Percentage of the total issued A Shares of the Company |

Percentage of the total issued H Shares of the Company |

Short positions |

|

|

|

|

|

|

|

|

|

CNAHC |

Beneficial owner |

7,421,462,701 A Shares |

42.53% |

59.41% |

- |

- |

|

CNAHC (1) |

Equity attributable |

1,332,482,920 A Shares |

7.64% |

10.67% |

- |

- |

|

CNAHC (1) |

Equity attributable |

616,779,308 H Shares |

3.54% |

- |

12.45% |

- |

|

CNACG |

Beneficial owner |

1,332,482,920 A Shares |

7.64% |

10.67% |

- |

- |

|

CNACG |

Beneficial owner |

616,779,308 H Shares |

3.54% |

- |

12.45% |

- |

|

Cathay Pacific |

Beneficial owner |

2,633,725,455 H Shares |

15.09% |

- |

53.15% |

- |

|

Swire Pacific Limited(2) |

Equity attributable |

2,633,725,455 H Shares |

15.09% |

- |

53.15% |

- |

|

John Swire & Sons (H.K.) Limited(2) |

Equity attributable |

2,633,725,455 H Shares |

15.09% |

- |

53.15% |

- |

|

John Swire & Sons Limited(2) |

Equity attributable |

2,633,725,455 H Shares |

15.09% |

- |

53.15% |

- |

|

|

|

|

|

|

|

|

Notes:

Based on the information available to the Directors and chief executive (including such information as was available on the website of the Hong Kong Stock Exchange) and to the knowledge of the Directors and chief executive, as at the end of the Reporting Period:

1. By virtue of CNAHC's 100% interest in CNACG, CNAHC was deemed to be interested in the 1,332,482,920 A Shares and 616,779,308 H Shares directly held by CNACG.

2. By virtue of John Swire & Sons Limited's 100% interest in John Swire & Sons (H.K.) Limited and their approximately 64.45% equity interest and 70.97% voting rights in Swire Pacific Limited, and Swire Pacific Limited's approximately 44.98% equity interest in Cathay Pacific as at the end of the Reporting Period, John Swire & Sons Limited, John Swire & Sons (H.K.) Limited and Swire Pacific Limited were deemed to be interested in the 2,633,725,455 H Shares of the Company directly held by Cathay Pacific.

Save as disclosed above, as at the end of the Reporting Period, to the knowledge of the Directors and chief executive of the Company, no other person had an interest or short position in the shares or underlying shares of the Company as recorded in the register required to be kept pursuant to Section 336 of the SFO.

TOTAL NUMBER OF SHAREHOLDERS

|

|

|

|

Total number of holders of ordinary shares as at the end of the Reporting Period (account) |

129,205 accounts, of which 2,777 accounts are registered holders of H Shares |

|

|

|

INFORMATION OF SHAREHOLDERS

|

|

|||||||

|

Unit: Share |

|||||||

|

|

|||||||

|

Shareholdings of the top 10 shareholders (excluding shares lent through securities lending and refinancing) |

|||||||

|

Name of shareholder (full name) |

Change(s) during the Reporting Period |

Number of shares held as at the end of the Reporting Period |

Shareholding percentage |

Number of shares held subject to selling restrictions |

|

Nature of |

|

|

|

|||||||

|

Status |

Number |

||||||

|

|

|

|

|

|

|

|

|

|

China National Aviation Holding Corporation Limited |

0 |

7,421,462,701 |

42.53 |

854,700,854 |

Frozen |

127,445,536 |

State-owned legal person |

|

Cathay Pacific Airways Limited |

0 |

2,633,725,455 |

15.09 |

0 |

Nil |

0 |

Foreign legal person |

|

China National Aviation Corporation (Group) Limited |

0 |

1,949,262,228 |

11.18 |

392,927,308 |

Frozen |

36,454,464 |

Foreign legal person |

|

HKSCC NOMINEES LIMITED |

275,350 |

1,689,880,685 |

9.69 |

0 |

Nil |

0 |

Foreign legal person |

|

China Securities Finance Corporation Limited |

0 |

311,302,365 |

1.78 |

0 |

Nil |

0 |

Other |

|

Hong Kong Securities Clearing Company Limited |

-21,281,787 |

279,073,653 |

1.60 |

0 |

Nil |

0 |

Foreign legal person |

|

China National Aviation Fuel Group Corporation |

0 |

238,524,158 |

1.37 |

0 |

Nil |

0 |

State-owned legal person |

|

National Social Security Fund 114 Portfolio (全國社保基金一一四組合) |

68,249,185 |

68,249,185 |

0.39 |

0 |

Nil |

0 |

Other |

|

Industrial and Commercial Bank of China - Huatai-PineBridge CSI 300 Exchange-traded Open-end Index Securities Investment Fund (中國工商銀行股份有限公司-華泰柏瑞滬深300交易型開放式指數證券投資基金) |

2,177,700 |

66,800,769 |

0.38 |

0 |

Nil |

0 |

Other |

|

China Structural Reform Fund Co., Ltd. (中國國有企業結構調整基金股份有限公司) |

0 |

52,833,706 |

0.30 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Unit: Share |

|||

|

|

|||

|

Shareholdings of the top 10 shareholders |

|||

|

Name of shareholder |

Number of tradable shares held not subject to selling restrictions |

|

|

|

Type |

Number |

||

|

|

|

|

|

|

China National Aviation Holding Corporation Limited |

6,566,761,847 |

RMB ordinary shares |

6,566,761,847 |

|

Cathay Pacific Airways Limited |

2,633,725,455 |

Overseas listed foreign shares |

2,633,725,455 |

|

HKSCC NOMINEES LIMITED |

1,689,880,685 |

Overseas listed foreign shares |

1,689,880,685 |

|

China National Aviation Corporation (Group) Limited |

1,556,334,920 |

RMB ordinary shares |

1,332,482,920 |

|

|

|

Overseas listed foreign shares |

223,852,000 |

|

China Securities Finance Corporation Limited |

311,302,365 |

RMB ordinary shares |

311,302,365 |

|

Hong Kong Securities Clearing Company Limited |

279,073,653 |

RMB ordinary shares |

279,073,653 |

|

China National Aviation Fuel Group Limited |

238,524,158 |

RMB ordinary shares |

238,524,158 |

|